Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat is Fair Value Gap (FVG)?

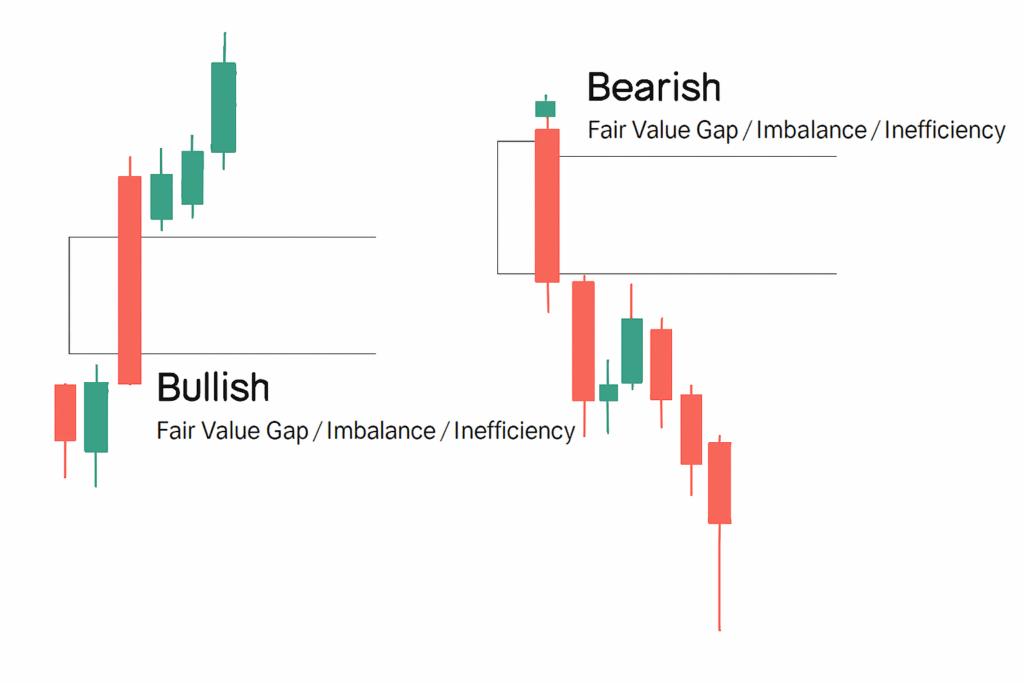

A Fair Value Gap (FVG) is a price action concept where the price of an asset moves too quickly, creating a gap between two price levels on a chart. This gap indicates an imbalance in the market, typically caused by strong buying or selling pressure. The gap represents a “fair value” zone that traders often watch for potential price retracements. Understanding Fair Value Gaps is essential for traders aiming to identify key price levels and improve their trading strategies.

The Theory Behind Fair Value Gaps (FVGs)

The theory behind Fair Value Gaps is based on market inefficiency. When price moves too fast, it can leave behind a gap that reflects an imbalance between supply and demand. Traders believe that these gaps often get filled, meaning that the price will return to the gap area to restore equilibrium. Understanding this theory helps traders identify entry points that align with market forces, allowing for better risk-to-reward ratios.

How to Identify a Fair Value Gap (FVG)

Identifying a Fair Value Gap on a chart involves recognizing areas where price has moved too quickly, leaving an imbalance. Here’s how to spot FVGs:

Look for Rapid Price Movements:

A Fair Value Gap typically forms after a significant price move. This could happen after major news events or market catalysts that cause a sharp change in sentiment.

Check for Price Imbalances:

The gap forms when the price skips several levels without any trading occurring in between. The gap is visible as a void between the low of one candle and the high of the next (for a Bullish FVG) or the high of one candle and the low of the next (for a Bearish FVG).

Monitor for Retracements:

After the gap is formed, the price often retraces back to the gap before continuing its trend. Traders use this information to time their entries and exits for better risk management.

How to Find a Bullish Fair Value Gap (FVG)

A Bullish Fair Value Gap forms when the price moves rapidly upwards, leaving a gap in the price levels. To identify a Bullish FVG, follow these steps:

Break Above Resistance:

A Bullish FVG typically occurs when price breaks above a significant resistance level, signaling strong upward momentum.

Look for a Sharp Price Surge:

The gap is formed when price surges quickly, leaving behind a void in the chart.

Wait for a Retracement:

Once the gap is formed, the price often retraces back to fill the gap, offering an entry point for traders looking to ride the trend higher.

How to Find a Bearish Fair Value Gap (FVG)

A Bearish Fair Value Gap occurs when the price drops quickly, creating a gap in the chart. Here’s how to identify a Bearish FVG:

Break Below Support:

A Bearish FVG often forms after price breaks below a significant support level, indicating strong downward momentum.

Watch for a Sharp Decline:

The gap is created when the price moves downward rapidly, leaving a void in the chart.

Wait for a Retracement:

After the gap is formed, the price often retraces back to fill the gap, giving traders an opportunity to enter short positions as the market continues its downtrend.

What Time Frames Are Best for Fair Value Gaps (FVGs)?

The best time frame to identify and trade Fair Value Gaps depends on your trading style:

For Short-Term Traders (Scalpers and Day Traders):

Lower time frames, such as the 5-minute or 15-minute charts, are useful for spotting short-term FVGs. These time frames allow traders to capitalize on small price movements and quick market changes.

For Medium-Term Traders:

If you hold positions for a few hours or a day, the 1-hour and 4-hour charts are ideal for identifying FVGs. These time frames provide a balance between capturing price movements and managing risk.

For Long-Term Traders:

Traders focusing on longer-term trends may prefer using the daily or weekly charts to spot more significant FVGs that can impact the market over a longer period.

Conclusion

Understanding Fair Value Gaps (FVGs) is a valuable tool for traders looking to optimize their trading strategies. By identifying these gaps, traders can gain a clearer insight into market inefficiencies, potentially improving their risk-to-reward ratio and overall trading performance. Whether you’re trading Bullish FVGs or Bearish FVGs, the ability to spot and act on these gaps is a key skill for any successful trader.

At Ultima Markets, we understand the importance of having the right tools and knowledge to make informed trading decisions. Our platform offers advanced charting features, real-time market data, and a user-friendly interface that can help you identify Fair Value Gaps and other key price action patterns. With our competitive edge in regulated trading, you can trade with confidence, knowing that you’re supported by a trusted and secure platform.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.