Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomEuro to Dollar Forecast Next 6 Months

The euro to dollar forecast for the next 6 months (July to December 2025) is slightly bearish, with EUR/USD likely trading between 1.05 and 1.10. The European Central Bank is expected to continue cutting interest rates due to weak Eurozone growth, while the U.S. Federal Reserve maintains higher rates amid persistent inflation and strong economic data. Unless the Fed signals early rate cuts, the dollar is likely to remain stronger, keeping downward pressure on the euro.

The euro to dollar forecast next 6 months remains a key focus for traders, investors, and businesses navigating the FX landscape in 2025. With central banks adjusting policy paths and economic indicators flashing mixed signals, the EUR/USD outlook is anything but straightforward. This article analyzes the latest data driving euro-dollar movements, based on real market indicators, not speculation.

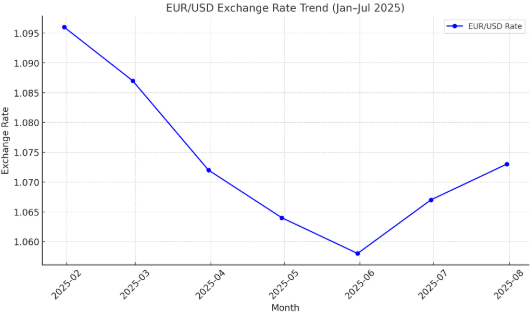

EUR/USD Overview: How the Pair Has Moved So Far in 2025

As of July 2025, EUR/USD trades around 1.07, recovering from a six-month low of 1.05 recorded earlier this year. The pair has experienced moderate volatility due to diverging monetary policies between the European Central Bank (ECB) and the U.S. Federal Reserve.

- ECB policy: The ECB began rate cuts in Q2 2025 to support weakening growth in Germany and France.

- Fed policy: The U.S. Federal Reserve maintained higher interest rates to combat sticky services inflation and robust labor market data.

These opposing directions in policy have kept the euro to dollar forecast next 6 months tightly contested among analysts.

Euro to Dollar Forecast Next 6 Months (2025): Key Drivers

Interest Rate Differentials

One of the most important drivers of EUR/USD is the interest rate gap between the U.S. and the Eurozone.

- Fed Rate Outlook: Market pricing (via CME FedWatch Tool) suggests the Fed may begin its rate cut cycle in Q3 or Q4 2025.

- ECB Rate Outlook: The ECB has already delivered two cuts, bringing the main refinancing rate to 3.25%, and is expected to continue easing.

If the ECB continues to cut faster than the Fed, the euro to dollar forecast for the next 6 months could tilt bearish.

Economic Performance: U.S. vs Eurozone

U.S. GDP: Q1 2025 GDP showed a healthy 2.1% annualized growth, with consumer spending remaining resilient.

- Eurozone GDP: Euro area output stagnated, with Germany narrowly avoiding a technical recession.

- Economic divergence favors USD strength in the near term.

Inflation Trends

U.S. Core PCE remains elevated around 3.0%, forcing the Fed to delay cuts.

- Eurozone CPI has eased to 2.2%, allowing more policy flexibility.

- If inflation differentials persist, it reinforces downside risk for EUR/USD.

Technical Outlook for EUR/USD (Q3–Q4 2025)

Resistance and Support Levels

- Key Resistance: 1.0850 (April high), then 1.10

- Support: 1.0500 (year-to-date low), followed by 1.0340 (2023 support)

Momentum Indicators

- RSI (Daily) has returned to neutral after oversold conditions in Q2

- MACD shows a weak bullish crossover, suggesting possible short-term recovery

Short-term traders eyeing a bounce toward 1.0850 may find opportunities if U.S. data underperforms.

Euro to Dollar Forecast for Next 6 Months (2025): Analyst Consensus

According to major institutional forecasts:

| Institution | EUR/USD Forecast (End-2025) |

| Goldman Sachs | 1.08 |

| ING Bank | 1.05 |

| Morgan Stanley | 1.10 |

Overall, analysts remain split, with many expecting limited upside unless the Fed cuts ahead of expectations.

Will Euro Rise Against Dollar in 2025?

This question reflects growing retail and institutional interest in EUR/USD positioning.

Potential Scenarios:

- Bullish: Fed signals earlier cuts, U.S. labor market weakens – EUR/USD may push toward 1.10+

- Bearish: U.S. growth stays firm, ECB cuts aggressively – EUR/USD risks falling below 1.05

Traders should monitor FOMC minutes, Nonfarm Payrolls, and ECB statements closely.

Conclusion

The euro to dollar forecast next 6 months remains uncertain but data-driven. Traders should watch central bank policies, macro data divergence, and geopolitical risks. EUR/USD remains vulnerable to downside risks unless the Fed turns dovish sooner than expected.

Ultima Markets offers competitive spreads, institutional-grade liquidity, and fast execution, perfect for capitalizing on EUR/USD trends. Whether you’re positioning for a euro rebound or dollar strength, Ultima provides the tools to act on your analysis.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.