Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteEBITDAR Meaning and How to Calculate It?

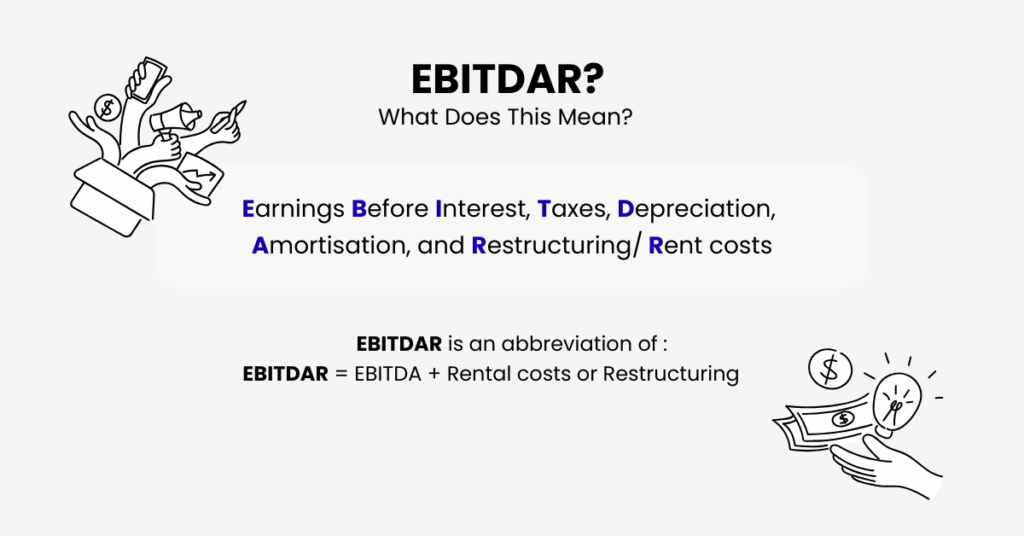

You keep seeing EBITDAR pop up in reports and pitch decks. If it feels like one more finance acronym, you are not alone. This guide breaks down EBITDAR meaning in plain English and shows when it gives you a cleaner view of performance than EBITDA, especially in lease heavy businesses like hotels and airlines.

What Is EBITDAR

EBITDAR is an abbreviation for “earnings before interest taxes depreciation amortisation and rent or restructuring”. In other words, the EBITDAR meaning refers to a company’s earnings before interest, taxes, depreciation, amortisation, and rent or restructuring costs.

To make it simpler, it shows how much money a business makes from its main operations before paying for loans, taxes, non-cash expenses, and big rent bills or one-time restructuring charges.

You can think of it as EBITDA plus rent or restructuring. It is especially useful in industries like hotels, casinos, retail chains, and airlines, where rent costs are high and can make results look very different from one company to another..

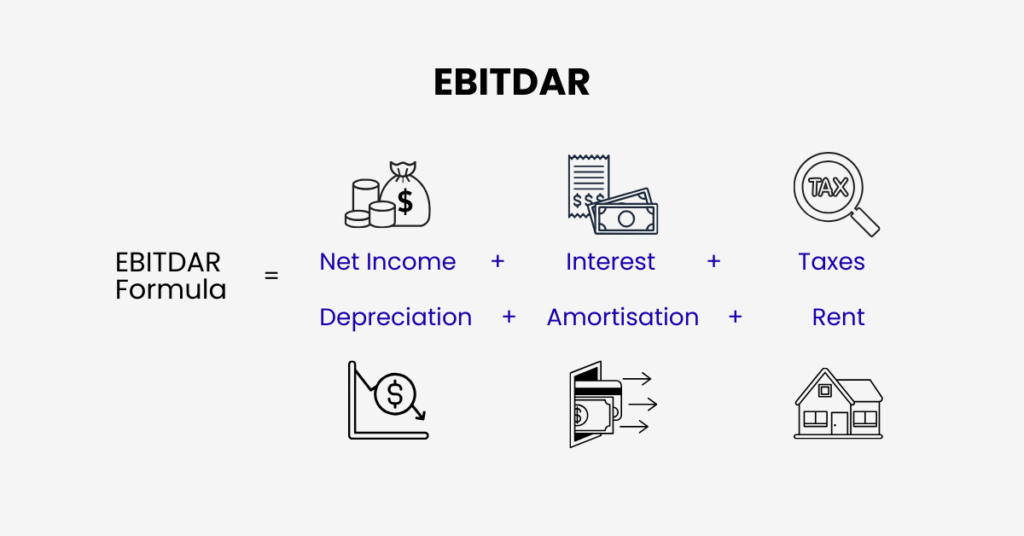

EBITDAR Formula And How To Calculate It

There are two equivalent ways to calculate it:

From Net Income

EBITDAR = Net income + Interest + Taxes + Depreciation + Amortisation + Rent or Restructuring

From EBITDA

EBITDAR = EBITDA + Rent or Restructuring

Quick Numeric Example

- Net income/ Earnings: 50

- Interest: 10

- Taxes: 20

- Depreciation and Amortisation: 15

- Rent: 30

EBITDA = 50 + 10 + 20 + 15 = 95

EBITDAR = 95 + 30 = 125

This tells you the company generated 125 from its operations before the effects of financing, tax and leases.

EBITDA Vs EBITDAR Understanding The Difference

There is a slight difference between EBITDAR meaning and EBITDA. Both metrics start with operating earnings before interest and taxes and add back non cash depreciation and amortisation. EBITDAR also adds back rent or restructuring. This adjustment is useful when you compare

- owned sites with leased sites in hospitality and gaming

- airlines that own aircraft with those that lease them

- retail chains across countries with different lease norms

Removing rent helps you compare operators fairly when lease intensity differs. The trade off is that rent is real cash, so you should not ignore it when judging long term sustainability.

Why Do We Use EBITDAR

The main reason to use EBITDAR is to get a fairer comparison. Imagine two hotels with the same revenues and efficiency. One owns its property, the other leases it. Their EBITDA will look very different, but their EBITDAR will be almost the same.

EBITDAR is also useful during restructuring periods when one-off charges could hide the underlying performance of a business. By removing these costs, analysts can still judge whether the core operations are sound.

For hotel groups, casinos, and other multi-site operators, EBITDAR is also helpful for unit-level benchmarking. It lets management compare leased and owned properties side by side without rent distorting the results.

Why Lease Accounting Changes Matter

In 2019, new accounting rules (IFRS 16) changed how companies record leases. Before this, rent appeared as a single operating expense. Now it is split into depreciation of right-of-use assets and interest on lease liabilities, and leases are shown on the balance sheet.

This change made EBITDA look higher for companies with a lot of leases, because rent was no longer counted as an operating cost. In reality, nothing changed in the cash flow, just the way it was reported.

That is why analysts still use EBITDAR as a “pre-lease view.” It helps compare companies before and after 2019, or businesses that own assets versus those that lease them, in a way that is fair and consistent.

Example Of EBITDAR Using A Simple Income Statement

Still remember the formula for EBITDAR?

Suppose Company ABC reports earnings of $1,600,000 in revenue in one year.

- It spends $600,000 on operating expenses (staff wages, utilities, supplies, etc.).

- Within those expenses, there are depreciation = $10,000, amortisation = $10,000, and rent = $70,000.

Step 1: Subtract operating expenses from revenue.

$1,600,000 − $600,000 = $1,000,000 operating profit (EBIT)

Step 2: Add back depreciation and amortisation.

$1,000,000 + $10,000 + $10,000 = $1,020,000 EBITDA

Step 3: Add back rent.

$1,020,000 + $70,000 = $1,090,000 EBITDAR

When To Use EBITDAR

Use EBITDAR when

- rent or restructuring materially distorts comparisons

- you value airlines, hotels, gaming or multi site retailers

- you benchmark site or property level performance on a like for like basis

Use EBITDA when

- lease effects are small

- you want a broad market multiple that works across most sectors

- you are screening a wide peer group quickly

Valuation Practice That Keeps Things Consistent

- EV to EBITDA remains the default cross sector multiple

- EV to EBITDAR is common in airlines and hospitality because it reduces noise from different lease strategies

If you use EV to EBITDAR, be consistent about leases. Either add lease liabilities to enterprise value or apply the same adjustment across all peers so numerator and denominator treat leases in the same way.

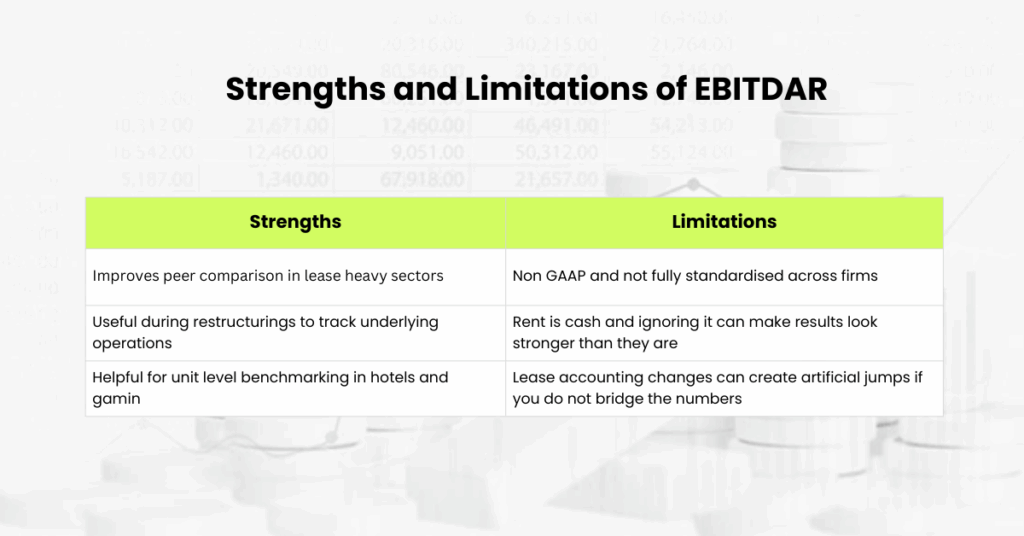

Pros And Cons of EBITDAR

Strengths

One of the main strengths of EBITDAR is that it improves comparisons between companies in lease heavy industries. By adding back rent, analysts can evaluate performance on a more equal footing between businesses that own their assets and those that lease them.

EBITDAR is also useful during restructurings, as it allows you to track the underlying operations without temporary charges masking results. In sectors such as hotels and gaming, EBITDAR is particularly valuable for unit-level benchmarking, helping managers compare the performance of individual properties or locations more accurately.

Limitations

At the same time, EBITDAR has its limits. It is a non-GAAP measure, which means there is no universal standard for how companies calculate it, making comparisons less consistent. Another drawback is that rent is a real cash outflow, so ignoring it can make results look stronger than they really are if taken at face value.

Finally, changes in lease accounting rules (such as IFRS 16) can cause sudden jumps in EBITDA and EBITDAR figures, which may not reflect actual changes in performance unless you adjust and bridge the numbers properly.

What Is A Good EBITDAR

There is no universal “good” EBITDAR margin because it depends on the business model, property type, and location. In the hotel industry, margins of around 10% or higher are often seen as healthy, but franchised or asset-light models may show higher margins. The key is always to benchmark against similar businesses and your own history.

Conclusion

The EBITDAR meaning is simple. It is EBITDA adjusted for rent or restructuring so you can compare operators on a common footing when leases or one off changes would otherwise blur the picture.

Use it to sharpen your analysis in hospitality, airlines, gaming and retail, then cross check with cash flows, lease obligations and sensible valuation adjustments. That way you see both the engine and the fuel bill.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.