Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

What Are Dividend Stocks?

Dividend stocks are shares of companies that pay a portion of their earnings to shareholders in the form of dividends. These payments are typically made on a regular schedule quarterly, semi-annually, or annually and are particularly favored by income-focused investors seeking reliable cash flow.

While many dividend stocks come from well-established companies with a long history of paying out dividends, they can be found across various sectors, including utilities, consumer staples, and financial institutions.

Why Invest in Dividend Stocks?

Investing in dividend stocks provides numerous advantages, particularly for those seeking a balance between income generation and capital appreciation. Let’s explore why these stocks are an appealing choice for many investors.

Steady Income Stream

Dividend-paying stocks are particularly attractive to retirees and long-term investors who need a stable, recurring income. This steady cash flow comes in the form of dividends, which provide a predictable income stream regardless of market fluctuations.

Example: Investors in established blue-chip companies like Johnson & Johnson or Coca-Cola have long benefited from consistent dividend payments, creating a reliable source of income over time.

Reinvestment Opportunities

One of the key strategies for maximizing the potential of dividend stocks is reinvesting the dividends. Through Dividend Reinvestment Plans (DRIPs), investors can automatically reinvest their dividend payouts to purchase additional shares, compounding their returns without having to purchase more shares manually.

Compounding Returns: Over time, reinvested dividends lead to more shares, increasing the amount of dividends received, which in turn helps grow the investment.

Risk Mitigation

Dividend-paying stocks tend to come from companies with stable earnings and solid financials. These companies are often less volatile and can weather economic downturns better than non-dividend-paying counterparts. As such, these stocks are considered safer investments, especially in uncertain market conditions.

Example: Procter & Gamble, with its long track record of paying and increasing dividends, is often seen as a defensive investment during market downturns.

Tax Advantages

In many countries, dividends are taxed at a lower rate than ordinary income. For example, in the United States, qualified dividends are taxed at 0%, 15%, or 20% depending on the income bracket, while regular income is taxed at higher rates.

Tax Efficiency: This preferential tax treatment allows investors to retain a larger portion of their dividend income, enhancing the attractiveness of dividend stocks.

Outperformance in Market Volatility

Dividend stocks are often less affected by market volatility compared to growth stocks. In periods of market decline, investors may rely on dividends to provide some return on their investment even when stock prices are falling.

Example: During the 2008 financial crisis, many dividend-paying stocks, such as PepsiCo and AT&T, continued to provide dividends to shareholders, offering stability when markets were otherwise uncertain.

How to Find Dividend Stocks

Identifying reliable dividend stocks requires research and careful consideration of several factors. Here are some critical steps to help you find the best dividend-paying stocks:

Look for Companies with a Proven Dividend History

The most important indicator of a solid dividend stock is the company’s history of consistent dividend payments. Companies with a long track record of paying dividends, preferably increasing them year over year that demonstrate financial stability.

- Companies that have paid dividends for 25+ years are often called Dividend Aristocrats.

Assess the Dividend Yield

The dividend yield is calculated by dividing the annual dividend payment by the stock price. It’s a quick way to assess the income potential of a stock. However, a very high yield could be a red flag, as it may indicate financial stress or an unsustainable payout ratio.

- Look for a yield that’s in line with the industry standard and supported by the company’s earnings and cash flow.

Evaluate Financial Health

A company’s payout ratio (the proportion of earnings paid out as dividends) should be sustainable. The payout ratio can be found in the company’s financial reports, and ideally, it should be below 60%, allowing for flexibility in challenging times.

- Strong cash flow, low debt levels, and consistent earnings growth are signs of a healthy company that can maintain dividend payments.

Look for Dividend Growth

Focus on stocks that not only pay dividends but also grow their dividends consistently. A growing dividend is often a sign of increasing profits and financial strength.

- Example: Companies like Microsoft and McDonald’s have demonstrated strong dividend growth, rewarding shareholders year after year.

Use Screening Tools

Leverage stock screening tools available on platforms. These tools allow investors to filter stocks based on criteria such as dividend yield, payout ratio, and dividend growth.

- Look for stocks that meet the criteria for dividend sustainability and growth to find high-quality dividend stocks.

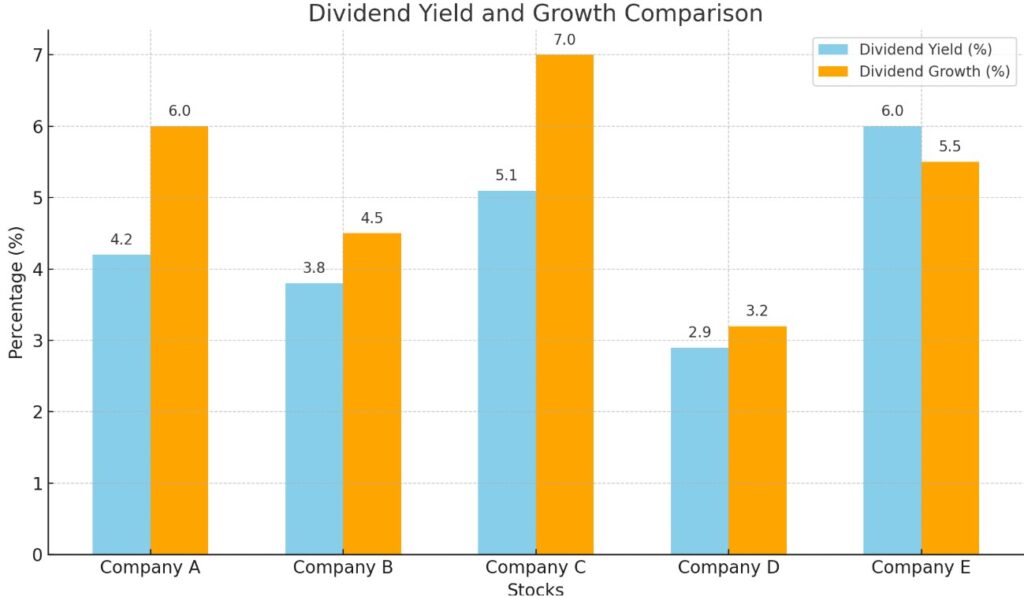

Let’s look at the example below:

The chart above compares two key metrics for dividend stocks:

Dividend Yield (%)

- This is represented by the sky blue bars and shows the percentage of a company’s stock price paid out as dividends annually.

- A higher dividend yield typically means more income for shareholders from dividend payments.

- For example, Company E offers the highest dividend yield at 6.0%.

Dividend Growth (%)

- This is represented by the orange bars and indicates the annual growth rate of the dividend payments over time.

- A higher growth rate suggests that the company is consistently increasing its dividend payouts, which can be appealing to long-term investors looking for increasing income.

- For instance, Company C has the highest dividend growth rate at 7.0%.

Key Observations:

- Company E offers the highest dividend yield at 6.0%, which means it provides a relatively higher income relative to its stock price compared to other companies. However, its dividend growth rate is slightly lower than others, at 5.5%.

- Company C offers a strong dividend growth rate at 7.0%, but its dividend yield of 5.1% is slightly lower compared to Company A and Company E.

- Company B and Company D have more moderate figures for both yield and growth, with Company D having a lower dividend yield (2.9%) but a solid dividend growth rate (3.2%).

Interpretation for Traders:

- High Dividend Yield: For traders who prioritize immediate income generation, stocks with high dividend yield (e.g., Company E) may be more appealing.

- High Dividend Growth: Traders focusing on long-term income growth may prefer companies with higher dividend growth (e.g., Company C), which can provide increasing dividend payments over time.

How to Tell If a Stock Pays a Dividend

Determining whether a stock pays a dividend is relatively simple. Here’s how you can find out:

Check the Dividend History

You can find detailed information about a company’s dividend history on financial website or the company’s investor relations page. This will provide a record of past dividend payments and help you gauge the consistency of those payouts.

Look for Dividend Yield Information

Some financial websites will display a stock’s dividend yield. If this information is present, it indicates that the company pays a dividend.

Company’s Earnings Report

The earnings report is another valuable source of information. Companies typically announce dividend payments in their quarterly earnings releases, and any changes in the dividend payment will be disclosed here.

Conclusion

In conclusion, dividend stocks offer a solid way to generate passive income while also benefiting from capital appreciation. With their consistent payout structures, lower volatility, and tax advantages, dividend stocks have long been a staple for income-focused investors. However, it’s essential to perform thorough research and evaluate each stock’s financial health before making an investment.

At Ultima Markets, we encourage you to consider dividend stocks as part of a diversified trading strategy. As a trust trading platform, we provide you with the tools and resources to engage in strategic investments across various markets, including equities that pay dividends.

Whether you’re new to investing or an experienced trader, Ultima Markets offers access to a wide range of educational resources to support your financial growth.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.