Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Discord IPO: When Will It Go Public?

As of July 2025, Discord has not officially filed for an IPO. However, it is reportedly in early-stage talks with JPMorgan and Goldman Sachs for a potential late-2025 listing, based on recent reports.

Key Facts:

- Discord was last valued at $15 billion in a private round in 2021.

- It rejected a $12 billion acquisition offer from Microsoft in 2021, signaling confidence in its independent growth path.

- Discord appointed Pinterest’s former finance chief Tomasz Marcinkowski as CFO in 2022, a common pre-IPO move.

There is currently no confirmed Discord IPO date, but preparations suggest growing intent to go public.

But before that, let’s understand Discord’s business model and what it’s most known for.

What Is Discord Most Known For?

Discord is a free voice, video, and text communication app originally created for gamers. Over time, it has evolved into a widely used platform for communities, creators, education, crypto, and enterprise discussions. It’s most known for:

- Real-time voice channels and group chats

- Private servers for gaming, trading, investing, and more

- Low latency and API flexibility, which supports bot integration

- A vibrant ecosystem with over 19 million active servers

Its growth has made it a strong contender for the public markets, especially as demand for digital community platforms increases.

Who Owns Discord?

Discord was co-founded by Jason Citron and Stan Vishnevskiy in 2015. It remains privately owned, with major stakeholders including Index Ventures, Greylock Partners, IVP (Institutional Venture Partners), Tencent, Sony Interactive Entertainment, Fidelity, Dragoneer.

These backers could benefit significantly from a public offering, especially if Discord goes public near its last valuation.

What Will the Discord IPO Be Valued At?

While no official IPO valuation has been released, Discord’s last private valuation was $15 billion. However, some secondary market activity in 2025 suggests a potential reset closer to $10 billion.

Factors influencing its IPO valuation:

- Revenue: Discord earned an estimated $575–600 million in 2023, according to Business of Apps.

- Subscription Strength: Its Nitro subscription revenue reached around $207 million.

- User Growth: With an MAU range of 150–200 million, its user base supports scalability.

- Tech IPO Appetite: Market demand for tech listings will shape final valuation.

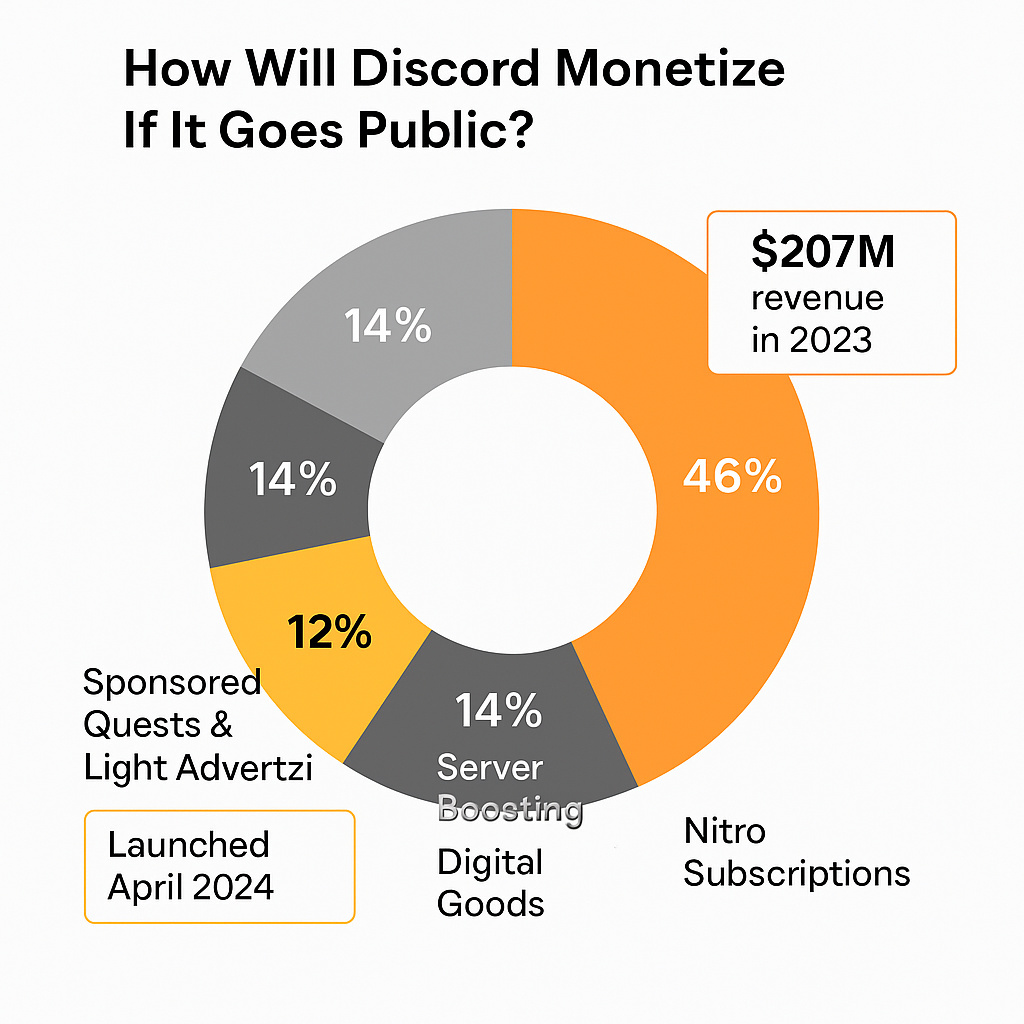

How Does Discord Make Money?

Discord primarily runs a freemium model, where core features are free, and monetization happens through:

- Nitro Subscriptions: Generated $207 million in 2023, offering perks like HD streaming, higher upload limits, and customizations.

- Server Boosts & Digital Goods: Users pay to upgrade their servers or purchase avatar decorations. Discord also earns a 10% cut from game and developer marketplace sales.

- Sponsored & Video Quests: Discord launched ad formats called Sponsored Quests in April 2024, followed by Video Quests in October 2024. As of June 2025, mobile versions have rolled out. These gamified ad experiences are now a growing revenue stream and could soon rival subscription income.

- Developer Marketplace & Digital Sales: Includes monetization from game integrations, digital stickers, and partnerships, with potential to expand into enterprise tools.

Estimated total revenue for 2024 could reach $850–$879 million, driven by growth in ads and digital sales.

How to Buy Discord IPO Shares

Buying IPO shares isn’t as straightforward as regular stock trading especially for high-demand tech listings like Discord. Here’s how you can prepare to invest:

Watch for the S-1 Filing

The first step to investing is confirming that Discord has filed a public S-1 with the U.S. Securities and Exchange Commission (SEC). This document reveals key details like financials, risk factors, share allocation, and underwriters.

Open an Account With an IPO-Access Broker

Most IPO shares are initially reserved for institutional investors or high-net-worth individuals. However, some brokers offer access to retail traders.

Retail brokers with IPO access include:

- Fidelity – Offers IPOs to eligible clients with $100,000+ assets or 36 trades/year

- Charles Schwab – Similar criteria to Fidelity

- TD Ameritrade – Occasionally provides IPO access through syndicate offerings

- Robinhood – Offers IPO shares through a lottery-based system

- SoFi – Provides IPO access with no account minimum for approved users

Invest Pre-IPO (If Eligible)

Some investors can gain access to pre-IPO shares through private markets or equity crowdfunding platforms. This is usually limited to:

- Accredited investors

- Private equity firms

- Employees of Discord or early stakeholders

Note: Pre-IPO shares come with lock-up periods and higher risk due to lack of liquidity.

Buy Shares on IPO Day

If you don’t receive a pre-IPO allocation, you can still buy Discord shares once it lists publicly on the NYSE or Nasdaq.

Steps to do this:

- Fund your brokerage account in advance

- Watch the opening bell on IPO day

- Be aware of high volatility, prices often surge, then pull back

Consider Fractional Shares or ETFs

If the IPO price is high, some platforms offer fractional shares, allowing you to invest small amounts. Alternatively, Discord may be added to tech or communication-focused ETFs (e.g., QQQ, VGT) post-IPO offering indirect exposure with diversification.

When Is Discord IPO Likely to Happen?

There is no confirmed IPO date. However, internal restructuring, CFO hiring, and bank talks suggest a possible late-2025 IPO window, depending on broader market conditions.

Conclusion

The Discord IPO is one of the most anticipated in the tech sector. With a strong brand, nearly 200 million users, and robust monetization, it could deliver compelling opportunities once it goes public. However, there is no set listing date yet, and investors should stay alert for SEC filings and formal announcements.

For those looking to capitalize, advanced preparation and trading strategy alignment are key.

For a secure and transparent trading experience around major IPOs and tech opportunities, consider partnering with Ultima Markets, your trust broker providing access to a wide range of global markets, expert analysis, and educational tools tailored for traders of all levels.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.