Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Before diving into the topic of “depreciation,” consider the currency fluctuations Taiwan experienced over the past year: in the first half of 2025, the New Taiwan Dollar (TWD) once depreciated past 33 per USD, hitting a nearly nine-year low. This highlights the economic risks and investment opportunities associated with depreciation.

This article will start by exploring the causes of depreciation, helping you understand its impact on individuals and businesses, and how to seize opportunities through forex instruments to build effective trading strategies.

Definition and Current Phenomenon of Currency Depreciation

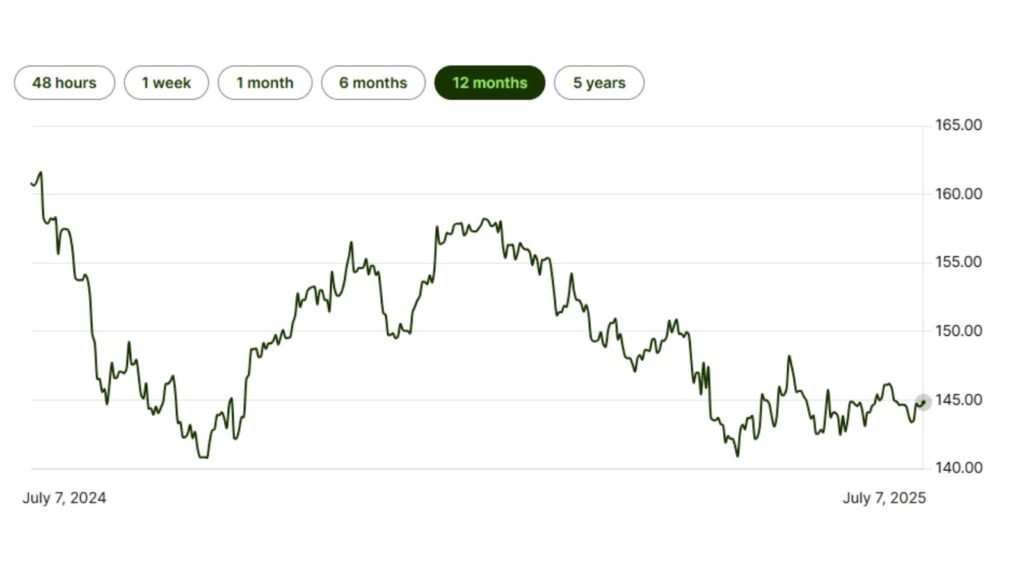

In the first half of 2025, major global currency markets experienced significant volatility. Among Asian currencies, the depreciation of the Japanese Yen, New Taiwan Dollar, and South Korean Won drew substantial attention from investors and businesses. Data shows that in 2024, the Yen once fell below 160 per USD—its weakest level in over 37 years. In April 2025, the TWD depreciated to 33.2 per USD, marking a nine-year low. This depreciation trend has had real consequences for both Taiwanese individuals and businesses.

Simply put, currency depreciation refers to the decline in a country’s currency value relative to other currencies, reducing the purchasing power of the same amount of domestic currency in the international market. This is a common phenomenon under a floating exchange rate system, especially evident during periods of rising inflation, loose monetary policy, or capital outflows.

What Causes Currency Depreciation?

Currency depreciation is rarely driven by a single factor. Instead, it is usually the result of multiple intertwined economic variables. According to research from the Bank for International Settlements (BIS) and the Central Bank of the Republic of China (Taiwan), the following are the main contributors to the depreciation of Asian currencies in 2025:

1. Loose Monetary Policy

From 2024 to 2025, many central banks maintained low interest rates to stimulate economic growth. Notably, the Bank of Japan (BoJ) continued its negative interest rate policy, causing capital outflows and leading to Yen depreciation.

2. Capital Outflows and a Strong US Dollar

The continued strength of the US economy led to a stronger dollar, resulting in broad weakness across emerging market currencies. Capital outflows from emerging markets into US assets further intensified depreciation pressure on the TWD and KRW.

3. Trade Deficits and Inflationary Pressure

When a country imports far more than it exports or faces a sharp rise in domestic prices (CPI), confidence in its currency weakens, accelerating depreciation.

4. Political or Geopolitical Risk Escalation

Regional conflicts and political instability can erode market confidence in a country’s currency. For example, during periods of Middle East tension, surging oil prices burden importing economies and can trigger currency depreciation.

Impact of Currency Depreciation on Taiwan’s Export-Import Sector and the Public

Export-Import Businesses

TWD depreciation is a double-edged sword for exporters: in the short term, it improves competitiveness by making products more attractive to foreign buyers. However, for companies that rely on imported raw materials, costs rise simultaneously.

Importers and Consumers

For the general public, outbound travel becomes more expensive as more TWD is required to buy the same amount of foreign currency. Coupled with high oil prices and rising import costs, overall consumer spending increases. Currency depreciation directly affects travel expenses, including airfares, hotel rates, and overseas purchases, forcing higher travel budgets.

How to Manage Forex Risk During a Depreciation Trend

In the face of currency depreciation, both individuals and businesses must take proactive measures to reduce financial risks and the erosion of purchasing power.

1. Allocate to Foreign Currency Assets and Gold

When TWD depreciation is expected, reallocating part of assets into anti-depreciation instruments—such as USD, CHF, or gold—can effectively hedge risks. According to the World Gold Council, gold prices rose more than 25% year-to-date in the first half of 2025.

2. Use Forex Hedging Instruments

Businesses can use forward contracts to lock in import/export pricing and stabilize profit margins. Individual investors can trade forex CFDs to capture short-term volatility.

3. Invest in Assets Negatively Correlated to the Base Currency

This includes USD-denominated ETFs, commodities, or bonds, which can offer compensatory returns when the local currency depreciates.

Emerging Market Currency Depreciation Trends and Investment Opportunities

In addition to Taiwan, most emerging market currencies also faced depreciation pressure in 2025, with the South Korean Won notably weakening due to domestic political instability. These trends suggest that forex trading strategies should include diversified global currency exposure to enhance opportunity and resilience.

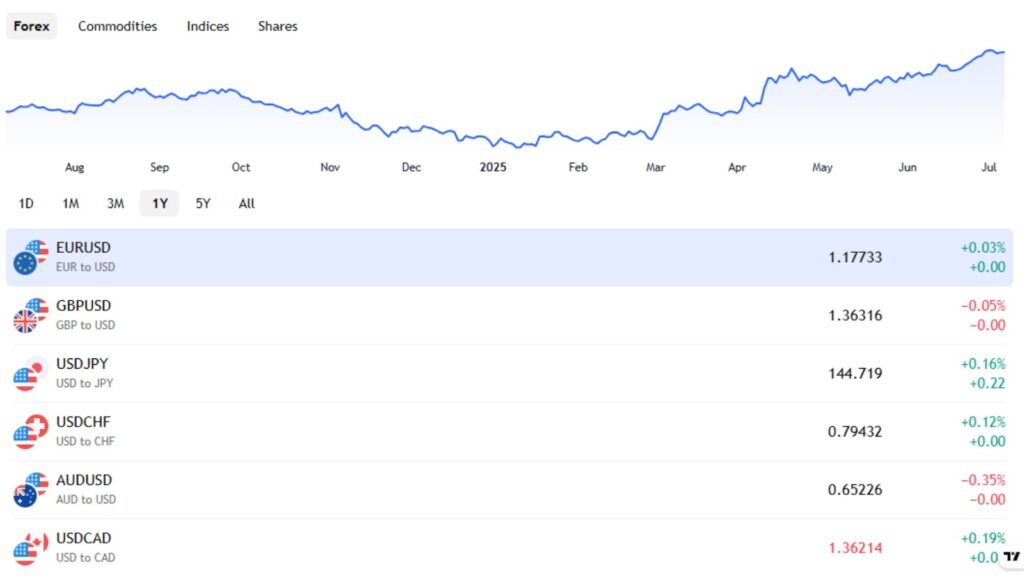

The UM platform supports over 80 currency pairs, allowing traders to engage in popular pairs such as USD/TWD and JPY/USD for arbitrage opportunities.

How to Capture Depreciation Arbitrage Opportunities Through Forex Trading

During depreciation cycles, forex market volatility increases, creating more short- and medium-term trading opportunities. With the right platform and tools, investors can hedge risk and potentially profit.

Take Ultima Markets as an example: the platform offers a wide selection of currency pairs (e.g., USD/TWD, USD/JPY, EUR/USD) and leverage up to 1:2000, enabling even small-capital traders to participate in large market movements. Coupled with a low-latency trading environment and ECN accounts offering 0.0 pip spreads, it is highly suitable for high-frequency or EA automated strategies.

With Ultima Markets’ demo account feature, new traders can practice and test strategies in a risk-free environment. Whether engaging in short-term USD appreciation trades or capturing medium-term emerging market currency depreciation trends, both are critical steps toward improving financial independence.

Mastering the Forex Market: Practical Strategies to Turn Risk into Opportunity

In 2025, global monetary policy remains highly divergent. The US dollar continues to strengthen, while Asian currencies face ongoing depreciation pressure. For Taiwanese investors, this presents both risk and a strategic opportunity for asset reallocation. You can:

- Use technical analysis tools (such as Trading Central) to track exchange rate trends

- Set clear risk parameters and stop-loss levels to avoid overleveraging

- Adjust your portfolio based on economic data and central bank meeting minutes

When you’re ready to take the next step into the market, choosing a safe, regulated, and execution-efficient platform is essential.

Conclusion

The 2025 wave of currency depreciation is a significant economic signal, driven by a complex mix of central bank policies, capital flows, and global geopolitical and economic shifts. Whether you are managing import/export operations, planning overseas spending, or seeking investment gains, it is crucial to understand and respond to this trend with clear strategies for risk control and opportunity capture.

By applying balanced asset allocation, hedging tools, and engaging with over 80 currency pairs through the high-performance platform and demo tools provided by Ultima Markets, you can shift from being a passive observer of depreciation to an active participant in market movements.

Open a trading account today, practice with a demo account, and step confidently into the real market to seize the opportunities of this volatile era.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.