Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomHow to Master Exchange Rate Conversion and Save Fees

In the rapidly evolving landscape of globalization and digitalization in 2025, exchange rate conversion has become an indispensable component of international financial activities. Whether for businesses conducting cross-border transactions or individuals investing in the forex market, accurately understanding exchange rates is key to success. This article will explore the fundamental concepts, calculation methods, and practical strategies of exchange rate conversion, while introducing how to trade forex effortlessly through professional platforms like Ultima Markets.

What Is Exchange Rate Conversion?

Exchange rate conversion refers to the process of exchanging one currency for another, usually calculated based on the real-time exchange rate. In the global forex market, exchange rates are influenced by multiple factors, including economic data, interest rate changes, and political developments. According to data from the International Monetary Fund (IMF), the global forex market reached a daily average trading volume of USD 7.5 trillion in 2024, highlighting its immense scale and liquidity.

Key Terms Explained: Spread, Mid-rate, Hidden Costs

When it comes to understanding exchange rate conversion, there are several key terms every investor must grasp; otherwise, one can easily suffer losses due to information asymmetry.

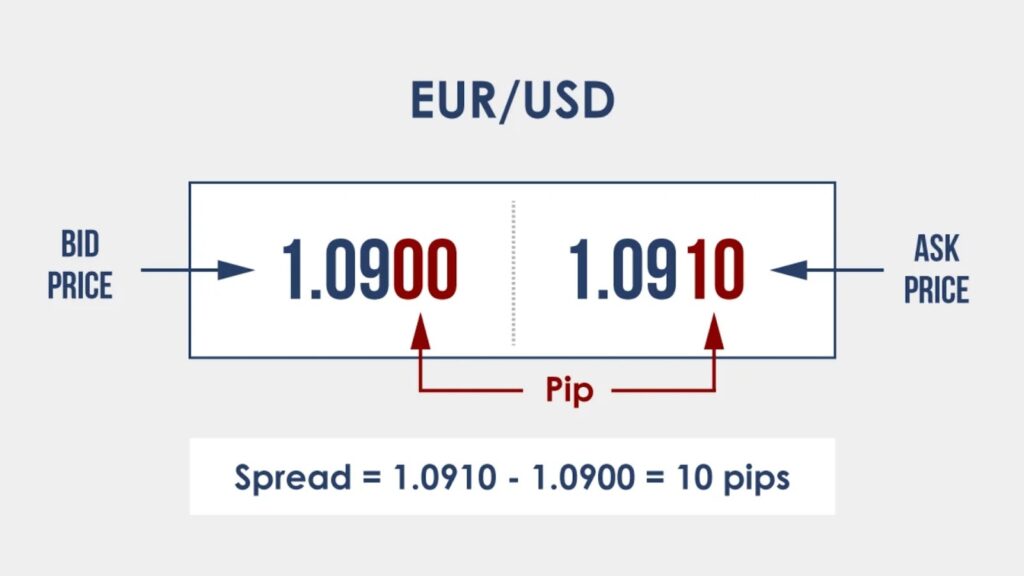

- Spread:

Spread refers to the difference between the bid price and the ask price in forex trading, typically measured in “pips.”

For example, if EUR/USD is quoted at 1.0910/1.0900, the spread is 0.0010 or 10 pips. A narrower spread benefits traders by lowering entry and exit costs. At Ultima Markets, ECN accounts offer spreads as low as 0 pips, combined with a fixed commission of USD 5 per lot, making it especially attractive for high-frequency traders.

- Mid-rate:

Mid-rate refers to the average between the bid and ask prices, often considered the “theoretical fair price.” However, in practice, regular users rarely transact at the mid-rate, as both banks and trading platforms typically charge a margin as a source of revenue. - Hidden costs:

In addition to visible fees and spreads, hidden costs should also be considered. For example, some platforms may quietly include opaque markups in their exchange rate quotes or charge extra currency conversion service fees. These costs can be difficult to detect directly but may significantly impact returns over time. Choosing a platform like Ultima Markets, with transparent quotes and clear spreads, helps minimize such hidden charges.

Understanding these terms not only helps you choose more cost-effective exchange rate conversion methods but also allows for better cost control in your investments, ultimately improving overall returns.

How to Calculate Forex Conversion Costs?

When performing exchange rate conversion, it is important to consider not only the real-time rate but also the applicable transaction fees and potential hidden charges. Banks or currency exchange platforms may impose percentage-based service fees or include additional margins in quoted prices.

Take Taiwan as an example: According to a report from the Central Bank in March 2025, the Taipei forex market recorded an average daily trading volume of USD 48.6 billion, with NT dollar–USD transactions accounting for 39.4%. This highlights the NT dollar’s significance in the forex market and serves as a reminder for investors to closely monitor related exchange rate fluctuations and fee structures.

How Are Exchange Rates Determined?

Exchange rates are primarily determined in two ways: through market-based floating exchange rates and bank-set pricing.

- Market-based floating exchange rate:

This type of exchange rate is determined directly by the supply and demand dynamics within the foreign exchange market. For example, if global investors increase their demand for the US dollar—due to factors such as Fed interest rate hikes or robust economic growth—the dollar will appreciate against other currencies.

In the first quarter of 2025, the Federal Reserve maintained its high-interest-rate stance, pushing the US Dollar Index up to 106.5. These market-driven exchange rates are generally transparent and capable of reflecting investor sentiment and global capital flows in real time.

- Bank-set exchange rates:

To maintain operational stability, banks formulate their own buy and sell prices by adding internal costs, risk premiums, and profit margins to the base market exchange rate—thus creating a spread.

For example, Bank of Taiwan and CTBC Bank publish daily cash and spot exchange rates that already include a certain degree of spread and service fees. This explains why currency exchange through banks often results in slightly less favorable rates compared to real-time market rates.

Understanding how exchange rates are determined helps traders choose more favorable channels for currency conversion or investment. For example, professional forex trading platforms like Ultima Markets use market-based floating rates, which are highly transparent and liquid—an undeniable advantage for investors who require accurate pricing and rapid execution.

Essential Tips for Exchange Rate Conversion in Forex Trading

Mastering exchange rate conversion techniques can improve the efficiency and profitability of forex trading. Here are a few practical tips:

- Use real-time conversion tools: Rely on tools provided by professional platforms to stay updated on the latest exchange rates and make timely decisions.

- Monitor market developments: For instance, in February 2025, US President Trump announced tariffs on several trade partners, causing the US dollar to weaken and impacting the global forex market.

- Set stop-loss and limit orders: Defining appropriate stop-loss and limit levels during trading can help control risk and prevent losses from exchange rate volatility.

- Choose low-fee platforms: Opt for trading platforms like Ultima Markets that offer low transaction costs and transparent pricing to reduce your overall trading expenses.

A Guide to Exchange Rate Conversion and International Remittance

Exchange rate conversion plays a critical role in international remittances. Here are several useful tips:

- Compare exchange rates and fees: Banks and remittance platforms may offer varying rate and fee structures. Choosing the most favorable option can help reduce costs.

- Understand remittance timelines and procedures: Different transfer methods may require different processing times. Knowing the flow in advance helps you better manage your funds.

- Be aware of exchange rate volatility: Currency values may fluctuate during the remittance process. Choosing a platform that offers real-time rate-locking services can reduce risk.

Ultima Markets supports multiple base currencies and offers various deposit options—including bank transfers, credit cards, and cryptocurrency wallets—to meet the diverse needs of users.

Cost Analysis of Banks, Payment Platforms, and Forex Brokers

When it comes to executing currency conversion, there are three main channels in practice: banks, payment platforms (such as PayPal and Wise), and professional forex brokers. These options vary significantly in terms of cost structure, advantages, and disadvantages. The following provides a detailed comparison using the 2025 exchange rate between the New Taiwan Dollar (TWD) and the US Dollar (USD) as an example.

Banks: Stable but High Costs

Large banks in Taiwan (such as Bank of Taiwan and CTBC Bank) generally offer stable currency exchange services but have higher fees and wider spreads.

According to a May 2025 announcement by Bank of Taiwan, the spot exchange rate is about TWD 32.6 to USD 1. However, when actually exchanging currency, the bank charges a service fee of around 0.1%–0.2%, with the bid-ask spread averaging 3–5 pips (approximately 0.01–0.02 USD/TWD). While banks are trusted for large-scale exchanges or commercial use, their costs are higher for individual users.

Payment Platforms: Convenient but Hidden Fees

Payment platforms like PayPal and Wise have become increasingly popular in recent years due to their convenience and fast processing. However, their exchange rates often include hidden fees.

For example, although Wise claims to exchange currency at the market mid-rate, it charges an additional 1%–1.5% service fee. PayPal is more obvious, as it embeds a 1.5%–4% markup in the exchange rate and may also charge additional fees for different countries or currencies. In other words, although users may not feel the “fees,” the actual exchange cost is not cheap.

Forex Brokers: Low Costs and Professional Focus

Professional forex brokers like Ultima Markets offer real-time market floating exchange rates, with spreads as low as 0 and clearly stated commissions (such as USD 5 per lot for ECN accounts).

For example, if using Ultima Markets to exchange TWD to USD, the actual exchange cost is about 0.02%–0.05%, much lower than that of banks and payment platforms. Additionally, Ultima Markets offers leverage of up to 2000x and advanced risk management tools, which is especially attractive to investors who need flexible capital management.

The strengths and weaknesses of the three main channels are summarized in the table below:

| Channel | Advantages | Disadvantages | Cost Details (TWD/USD Example) |

| Bank | Reliable, reputable, suitable for large-scale commercial transactions | High fees, wide spreads, lower exchange efficiency | Fee approximately 0.1%–0.2%, spread about 3–5 pips (approximately 0.01–0.02 USD/TWD) |

| Payment Platforms | Convenient operation, fast processing, multi-currency support | Hidden fees embedded in exchange rates, high overall cost | Wise: Mid-rate + 1%–1.5% fee; PayPal: Mid-rate + 1.5%–4% markup |

| Forex Brokers | Real-time rates, low cost, professional tools, transparent pricing | Suitable for advanced users, requires account setup and platform familiarity | Spread as low as 0, clear commission (e.g., USD 5 per lot for ECN accounts), total cost approx. 0.02%–0.05% |

In summary, for small, one-off exchanges (such as online shopping or travel), payment platforms, while convenient, have higher exchange costs. For large amounts or investment purposes, forex brokers offer clear advantages with their professionalism and lower costs.

If you’re looking for an efficient, transparent, and low-cost currency conversion and investment platform, Ultima Markets is definitely worth considering.

FAQ

Q1: Are there any platforms that offer exchange rate conversion with no fees?

A: Some platforms, such as Ultima Markets, offer low or no-fee trading options. It is recommended that users carefully compare the fee structures when selecting a platform.

Q2: What is the difference between exchange rate conversion and forex margin trading?

A: Exchange rate conversion refers to exchanging one currency for another, whereas forex margin trading is a leveraged investment method with higher risks and potential returns.

Q3: How much capital is needed to start forex trading?

A: Ultima Markets offers demo accounts, allowing users to practice trading in a risk-free environment. The actual capital required for real trading depends on the individual’s strategy and risk tolerance.

Conclusion

In the rapidly changing financial markets, exchange rate conversion is not only a basic operation in daily transactions but also an important component of investment strategies. By gaining a deeper understanding of exchange rate conversion concepts, calculation methods, and practical techniques—and by choosing professional platforms like Ultima Markets for trading—you’ll be better able to capture market movements and enhance investment returns.

Take action now—start your forex trading journey, take control of exchange rate conversions, and move toward a more prosperous financial future!

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.