Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat is CPI: A Key Investment Indicator

What is the Consumer Price Index (CPI)? It is an economic indicator used to measure the changes in prices of general goods and services in the market, reflecting the rise and fall of consumers’ daily living costs.

CPI is an important tool for governments, investors, and businesses to understand economic momentum and inflationary pressures.

What is CPI and how is it calculated

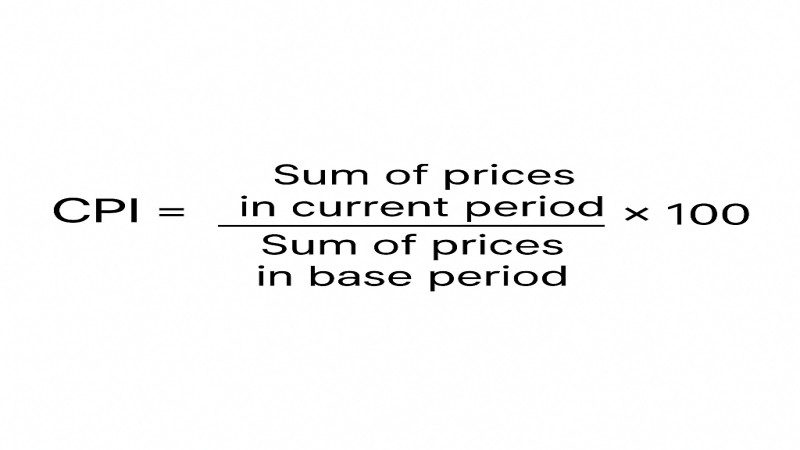

What is CPI? CPI is calculated by taking a weighted average of the prices of a fixed basket of goods and services (such as food, housing, transportation, medical care, etc.) purchased by urban households. The formula is: CPI = (total price of goods and services in the current period ÷ total price of goods and services in the base period) × 100.

For example, using 2020 as the base period, if prices in 2024 increase by 10%, the CPI would reach 110, representing an inflation rate of 10%. Such data accurately reflects the changes in the actual living burden of average households.

How does CPI impact investment markets

Investors must understand what CPI is, as its data has a significant impact on capital markets such as stocks and forex. When CPI rises, central banks typically implement tighter monetary policies, such as raising interest rates to curb inflation.

This increases the cost of capital and leads to adjustments in asset valuations in the market, which may result in falling stock prices. Technology companies and highly leveraged firms are particularly susceptible.

Relationship between CPI and the stock market

Historical data shows that when CPI data is higher than expected, the Dow Jones index in the US has a more than 60% chance of declining in the short term. This is because high CPI figures trigger expectations of interest rate hikes, causing funds to shift to lower-risk assets.

Therefore, investors should closely monitor the monthly CPI releases from the US Bureau of Labor Statistics and adjust their investment allocations accordingly.

Relationship between CPI and forex

Forex market investors should also pay attention to changes in CPI. For instance, when US CPI data exceeds expectations, the US dollar exchange rate typically rises because the market anticipates that the Federal Reserve will raise interest rates, attracting more funds into dollar assets.

Conversely, if CPI data falls short of expectations, the US dollar may depreciate. As a result, CPI becomes a critical indicator for determining forex market fluctuations.

How to adjust investment strategies based on the CPI

After understanding what CPI is, investors should adjust their asset allocation based on its trend. If CPI continues to rise, indicating growing inflationary pressures, they can consider allocating to inflation-resistant assets such as gold and commodities.

If CPI shows signs of slowing, investors can focus on growth stocks as potential investment opportunities. Ultima Markets’ demo account allows investors to practice trading in real-world market conditions, helping them become familiar with how the market reacts to changes in CPI.

What is CPI and how it differs from other economic indicators

Many people tend to confuse CPI with PPI (Producer Price Index), but these two focus on different aspects. CPI tracks price changes at the consumer level, directly reflecting living costs, while PPI measures price fluctuations at the production stage, mainly focusing on manufacturing and supply chain costs.

Clearly distinguishing these two helps accurately understand the source and potential direction of economic pressures. Manufacturers often refer to PPI as a cost indicator, while retailers and service industries rely more on CPI to assess consumer-side pressure.

| Indicator | Target | Scope of Impact |

| CPI | Consumers | Living costs and inflation |

| PPI | Producers | Manufacturing costs and profits |

FAQ

Q: Does a high CPI always mean the economy is in bad shape?

A: Not necessarily. Sometimes, a high CPI comes from an active economy and rising demand, which reflects market prosperity. However, if prices rise too quickly and outpace wage growth, there is a risk of declining real purchasing power. In such cases, it’s important to watch whether central banks will implement measures like raising interest rates.

Q: How does CPI affect my salary adjustment?

A: CPI changes directly affect the cost of living, and many companies and government agencies refer to CPI data when adjusting employee salaries to ensure stable real incomes. Therefore, if CPI continues to rise, there is a reasonable basis to ask for wage adjustments.

Q: Why is it important to pay attention to CPI data release schedules?

A: CPI data is usually released regularly by official agencies in each country. For example, in the US it is released mid-month, while in Taiwan it is released by the Directorate-General of Budget, Accounting and Statistics. Since the data can trigger market volatility as soon as it is released, investors should be aware of the release schedule to adjust strategies proactively or in real time, reducing the risks from market uncertainty.

Q: How can investors effectively monitor changes in CPI?

A: Professional trading platforms like Ultima Markets offer comprehensive market monitoring tools and real-time data services. Users can access diverse asset classes through trading accounts and combine trading tools with CPI information to plan their strategies.

Ultima Markets also offers trading journals, chart analysis, and educational resources to help investors interpret the impact of CPI effectively and respond flexibly in forex, commodities, and stock index CFDs.

Conclusion

In summary, what CPI is no longer just an abstract economic term, but an important indicator that affects household budgets, business operations, and global markets.

Whether you are a newcomer or an experienced investor, understanding the definition, calculation method, and trend of CPI and its impact on different markets is fundamental to building a solid investment system.

With the support of professional trading platforms like UM, investors can respond more flexibly to market challenges. Understanding what CPI is is worth the time to explore and make good use of.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.