Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomThe Consumer Price Index (CPI) is a core metric that reflects a country’s inflation level. Each CPI release can move global financial markets significantly, with direct impact on asset prices such as foreign exchange, equities, bonds, and gold. In particular, US CPI serves as a key indicator for the direction of the US dollar and global capital flows.

Understanding the meaning of CPI and its economic implications is essential foundational knowledge for every investor.

What Is CPI?

The CPI is an index that measures the price changes of goods and services purchased by households in a given country, such as food, housing, transportation, and healthcare. It reflects the level of inflation or deflation. By comparing price levels across different time periods, CPI indicates changes in consumer living costs and serves as a key reference for central banks when formulating monetary policy.

CPI’s Impact on Economic Policy

When CPI rises continuously, it typically signals mounting inflation pressure. In such cases, the central bank may raise interest rates to curb demand and slow down price increases.

Conversely, if CPI is too low or turns negative, the central bank may implement easing policies to stimulate the economy. These policy shifts directly impact currency exchange rates and financial market trends.

Correlation Between CPI and Investment Markets

CPI releases have a particularly strong influence on forex market volatility. For example, if US CPI comes in higher than expected, it often leads to USD appreciation as markets anticipate faster rate hikes by the Federal Reserve. Investors who monitor CPI release timing and forecasts can position themselves ahead of time to capture potential trading opportunities.

2025 CPI Release Schedule for the US and Taiwan

CPI data follows a fixed release schedule. Knowing the exact release dates helps traders formulate strategies. The following is the schedule through the end of 2025:

US CPI Release Dates (Taiwan Time)

| Month | Data for Month | Release Date (Taiwan Time) |

| July | June | July 15 (Tuesday) |

| August | July | August 13 (Wednesday) |

| September | August | September 11 (Thursday) |

| October | September | October 15 (Wednesday) |

| November | October | November 13 (Thursday) |

| December | November | December 11 (Thursday) |

*Source: U.S. Bureau of Labor Statistics (BLS)

Taiwan CPI Release Dates (Taiwan Time)

| Month | Data for Month | Estimated Release Date (Taiwan Time) |

| July | June | July 4 (Friday) |

| August | July | August 5 (Tuesday) |

| September | August | September 4 (Thursday) |

| October | September | October 3 (Friday) |

| November | October | November 4 (Tuesday) |

| December | November | December 4 (Thursday) |

*Source: Directorate-General of Budget, Accounting and Statistics (DGBAS)

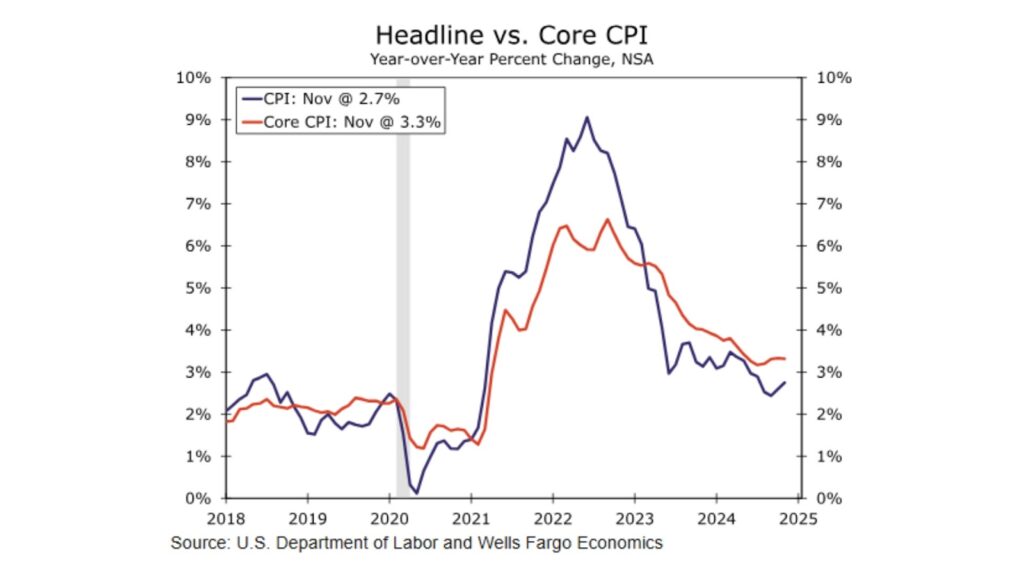

Difference Between Core CPI and Headline CPI

CPI is divided into “headline CPI” and “core CPI.”

Headline CPI includes the price changes of all consumer items. Among them, food and energy prices are highly volatile and often affected by seasonal or international factors.

In contrast, core CPI excludes food and energy and is used to observe long-term structural changes in price levels.

As a result, core CPI provides a more accurate reflection of underlying inflation trends and is more heavily relied upon by central banks when setting interest rate policy. For investors, understanding the difference between the two helps in evaluating market direction and policy shifts more comprehensively.

Three Immediate Market Reactions After CPI Release

Increased Volatility in the US Dollar Index (DXY) and Exchange Rates

When CPI comes in higher than expected, the US dollar typically strengthens. In June 2025, a slight CPI increase led to a brief rebound in the dollar.

Immediate Adjustment in Fed Policy Outlook

According to the June FOMC meeting minutes, while the Fed kept interest rates steady at 4.25–4.50%, markets had anticipated two rate cuts within the year, with inflation expected to stay around 3% by year-end. However, the 2.4% CPI increase weakened expectations for rate cuts.

Increased Volatility in Risk Assets (Equities, Gold, Bonds)

After the May 2025 CPI release, US equity indices rebounded, gold prices rose due to higher demand for safe-haven assets, and US Treasury yields edged slightly lower.

Trader Preparation Before a CPI Release

To capture market movement while managing risk, the following is recommended:

- Set clear stop-loss and take-profit levels;

- Use a demo account to simulate post-CPI market volatility;

- Choose a trading platform with low spreads and fast execution.

Among available options, Ultima Markets’ ECN account offers ultra-low spreads and execution speeds under 20 milliseconds, making it ideal for trading around economic events.

How to Use CPI Releases for Short- and Long-Term Positioning

Short-Term Strategy

If headline or core CPI exceeds expectations, consider short-term long positions; if it significantly overshoots market consensus, shorting the USD against major currencies may be viable.

Long-Term Strategy

The Fed forecasts overall inflation to reach about 3% by the end of 2025, with core inflation near 3.2%. This suggests that reallocating to inflation-resistant assets such as gold or non-USD currencies may be a viable medium-to-long-term strategy.

Ultima Markets provides Trading Central technical analysis tools to help traders interpret CPI releases and develop strategies in advance.

Why Choose Ultima Markets for High-Volatility Trading?

High-Performance Execution and Tight Spreads

Ultima Markets uses professional-grade MT4/MT5 platforms supported by a global server network. Average order execution latency is under 20 milliseconds, with ECN spreads starting at 0.0 pips to reduce slippage and trading costs. The platform supports EA automation, enabling efficient responses to every CPI-driven market spike—ideal for trading highly volatile releases.

Multi-Layered Fund Protection and Regulatory Oversight

The platform is regulated by CySEC and ASIC. Client funds are held in segregated accounts at Westpac and are not mixed with operational funds. Additional protection includes a €20,000 compensation scheme from the Financial Commission and up to USD 1 million in extra insurance—ensuring peace of mind for traders.

Demo Account and Educational Resources

With leverage up to 1:2000, even small capital can be flexibly deployed. For beginners, Ultima Markets offers a demo account along with real-time CPI explanations, market reports, and educational content to help you learn how to navigate data-driven markets from scratch.

Conclusion

CPI releases are not just macroeconomic indicators—they are essential tools for traders to assess market trends and form strategies. With the right data, risk controls, and tools in place, each CPI announcement can present a high-potential trading opportunity.

Start now with a professional and transparent platform like Ultima Markets to participate confidently in major global data-driven events and enhance your asset management efficiency.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.