Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhen Did CoreWeave Go Public?

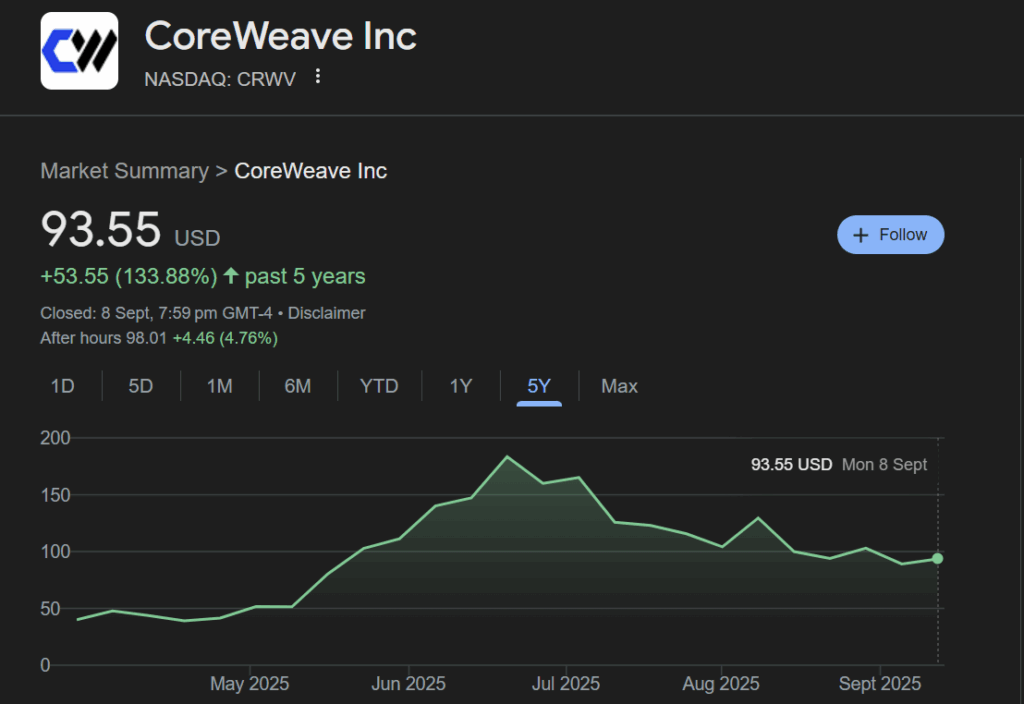

The CoreWeave IPO date was March 28, 2025, when the company listed on the Nasdaq under the ticker symbol CRWV.

CoreWeave IPO Price

Shares were priced at $40 each, below the originally expected range of $47–$55. CoreWeave sold 37.5 million shares, raising around $1.5 billion in proceeds. That pricing implied a $23 billion fully diluted valuation at IPO.

Market Reaction

On its first day, CoreWeave’s stock opened slightly lower at $39 and closed flat at the $40 IPO price. But within three trading days, the stock had surged 42%, closing at $52.57 on April 1, 2025.

By June 2025, CoreWeave shares had skyrocketed more than 250% from the IPO price, briefly pushing its market cap close to $70 billion. This explosive move put it at the center of trader attention.

What Does CoreWeave Do?

CoreWeave, founded in 2017 and headquartered in Livingston, New Jersey, began as a crypto mining startup but quickly pivoted into one of the fastest-growing AI cloud computing providers. Today, the company rents out massive GPU infrastructure powered by NVIDIA chips to enterprises and developers working on artificial intelligence, machine learning, and high-performance computing.

With customers ranging from Microsoft to leading AI labs, CoreWeave has positioned itself as a backbone of the AI revolution. Its $1.6 billion Plano, Texas facility, often described as one of the world’s fastest AI supercomputers, highlights the scale at which it operates. For traders, that means CoreWeave is not just another tech IPO, it’s a play on the infrastructure fueling the AI boom.

What Drives CoreWeave Stock Price?

Revenue Growth and Profitability

CoreWeave’s stock is highly sensitive to its top-line revenue growth. In 2024, revenue jumped from $229M to nearly $1.9B that hypergrowth was a major driver of post-IPO enthusiasm. But traders also watch the net losses (–$863M in 2024). If CoreWeave can show a path toward profitability while keeping revenue growth above 30% per year, the stock tends to rally.

Customer Concentration

Microsoft accounts for roughly two-thirds of CoreWeave’s sales. That reliance cuts both ways:

- Positive news of expanded contracts with Microsoft can send the stock higher.

- Any hint of reduced demand or over-concentration risk can weigh on valuations.

NVIDIA Supply and GPU Pricing

CoreWeave rents GPU infrastructure built on NVIDIA chips. Stock price performance often mirrors NVIDIA’s supply chain updates, GPU price changes, and AI demand outlook. If NVIDIA faces bottlenecks, CoreWeave may struggle to scale, hurting investor sentiment.

Debt and Financial Leverage

With nearly $8B in balance-sheet debt and $12.9B in total commitments, CoreWeave’s ability to service debt is a big factor. Traders monitor interest costs, refinancing risks, and whether heavy leverage is being offset by expanding cash flow.

AI Market Sentiment

CoreWeave is seen as a proxy for AI infrastructure growth. When markets are bullish on AI (due to ChatGPT adoption, new AI models, or enterprise AI spending), CRWV stock tends to soar. Conversely, when AI hype cools or capital spending slows, it corrects quickly.

Analyst Ratings and Price Targets

Brokerage coverage and analyst upgrades/downgrades often create short-term swings. For example, when analysts raised average price targets above $70 in mid-2025, momentum buyers piled in.

Broader Market Conditions

As a high-growth, unprofitable tech stock, CoreWeave trades like a risk-on asset. Rising interest rates, tighter credit, or weaker equity markets put pressure on valuation multiples. On the other hand, dovish Fed signals or strong tech inflows lift the stock.

CoreWeave Stock Valuation: Opportunity and Risk

Rapid Growth

- Revenue: $1.92 billion in 2024 (up from just $229 million in 2023).

- Losses: Net loss of $863 million in 2024, highlighting heavy expansion costs.

- Clients: Microsoft alone contributed about two-thirds of revenue, with the top two customers accounting for 77% of sales.

Debt and Leverage

By year-end 2024, CoreWeave carried ~$7.9 billion in debt on its balance sheet, plus $12.9 billion in total debt commitments. For traders, this leverage is a double-edged sword: it fuels rapid expansion but magnifies financial risk if growth slows.

Dependency on NVIDIA

CoreWeave’s business model relies heavily on NVIDIA GPUs. Any disruption in NVIDIA’s supply chain or changes in chip pricing could directly impact CoreWeave’s margins.

CoreWeave IPO Price Prediction and Analyst Targets

Analysts were cautious at first, citing high valuation multiples and customer concentration risk. Early June 2025 consensus targets averaged $72.61, though the stock traded well above that level as investor enthusiasm for AI infrastructure intensified.

More recent estimates (late 2025) vary widely, with some analysts projecting three-figure price targets if CoreWeave maintains 30%+ revenue growth. Others warn that slowing AI investment or reduced orders from Microsoft could lead to sharp corrections.

For traders, this split makes CoreWeave a high-beta AI proxy capable of both outsized gains and painful drawdowns.

Conclusion

The forces driving CoreWeave’s stock price from rapid revenue growth and reliance on Microsoft, to NVIDIA’s GPU supply and overall AI market sentiment make it one of the most volatile and closely watched AI plays on the market. For traders, this volatility creates both opportunities and risks.

At Ultima Markets, we provide the tools and insights you need to navigate these fast-moving stocks. Whether it’s staying on top of the latest CoreWeave IPO updates, monitoring AI sector momentum, or executing trades with precision, Ultima helps you trade smarter and with confidence in today’s rapidly evolving markets.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.