Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat’s a CFD? How to Trade? Beginner’s Must-Read Guide

With rapid financial market development, Contract for Difference (CFD) trading gains global popularity. Market forecasts project $10 trillion global CFD volume by 2025, with Asia-Pacific growth surging and Taiwanese adoption rising. This guide analyzes CFD mechanisms, advantages, risks, fraud prevention, and platform selection to capitalize on asset volatility.

What is a Contract for Difference (CFD)?

A Contract for Difference (CFD) is a derivative financial instrument enabling investors to speculate on price movements without owning the underlying asset. Investors enter contracts with brokers, with profits/losses settled based on the price difference between opening and closing positions.

CFDs cover diverse assets: forex, gold, crude oil, indices, equities, and cryptocurrencies. Their high flexibility, leveraged trading, and two-way market access (long/short) attract substantial trading activity.

Advantages and Features of CFDs

1.High Leverage Trading

CFD trading’s high-leverage nature is a key attraction. Professional brokers like Ultima Markets offer leverage up to 1:2000, enabling investors to control large positions with minimal margin.

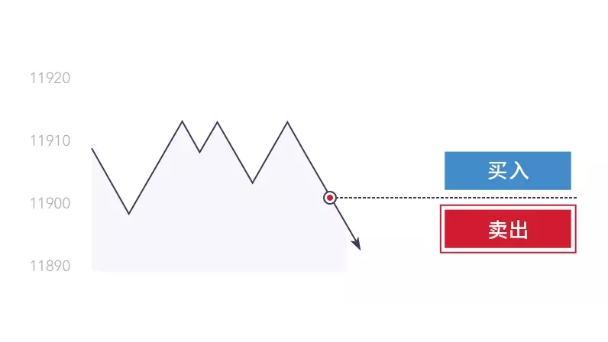

2.Two-Way Market Access

CFDs enable trading in both rising/falling markets. Execute long (bullish) or short (bearish) positions to capitalize on market movements.

3.Diversified Asset Portfolio

Trade multiple assets through a single account: EUR/USD, gold, WTI crude, US indices, Bitcoin, etc. Achieve risk diversification while capturing global opportunities.

4.No Physical Asset Holding

CFDs eliminate physical delivery requirements, removing settlement costs and administrative complexities while lowering capital barriers and counterparty risks.

5.Transparent Cost Structure

Using Ultima Markets as an example, its ECN account offers spreads as low as 0.0, with a commission of only USD 3 per lot—significantly lower than the market average of USD 6 to 7—making its trading costs highly competitive.

CFD vs Traditional Investment Instruments

| Category | CFD Trading | Traditional Investments (Stocks, Funds, Futures) |

| Asset Ownership | None (price differential speculation) | Physical ownership |

| Trading Direction | Two-way: long/short positions | Mostly one-way (e.g., stocks long-only) |

| Leverage Ratio | High (1:2000 at UM) | Lower (stocks 1:1-1:3; margin-based futures) |

| Cost Structure | Spreads + commissions (0 USD/lot) | Brokerage fees, taxes, exchange charges |

| Trading Hours | Near-24/5 (asset-dependent) | Restricted sessions (e.g., TWSE 09:00-13:30) |

| Target Investors | Short-term/swing traders | Risk-averse/long-term investors |

| Capital Flexibility | High (micro-lot access) | Higher capital thresholds |

| Technical Support | EA/automated trading compatible | Limited advanced tools |

Inherent Risks of CFD Trading

While CFDs offer flexibility, high leverage amplifies risk exposure.

1.Stop-Out & Forced Liquidation Risks

Extreme market volatility may trigger forced liquidation when margin falls below requirements. Ultima Markets enforces a 50% stop-out level – automatic stop-loss execution activates when account equity breaches this threshold.

2.Strategy Miscalculations

CFDs’ short-term trading nature accelerates losses with inexperience or miscalculations. Mastering risk management and technical analysis is critical.

3.Emotional Discipline

Volatile markets amplify losses from overtrading/emotional decisions. Maintain strict stop-loss/take-profit protocols to enforce discipline.

How to Avoid CFD Scams?

With global investment fraud rising in 2025, investors must stay vigilant against social media impersonation scams and fake trading platforms.

Common Fraud Tactics:

- Impersonating licensed brokers to distribute malicious apps

- Promising “risk-free returns” via unverified “trading gurus”

- Recruiting victims into groups to promote high-risk platforms

- Delaying/blocking withdrawal requests

Anti-Scam Protocols:

- Verify platforms are internationally regulated (CySEC, ASIC)

- Authenticate official URLs/contact details; avoid suspicious links

- Prioritize platforms with compensation schemes & client fund segregation (e.g., Ultima Markets)

- Reject “guaranteed profit” claims – trade based on independent analysis

Can Taiwanese Investors Legally Trade CFDs?

CFD trading is not explicitly prohibited in Taiwan, though local financial institutions typically do not offer such services. Investors can legally participate in CFD trading through internationally regulated platforms (e.g., platforms licensed by CySEC [Cyprus Securities Commission] or ASIC [Australian Securities Commission]).

How to Choose a Suitable CFD Trading Platform?

Evaluate platforms based on the following criteria:

- Regulation & Reputation: Choose platforms like UM with multiple regulations for greater security

- Fund Safety: Whether client funds are segregated (UM client funds are held in Westpac Bank, Australia)

- Trading Costs: Low spreads and low commissions enhance profit potential

- Platform Features: Supports MT4/MT5, automated trading, technical analysis, etc

- Customer Support: Offers Chinese-speaking support for timely resolution of trading queries

Why Choose Ultima Markets?

- CySEC, ASIC & FSC regulated

- Spreads as low as 0 pips, commissions only $3 per lot

- ECN accounts with fast execution (latency below 20ms)

- $1M additional insurance + €20,000 compensation protection

- Client funds segregated in major Australian banks, diverse and efficient deposit/withdrawal methods

CFD Beginner’s Guide

- Practice with a demo account (UM offers $100,000 virtual funds)

- Learn technical analysis and fundamental judgment

- Establish trading discipline (control position size and leverage)

- Avoid over-leveraging and all-in trading; manage risks cautiously

- Monitor macroeconomic data (e.g., U.S. CPI, Non-Farm Payrolls)

| Start Demo Account |

Conclusion

While CFDs offer high flexibility and profit potential, they also carry inherent risks. Success in global capital markets requires selecting a regulated, secure trading platform and cultivating disciplined trading habits. If you seek a powerful, compliant CFD platform with Chinese support, Ultima Markets deserves your top consideration.

CFD Frequently Asked Questions (FAQ)

Q1: Can beginners invest in CFDs?

A: Yes, but starting with a demo account is recommended. CFDs, with their high leverage and rapid trading features, suit investors with foundational trading knowledge. Practice via demo trading to master platform operations and risk controls (e.g., setting stop-loss, reading charts). Ultima Markets offers a free demo account and extensive educational resources, ideal for beginners.

Q2: What risks should I be aware of with CFDs?

A: Key risks include:

- Leverage Risk: Amplifies potential losses

- Market Volatility: Rapid price swings may trigger stop-loss orders prematurely

- Platform Risk: Unregulated/non-transparent platforms may jeopardize fund security

- Overnight Fees: Extended positions incur additional costs

Mitigate risks by using tools like stop-loss orders, avoiding excessive leverage, and selecting regulated platforms.

Q3: What fees are involved in CFD trading?

A: Primary costs include:

- Spread: Difference between buy/sell prices

- Commission: Charged on certain account types (e.g., ECN: $3–5 per lot)

- Swap Fees: Overnight holding costs, dependent on asset and position direction

Example: Ultima Markets’ ECN accounts offer spreads from 0.0 pips and commissions of $3–5 per lot—transparent and cost-effective for advanced traders.

Q4: Are CFD trading profits taxable?

A: CFD profits fall under overseas investment income. Under Taiwan’s tax laws, a NT$6.7 million tax-free threshold applies to combined domestic and overseas income. If annual income exceeds filing thresholds, declare it under consolidated income tax. Maintain detailed trade records and consult tax professionals for compliance.