Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomOptions traders often look for strategies that balance risk and reward. A Bull Call Spread is one of the most effective ways to take advantage of a moderately bullish outlook while keeping risk limited.

What is a Bull Call Spread?

A Bull Call Spread is an options trading strategy where a trader buys a call option at a lower strike price and sells another call option at a higher strike price with the same expiration date. This creates a limited-risk, limited-profit position designed to benefit from moderate upward price movement.

This reduces the cost compared to buying a single call option outright. The trade-off is that profits are capped, but losses are also limited.

- Maximum Profit = (Higher Strike − Lower Strike) − Net Premium Paid

- Maximum Loss = Net Premium Paid

- Break-even Point = Lower Strike + Net Premium Paid

In other words, you know your potential profit and maximum loss before entering the trade.

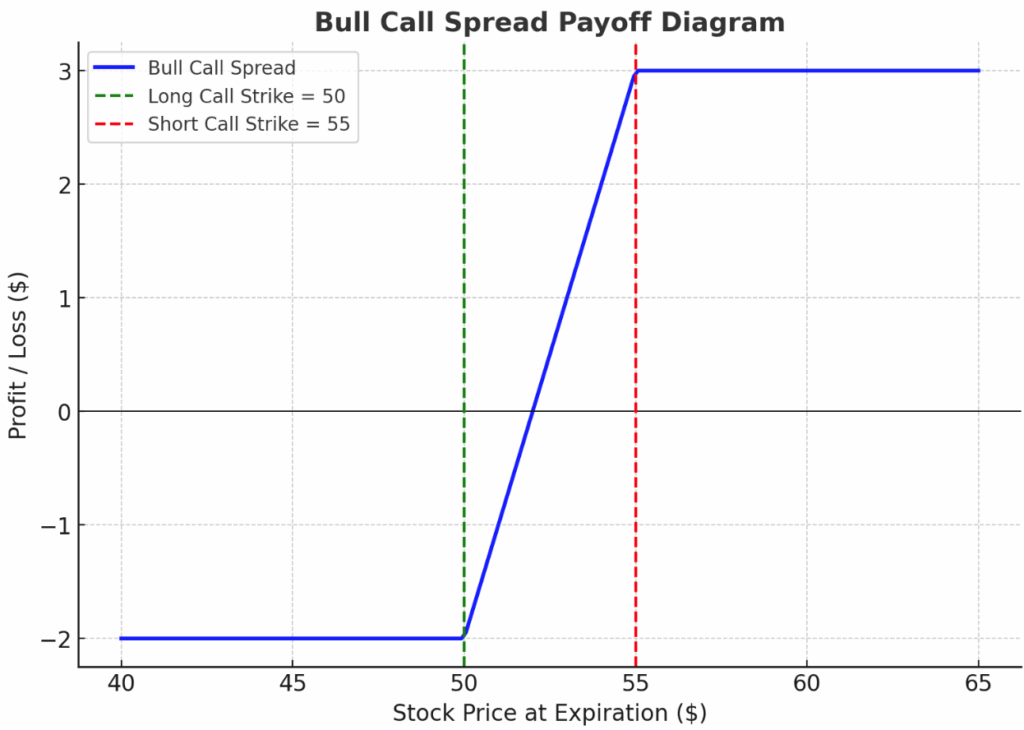

- The blue line shows the total payoff at expiration.

- The green dashed line marks the long call strike ($50).

- The red dashed line marks the short call strike ($55).

- Profit is capped above $55, and loss is limited to the net premium ($2).

The Bull Call Strategy Explained

The Bull Call Strategy is an options trading approach designed for traders with a moderately bullish outlook. Instead of buying a single call, you combine two positions:

- Buy a call option at a lower strike price (long call).

- Sell a call option at a higher strike price with the same expiry (short call).

This structure:

- Reduces cost compared to buying a call outright.

- Limits risk to the net premium paid.

- Caps profit at the difference between strike prices minus that premium.

The Bull Call Strategy works best when you expect a stock, index, or asset to rise moderately, not skyrocket.

- Moderately Bullish Outlook: Suited for traders who see gradual upside potential.

- Risk Control: Losses are capped at the net premium paid.

- Volatility Impact: The spread has positive vega (benefits if implied volatility rises), but the effect is smaller than a single long call. Traders often prefer entering when volatility is relatively low, with the possibility of increasing later.

Bull Call Spread Formula

To quickly evaluate the trade:

- Maximum Profit = (Strike Price of Short Call − Strike Price of Long Call) − Net Premium Paid

- Maximum Loss = Net Premium Paid

- Break-even Price = Lower Strike Price + Net Premium Paid

These calculations let traders assess if the reward outweighs the risk before entering.

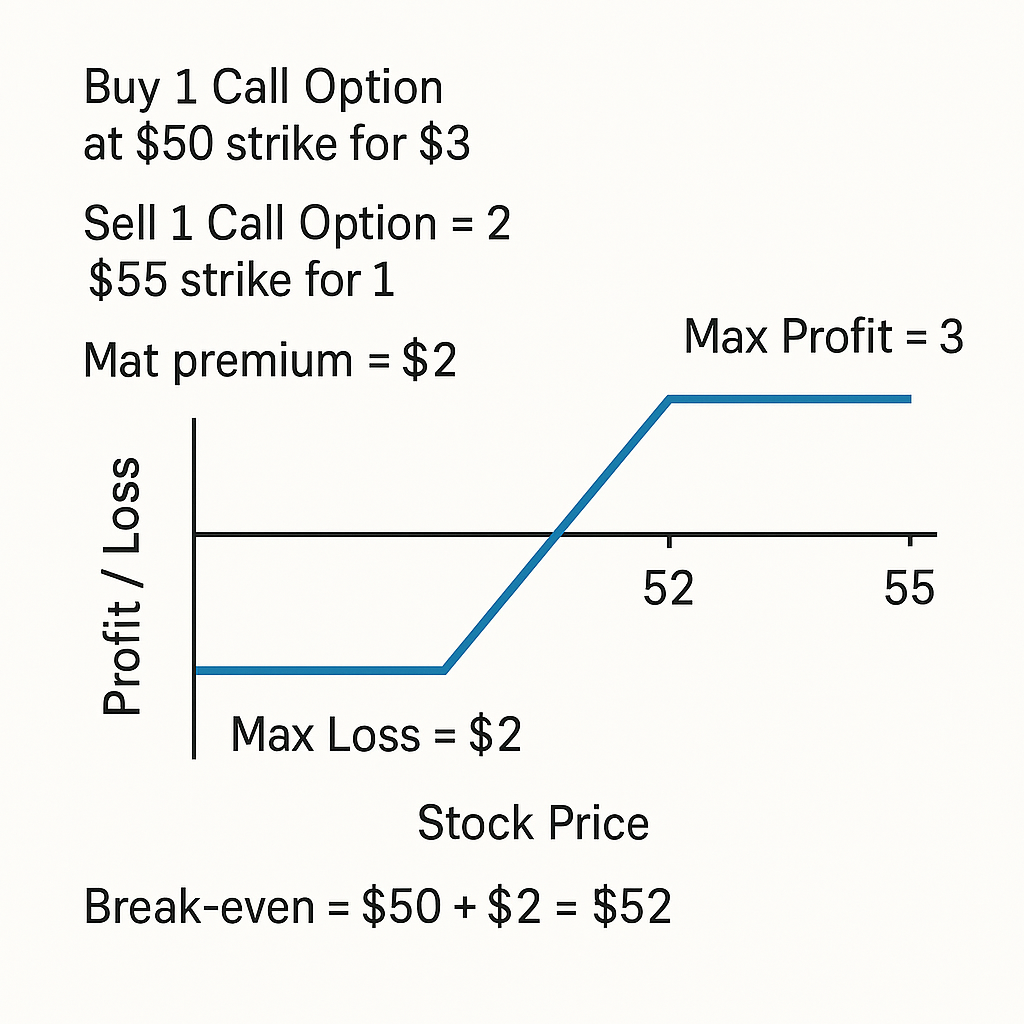

For example, a trader buys one call option with a $50 strike price for a premium of $3 and simultaneously sells one call option with a $55 strike price for a premium of $1.

This results in a net premium outlay of $2. The strategy’s maximum profit is the difference between the strikes ($55 − $50) minus the net premium, which equals $3. The maximum loss is limited to the $2 premium paid, while the break-even point is at $52, calculated as the lower strike plus the net premium.

When to Use a Bull Call Spread

A Bull Call Spread is most effective when you have a moderately bullish view on the market. It’s not designed for explosive rallies, but rather for steady, predictable gains.

You may consider using this strategy when:

Expecting Moderate Price Increases

If you believe the underlying asset will rise but stay within a defined range, the spread helps you capture profits without overpaying for a single call.

Looking for Defined Risk

Your potential loss is limited to the net premium paid, making it suitable if you want to control downside exposure.

Options Premiums Are Affordable

The strategy is often best when implied volatility is relatively low at entry, which makes call options cheaper to buy. If volatility rises later, it can enhance the value of the spread.

Short to Medium-Term Outlook

Bull Call Spreads are commonly used with expirations of one to three months, aligning with near-term market expectations.

Capital Efficiency Matters

Compared to buying a naked call, the spread requires a smaller upfront investment and is less sensitive to time decay and volatility swings.

In short: use a Bull Call Spread when you want controlled risk, capped profit, and exposure to a moderate bullish move within a defined timeframe.

How to Exit a Bull Call Spread

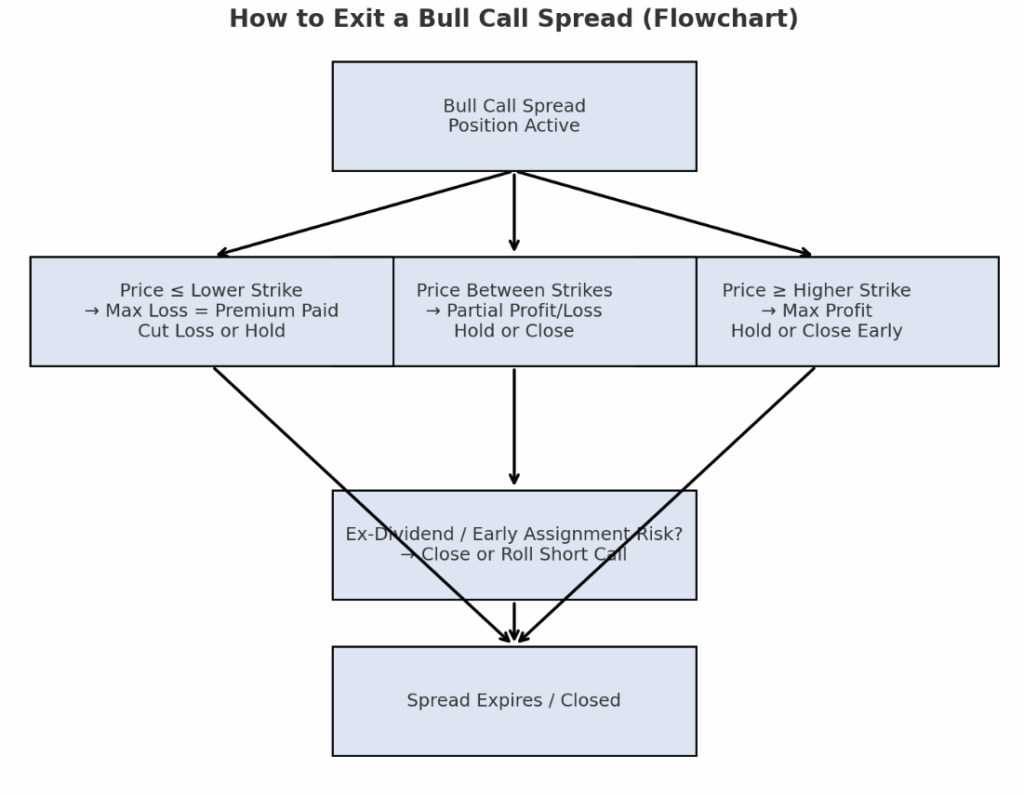

Exiting a Bull Call Spread depends on how the market moves and your trading objective. Because this is a defined-risk strategy, you have several clear exit paths:

Hold Until Expiration

- If the underlying price finishes above the higher strike, you’ll achieve maximum profit.

- If it finishes below the lower strike, you’ll lose only the net premium paid.

- Between the strikes, profit or loss is partial and depends on where the stock closes.

Close Early for Profit

- If the spread’s value rises close to its maximum potential before expiry, you can close both legs (buy back the short call and sell the long call) to lock in gains.

- This is useful if you don’t want to hold risk until expiration.

Cut Losses Early

- If the stock is moving against your outlook or time decay is eroding the spread’s value, you can close early to limit further losses.

Manage Assignment Risk

- With American-style options, the short call could be exercised early, especially near ex-dividend dates. To avoid unwanted assignment, consider closing or rolling the position before that risk becomes significant.

You can let the spread expire, close early for profit, or exit early to reduce losses. The right choice depends on price action, time left until expiration, and your risk tolerance.

Bull Call Spread vs Bull Put Spread

Both the Bull Call Spread and the Bull Put Spread are bullish options strategies, but they differ in construction, cost, and risk management.

A Bull Call Spread is a debit spread, meaning you pay a net premium to enter the trade. It is built by buying a call option at a lower strike and selling another call at a higher strike with the same expiry. Your maximum loss is limited to the premium paid, while your profit is capped at the difference between the strike prices minus that premium. This strategy is often used when you expect the market to rise moderately and you want defined, limited risk with lower capital outlay.

A Bull Put Spread is a credit spread, meaning you receive a net premium when opening the position. It involves selling a put option at a higher strike and buying another put option at a lower strike. Your maximum profit is the premium received, while your maximum loss is the difference between the strikes minus that premium. This strategy is often used when you expect the market to stay above a certain price level and are comfortable with higher margin requirements and potential assignment risk.

In short:

- The Bull Call Spread requires paying premium upfront, offers limited risk and limited profit, and is best when options are relatively cheap.

- The Bull Put Spread generates income upfront, carries higher margin requirements, and works best when options are more expensive and you expect the market to remain stable or move slightly higher.

| Feature | Bull Call Spread | Bull Put Spread |

| Structure | Buy lower call, sell higher call | Sell higher put, buy lower put |

| Capital Outlay | Debit (pay premium) | Credit (receive premium) |

| Maximum Profit | (Spread width- Net premium) | Net premium received |

| Maximum Loss | Net premium paid | Spread width- Net premium received |

| Margin Needs | Lower | Higher (due to short put) |

When constructed with the same strikes and expiry, a Bull Call Spread and Bull Put Spread are payoff-equivalent. The difference lies in upfront cash flow, margin, and assignment risk.

Conclusion

The Bull Call Spread is a versatile strategy for traders who want defined risk and predictable outcomes while capturing moderate upward price moves. By balancing cost efficiency with capped profits, it offers a structured way to approach the markets with discipline.

At Ultima Markets, we believe successful trading comes from combining knowledge, strategy, and the right platform. Our mission is to empower traders with advanced tools, transparent pricing, and educational resources so you can make informed decisions with confidence.

Whether you’re exploring options strategies like the Bull Call Spread or diversifying into other instruments, Ultima Markets provides the secure, regulated environment and global market access you need to trade smarter.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.