What is Bias and How to Identify Entry and Exit

In investment trading, the BIAS indicator is one of the most commonly used technical tools. By using BIAS, investors can determine how far a stock price or exchange rate deviates from its moving average, helping them identify optimal entry and exit points.

What Is the BIAS Indicator?

BIAS, also known as the deviation rate, measures the extent to which a stock or other asset’s price deviates from its moving average (e.g., 5-day, 10-day, or 20-day MA). The value can be positive or negative—a positive value indicates the price is above the moving average, while a negative value means it is below.

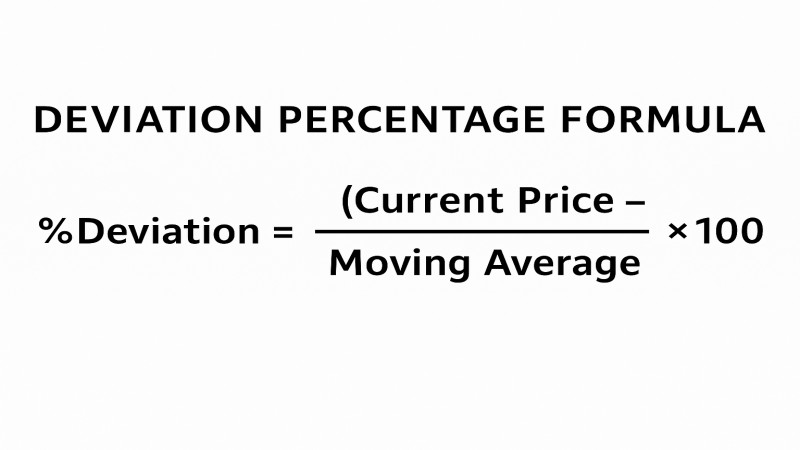

The formula for calculating BIAS is:

BIAS = (Closing Price − N-day Moving Average) ÷ N-day Moving Average × 100%

For Taiwanese investors, the practical value of BIAS goes beyond a mathematical formula. It is directly tied to trading gains or losses—especially in highly volatile markets like Taiwan stocks or TWD/USD forex pairs—helping determine whether the market is overheated or if it’s a good opportunity to buy low.

For example, many investors use the 5-day BIAS for short-term trades, considering exit points when the BIAS exceeds +10%, and entry points when it falls below -10%. This strategy is simple and effective, aligning well with the fast-paced trading style favored by Taiwanese retail investors.

Moreover, for intraday-volatile instruments like ETFs and warrants, the BIAS indicator is a crucial tool for timing entries, helping investors reduce the risk of being trapped in losing positions.

How to Apply the BIAS Indicator in Trading?

The core value of the BIAS indicator lies in revealing how far the price has deviated from its normal range, making it a valuable “thermometer” for identifying whether the market is overheated or oversold. Below are several practical and actionable ways to use it:

- Short-Term Reversal Detection

If the 5-day BIAS exceeds +10%, it typically indicates that the stock has risen excessively beyond its reasonable range, with limited upside remaining. This may be a good time to take partial profits or stay on the sidelines. Conversely, if it falls below -10%, it may signal a short-term oversold condition with high rebound potential—an ideal scenario for phased buying. - Mid-Term Trend Adjustment

The 20-day BIAS is suitable for mid-term investors. If a stock price stays above the 20-day moving average for a prolonged period and maintains a positive BIAS, it signals a strong uptrend. However, if the BIAS suddenly exceeds +15%, caution is warranted as it may indicate a coming correction. - Validate Signal Strength with Trading Volume

If the BIAS rises sharply while trading volume shrinks, it may be a false breakout. In contrast, if both BIAS and volume surge together, the signal is generally more reliable. - Confirm with Bollinger Bands or MACD

When BIAS reaches extreme levels and is accompanied by a MACD bearish crossover or a breakout above the upper Bollinger Band, the bearish signal carries higher credibility.

Below is a simplified table outlining BIAS reference ranges and suggested actions:

| BIAS Range | Market Interpretation | Suggested Action |

| Above +10% | Short-term overheating; high correction risk | Reduce position or sell short-term |

| Below -10% | Short-term oversold; potential rebound | Increase position or buy short-term |

| Within ±5% | Stable price; consolidating market | Wait-and-see or operate cautiously |

These strategies are not only applicable to Taiwan stocks but are also widely used in forex, commodities, and index trading. For example, on the Ultima Markets platform, investors can directly set BIAS conditions for technical analysis, combining them with other indicators to strengthen their trading decisions.

Real-World Example: Using BIAS to Hedge Successfully

In August 2023, during the AI stock frenzy in Taiwan, a major cooling component stock surged from NT$95 to NT$122 within just 10 trading days. At the time, the stock’s 5-day BIAS reached +17%, well above its historical average, with trading volume clearly diverging from the price trend.

A user of Ultima Markets, Mr. Chen, noticed this anomaly. Combining it with a bearish MACD divergence, he chose to lock in profits short-term and set take-profit and break-even levels on the platform. The stock subsequently pulled back sharply to NT$106, a correction of 13%.

This case demonstrates that BIAS is not only a tool for entry and exit timing but also a powerful hedge indicator that helps investors maintain rational judgment during overheated markets.

Accurately Capture Trading Opportunities with BIAS on the UM Platform

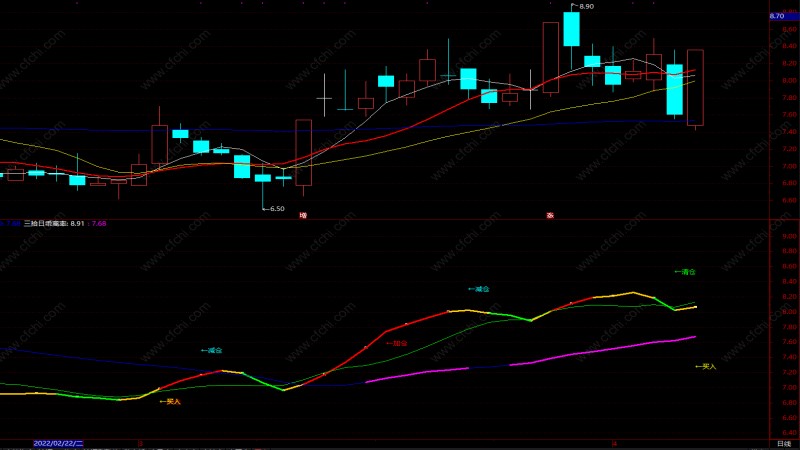

On the Ultima Markets trading platform, BIAS is one of the fundamental technical indicators and can be visualized through real-time charts. Whether trading forex, precious metals, or global stock indices, traders can quickly assess whether the current price has deviated from its moving average to inform their entry and exit decisions.

The platform offers multiple time period options and supports customizable BIAS parameter settings, such as using 5-day, 10-day, or 20-day moving averages as a reference. These can be combined with candlestick charts and other tools for cross-verification, allowing BIAS analysis to align more closely with your personal trading strategy.

Additionally, the trading interface supports synchronized switching between various instruments and technical indicator combinations. You can display BIAS alongside MACD, RSI, and others to build your own decision-making model, greatly improving the accuracy of trend reversal and continuation analysis.

If you’re a beginner, it’s recommended to start with a demo account to familiarize yourself with indicator combinations and the platform interface. Once your strategy is refined, you can upgrade to a trading account and access global markets.

Quick Q&A: BIAS Made Simple for Beginners

Q1: What moving average period is best for BIAS?

For short-term trading, a 5-day or 10-day moving average is recommended. For medium-term investors, 20-day or 60-day averages are better. Choose based on your trading time frame.

Q2: Does a positive BIAS always indicate a sell signal?

Not necessarily. In a bullish trend, a positive BIAS may continue to widen. It should be interpreted alongside trend indicators for better accuracy.

Q3: Is BIAS applicable to Taiwan stocks or forex trading?

Absolutely. Both forex and Taiwan stocks are highly volatile markets where BIAS effectively detects short-term overbought or oversold conditions, helping improve trading success rates.

Conclusion: BIAS Helps You Trade with Precision

BIAS is a simple yet powerful tool that helps investors stay in sync with volatile markets. By observing market deviation from the norm, traders can make smarter buy and sell decisions. Whether you’re a beginner or an experienced trader, leveraging Ultima Markets’ advanced technical indicators, real-time data, and multi-market support allows you to apply BIAS with greater precision and maximize your investment potential.

—BIAS is an indispensable compass for every rational trader.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.