Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat is the BIAS indicator and how to use it in stock market

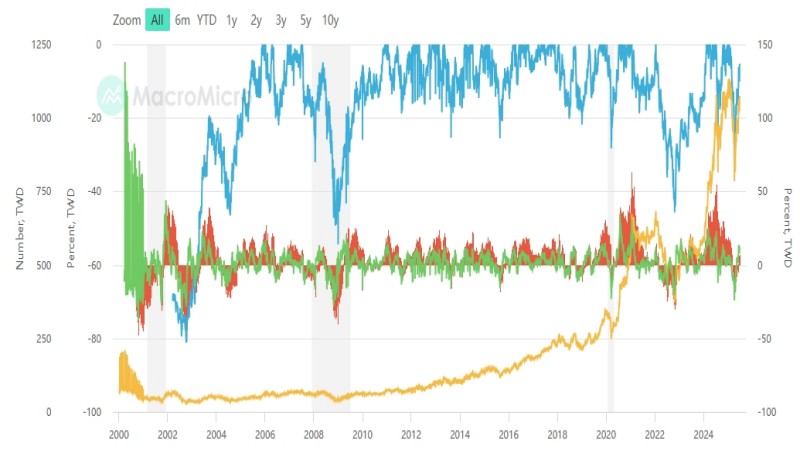

As more investors become familiar with technical analysis tools, the “BIAS indicator” has been gaining increasing attention. This article will explain in detail how the BIAS indicator can be effectively applied to the Taiwan stock market, helping investors accurately identify buying and selling opportunities, avoid common market cognitive biases, and enhance investment performance.

What Is the BIAS Indicator?

The BIAS indicator, also known as the bias ratio, is a technical indicator that reflects the deviation between a stock’s price and its moving average. It is highly effective in determining whether a stock is overheated or oversold, allowing investors to plan entry and exit points in advance, reduce investment risks, and increase profit potential.

In simple terms, when the stock price is significantly higher than the moving average, the BIAS value becomes high, indicating the market may be overheated and suggesting it may be a good time to sell. Conversely, when the value is too low, it may signal a potential buying opportunity.

BIAS Calculation Formula and Application

The calculation formula is as follows:

BIAS = (Closing Price − N-day Moving Average) ÷ N-day Moving Average × 100%

The most commonly used timeframes are 5-day, 10-day, and 20-day.

- 5-day BIAS: Suitable for short-term trading

- 10-day BIAS: Suitable for mid-term strategies

- 20-day BIAS: Suitable for long-term positioning

Take TSMC as an example: in March of this year, the short-term BIAS exceeded 8%, followed by a sharp price correction. This demonstrates that the BIAS indicator can effectively signal market overheating risks and help investors avoid buying at overly high levels and getting trapped.

How to Use the BIAS Indicator to Identify Entry and Exit Points?

The following are key techniques for using the BIAS indicator to identify entry and exit points in the Taiwan market:

Strategy Combining BIAS and KDJ Indicators

When the BIAS indicator shows divergence or overbought/oversold signals in conjunction with the KDJ indicator, the reliability of the signal significantly increases.

For instance, at the beginning of this year, UMC’s BIAS and KDJ indicators simultaneously signaled a buy opportunity. The stock price subsequently rose by approximately 12% within two weeks, validating the effectiveness of this strategy.

Divergence Signals Enhance Success Rate

When the bias rate diverges from the direction of the stock price trend, it usually indicates an upcoming reversal. For example, China Steel recently hit a new high in stock price while the BIAS value declined, signaling a potential sell opportunity.

BIAS Indicator and Investment Psychology Analysis

Investor sentiment in the market often causes short-term overheating or overselling of stock prices. The BIAS indicator effectively reflects such emotional overreactions, whether overly optimistic or pessimistic.

When the short-term BIAS of the Taiwan stock index rises sharply, it usually indicates that investor sentiment has deviated from fundamentals, and the market may undergo a correction. Conversely, an extremely low bias often signals excessive pessimism, creating excellent buying opportunities.

Recommended Practical BIAS Settings for the Taiwan Market

Given the frequent volatility in the Taiwan stock market, it is recommended to set BIAS thresholds at ±6% for short term, ±8% for medium term, and ±10% for long term. Data indicates that these thresholds effectively capture reversal opportunities and significantly improve the success rate.

The following table provides a quick reference:

| Trading Period | Recommended Duration | Suggested BIAS Threshold |

| Short-term | 5-day | ±6% |

| Mid-term | 10-day | ±8% |

| Long-term | 20-day | ±10% |

Why Ultima Markets Is the Better Choice for Using the BIAS Indicator?

For Taiwanese investors, while the concept of the BIAS indicator is simple, its actual application depends on quote timeliness, chart accuracy, and execution speed.

These technical details often determine whether a strategy can be implemented effectively. Ultima Markets is one of the few international brokers that has built its trading platform with these needs in mind.

First, the UM platform delivers ultra-low-latency quote updates and stable server support, enabling users to monitor BIAS changes in real time without missing trading opportunities due to network lag.

Its technical analysis charts come with built-in BIAS indicator configurations, allowing investors to customize periods and preset alert zones to easily capture entry and exit signals.

Additionally, whether you’re practicing on a demo account or executing live trades through a trading account, UM offers comprehensive tutorials and Chinese-speaking customer support, lowering the learning curve—especially for beginners using BIAS for the first time.

For example, before major economic data releases, the BIAS indicator often signals early market tension. The UM platform supports cross-asset trading across commodities, indices, and forex, enabling Taiwanese investors to compare BIAS signals across markets, expand strategy applicability, and diversify risk exposure.

Real Investment Case Using the BIAS Indicator

Take the popular Taiwanese ETF “Yuanta Taiwan Top 50” as an example: in January 2024, its BIAS indicator remained below -5%, signaling an entry point for investors. Over the following two months, the price rose nearly 15%, clearly demonstrating the practical value of the BIAS indicator.

FAQ

Q1: How can beginners quickly learn to use the BIAS indicator?

A1: It is recommended to use a demo account for practice, allowing beginners to quickly become familiar with technical analysis tools.

Q2: Which BIAS period is most useful in the Taiwan stock market?

A2: Given the high volatility in the Taiwan market, 5-day or 10-day BIAS is more practical for short-term trading, while the 20-day BIAS is better for long-term investments.

Q3: Is the BIAS indicator suitable for all instruments?

A3: The BIAS indicator works well for stocks, ETFs, and commodities such as gold and crude oil. However, for low-volatility instruments like government bonds, its relevance is more limited.

Conclusion: Use the BIAS Indicator to Better Navigate the Taiwan Stock Market

As a technical analysis tool, the BIAS indicator’s greatest advantage lies in its ability to quickly detect short-term market overheating or cooling. With proper learning and reasonable application, it helps Taiwanese investors avoid blindly chasing highs or panic-selling, thereby improving overall performance and market sensitivity to achieve long-term, stable returns.

On your investment journey, make good use of the BIAS indicator to make your strategy more stable and rational.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.