Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhich Bank Gives Best USD Exchange Rate in 2025?

In Taiwan, whether for overseas travel, studying abroad, or international investment, exchanging US dollars (USD) is a common need. However, “which bank offers the best USD exchange rate” depends not only on the exchange rate itself but also on fees, exchange channels, and convenience. Choosing the wrong provider could cost you hundreds of TWD more for every USD 1,000 exchanged!

This article will use the latest 2025 data to thoroughly compare the USD exchange terms of major banks and evaluate the pros and cons of different exchange methods to help you make the smartest decision.

Key Factors That Affect the Cost of Exchanging USD

Exchange Rate Types: Cash Rate vs. Spot Rate

Banks generally offer two types of exchange rates: the cash rate and the spot rate. The cash rate applies to physical currency exchange, while the spot rate is used for inter-account currency conversions or online FX settlements. In most cases, the spot rate is more favorable since handling cash incurs transportation and storage costs for the bank. Therefore, if you simply want to convert TWD into USD and deposit it into a foreign currency account, opting for the spot rate can significantly reduce your costs.

Fees and Spread

In addition to the exchange rate itself, fees can significantly impact the final cost of converting USD. Banks vary in how they charge—some apply a fixed fee (e.g., NT$100 per transaction), while others charge a percentage of the total amount (e.g., 0.3% or 0.7%). The spread is also a hidden cost, especially the gap between the cash rate and the spot rate, which is often an overlooked “invisible fee.”

Exchange Amount: Are There Discounts for Large Transactions?

Some banks in Taiwan offer additional benefits for “large amount” exchanges. For example, if a single transaction exceeds the equivalent of NT$100,000, certain banks may offer exclusive rates, waive fees, or provide rewards points:

- E.SUN Bank offers an online booking feature for large-amount currency exchange; if the amount meets a set threshold, a better rate is automatically applied.

- Mega Bank allows high-volume customers to apply for “VIP FX Services,” where dedicated staff help negotiate better live rates, offering greater flexibility.

- Bank of Taiwan doesn’t offer individual rate negotiations, but frequent FX users with foreign currency accounts may be eligible for higher-tier digital membership benefits.

In other words, if you’re planning to exchange a large amount of USD in one go, consider discussing it with your bank beforehand. You might also benefit from splitting the transaction or using different channels (such as online vs. over-the-counter) to secure the best deal.

Exchange Channels and Convenience

There are multiple methods to exchange currency, including over-the-counter bank services, online FX settlement, foreign currency ATMs, digital accounts, and foreign cash accounts. Each channel has different exchange rates, fees, and accessibility requirements. Choosing the method that best suits your needs can save you both time and money.

Comparison of USD Exchange Rates and Fees at Major Taiwanese Banks in 2025

Based on the latest consolidated data, the cash selling exchange rates for USD and associated fees at major banks are as follows (updated on 2025-06-03):

| Bank Name | Cash Buy Rate | Cash Sell Rate | Spot Buy Rate | Spot Sell Rate | Last Update | Cash Handling Fee |

| O-Bank | 29.591 | 30.391 | 29.941 | 30.041 | 14:04 | Minimum NT$100 |

| Sanxin Bank | 29.513 | 30.328 | 29.863 | 29.978 | 06:48 | NT$100 per transaction |

| HSBC | 29.690 | 30.290 | 29.940 | 30.040 | 14:04 | 0.5% of total TWD amount |

| King’s Town Bank | 29.577 | 30.267 | 29.947 | 30.047 | 14:00 | 0.6% of total amount |

| Taiwan Cooperative Bank | 29.624 | 30.262 | 29.939 | 30.039 | 14:04 | NT$100 per transaction (waived if account opened) |

| Yuanta Bank | 29.683 | 30.261 | 29.933 | 30.033 | 14:04 | NT$100 per transaction |

| Sunny Bank | 29.691 | 30.261 | 29.941 | 30.041 | 14:04 | NT$100 per transaction |

| Shin Kong Bank | 29.639 | 30.259 | 29.939 | 30.039 | 14:04 | NT$100 per transaction |

From the exchange rate quotes on June 3, O-Bank and Sanxin Bank offer relatively competitive USD to TWD rates. In addition, E.Sun Bank’s ATM exchange service offers no handling fees, making it a convenient option for users who prefer automated services.

Pros and Cons of Different Currency Exchange Methods

In-Branch Currency Exchange

Traditional in-branch currency exchange offers personalized service but requires visiting during business hours and generally comes with higher handling fees, ranging from NT$100 to NT$300. This method uses cash rates, which typically have a larger spread, resulting in higher overall costs.

Online Currency Exchange

Taiwan Bank and Mega Bank currently offer online exchange services, allowing customers to book exchanges online and collect cash at designated branches. This method usually has no handling fees and offers favorable exchange rates, making it ideal for office workers unable to visit during business hours. However, reservations must be made in advance, and pickup locations cannot be changed on short notice.

Foreign Currency ATM Withdrawals

Foreign currency ATMs provide 24-hour access using cash exchange rates. Some banks, such as E.Sun Bank, offer fee waivers for ATM withdrawals. While highly convenient, this method is limited by ATM locations and supported currencies.

Exchange via Foreign Currency Account

After opening a foreign currency account, customers can exchange using spot rates through online banking or mobile apps, which are more favorable. However, withdrawing physical cash still incurs a spread fee, calculated as Withdrawal Amount × (Cash Sell Rate − Spot Sell Rate). This method is suitable for customers with long-term foreign currency needs.

How to Choose the Most Cost-Effective Way to Exchange USD

Based on the above analysis, choosing the most cost-effective way to exchange USD depends on your personal needs and usage preferences:

- If you need a small amount of cash and prioritize convenience, foreign currency ATM withdrawals are the best option.

- If you are unable to visit a bank during business hours, online currency exchange offers a convenient and favorable solution.

- If you have a long-term need for foreign currency, opening a foreign currency account and using spot rates for exchange can help reduce costs.

- If you need to exchange large amounts and wish to save on fees, choosing banks that offer fee waivers, such as Mega Bank or Bank of Taiwan, will be more economical.

A New Investment-Oriented Exchange Option: Ultima Markets

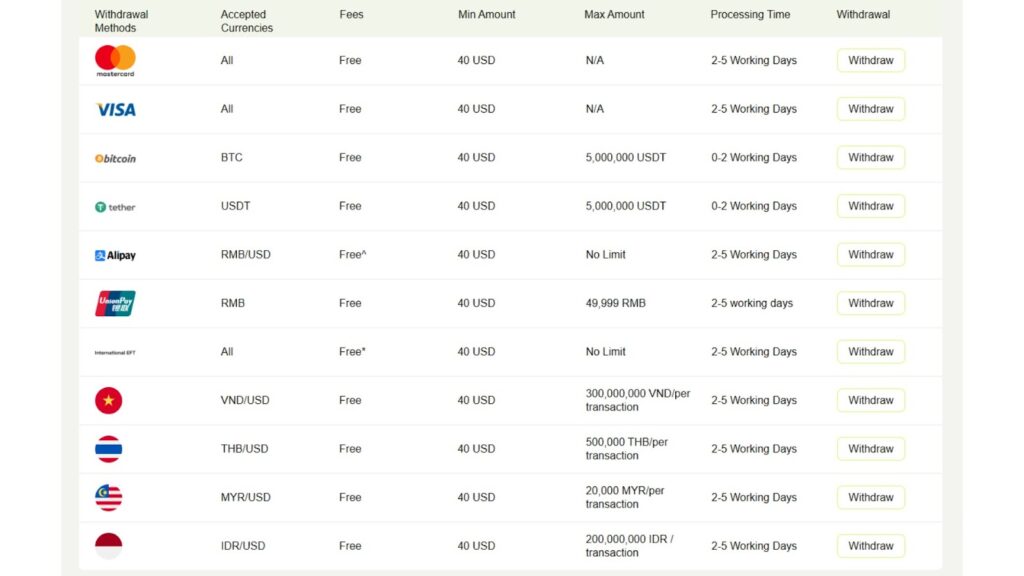

For clients with long-term USD asset allocation or international trading needs, traditional bank exchange methods may not meet the requirements for flexibility and cost-effectiveness. In such cases, professional forex trading platforms like Ultima Markets offer an alternative.

Unlike banks, which typically involve higher one-time costs and are restricted to business hours, Ultima Markets supports 24/7 USD deposits, withdrawals, and trading. The platform offers high leverage and real-time spread quotes, making it more flexible and efficient for both USD asset investment and short-term arbitrage.

UM provides various USD funding channels including wire transfer, USD wallet, cryptocurrency, and credit card to meet different customer needs. In addition, the platform supports trading of multiple USD-denominated assets such as US stocks and USD currency pairs, all in a low-spread, zero-commission environment.

For clients looking to allocate USD assets, the UM platform offers a demo account that allows users to familiarize themselves with the trading environment in a risk-free setting.

Conclusion

The answer to which bank offers the most cost-effective USD exchange depends on individual needs and usage habits. For short-term travel or small exchanges, choosing banks that offer fee waivers and favorable rates will be more economical. For clients with long-term USD asset allocation or international trading needs, professional forex trading platforms like Ultima Markets provide a more flexible and cost-effective solution.

Before proceeding with currency exchange, it is recommended to compare exchange rates and fees among banks and trading platforms, and evaluate your own needs (e.g., need for physical cash, long-term USD holding, or flexible trading). By making an informed choice, you can not only save on costs but also enhance the efficiency of your USD asset utilization.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.