Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomBear Flag Stock Pattern: Signals and Meaning

When stock markets appear to stabilise after a sharp drop, many traders assume a recovery is on the horizon. But what may seem like a bounce could actually be a bear flag stock pattern—a deceptive technical setup that warns of further downside. This pattern is commonly found across financial markets, including stocks, forex, commodities, and cryptocurrencies.

In this article, we’ll explore how to identify the bear flag stock pattern, what it signals, how long it typically lasts, and how to trade it effectively.

What Is a Bear Flag Pattern?

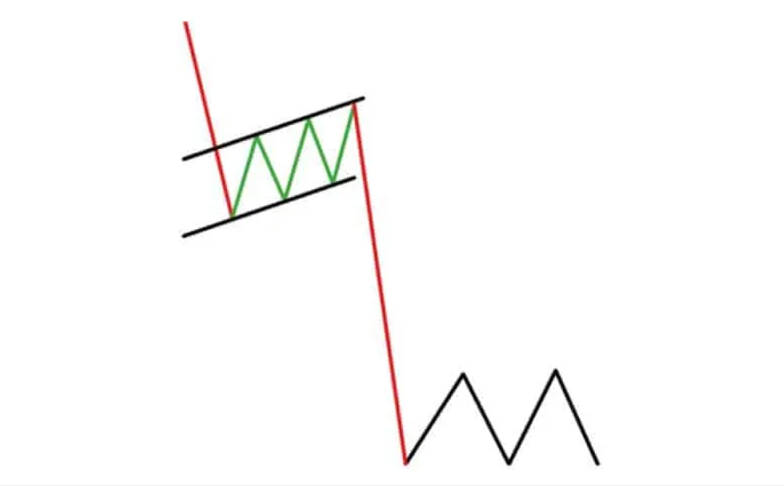

The bear flag is a bearish continuation pattern that occurs during a downtrend. It begins with a steep, rapid price drop (known as the flagpole) followed by a brief period of upward or sideways consolidation, forming the flag.

This consolidation represents a temporary pause before the downtrend resumes. The pattern’s structure, comprising strong bearish candlesticks followed by smaller candles and reduced volume, makes it a reliable signal of continued weakness. Bear flags appear across various timeframes, making them useful for both day traders and swing traders.

What Does the Bear Flag Stock Pattern Indicate?

The bear flag stock pattern is a strong indicator of market weakness and typically appears when investor confidence is low or broader economic sentiment is negative. It is widely regarded as one of the more reliable bearish continuation patterns, signalling a high probability that the current downtrend will resume after a brief consolidation.

This pattern suggests to traders that:

- The recent decline was not an isolated event.

- Selling pressure remains dominant.

- Any short-term bounce is likely temporary.

To improve the accuracy of their trades, traders often compare the bear flag with other chart patterns or use it alongside technical indicators to confirm continuation signals.

As a result, it’s a favoured tool among bearish traders and short-sellers aiming to capitalise on sustained downward moves in price.

How to Spot a Bear Flag Stock Pattern on the Chart

Identifying a bear flag requires close attention to both price action and volume. The first clue is a steep drop that forms the flagpole. This is followed by a short-term consolidation, which usually appears as a narrow, upward-sloping or sideways channel. During this time, trading volume tends to decline, showing reduced buying interest.

The confirmation comes when the price breaks below the lower boundary of the flag. Ideally, this breakdown is accompanied by a spike in volume, which reinforces the bearish momentum and confirms that the pattern is valid.

Bear flags can form over different timeframes, making them versatile tools for both day traders and swing traders.

What Happens After the Bear Flag?

Once the bear flag pattern completes, the price typically breaks downward, continuing the original trend. This breakout often results in further losses, with the next price move roughly equal in size to the original decline that formed the flagpole. Traders use this projection to set price targets or determine exit points for short trades.

The pattern also increases bearish sentiment in the market, confirming that the rally was short-lived and that sellers remain in control.

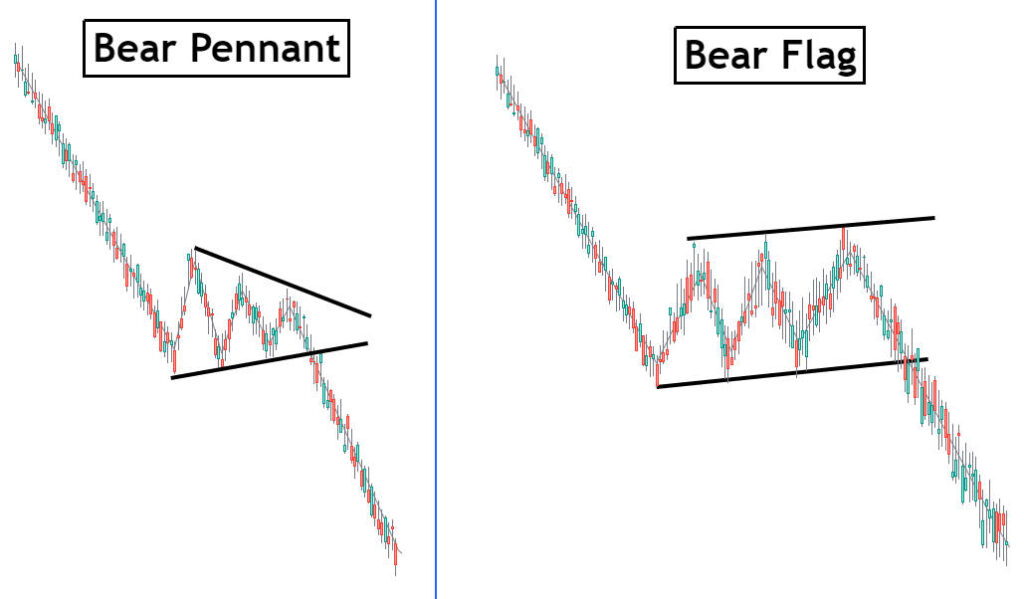

Bear Pennant vs. Bear Flag

While both the bear flag and bear pennant are classic bearish continuation patterns, understanding their differences can sharpen your technical analysis and improve your trading decisions.

A bear flag is characterised by a sharp, straight-line decline followed by a brief, upward-sloping rectangular consolidation. In contrast, a bear pennant forms after a similar sharp drop, but its consolidation phase creates a small, symmetrical triangle as the price range narrows.

Bear pennants are often considered more reliable than bear flags, as the converging trendlines indicate a stronger, more focused bearish trend. Additionally, bear pennants typically show a more pronounced decrease in volume during consolidation, which can make the pattern more convincing to traders.

Recognising whether you’re seeing a bear flag or a bear pennant on your chart can help you make more informed trading decisions and better anticipate the strength and direction of the next move in the bearish trend.

Can a Bear Flag Stock Patterns Turn Bullish?

Though rare, a bear flag stock pattern can break to the upside. If the price breaks above the upper boundary of the flag, this may signal a reversal instead of a continuation. In such cases, traders may be witnessing a failed pattern or a shift in momentum, prompting a bullish move.

While this does not turn the pattern into a bullish one, it does serve as a reminder to stay flexible and manage trades based on current price action, not assumptions.

How Long Does a Bear Flag Last?

On daily charts, bear flags typically last between one to three weeks, depending on market conditions. On intraday charts, they can form within a few hours. The length of the pattern is often influenced by market volatility, trader sentiment, and external news.

Regardless of timeframe, once the breakout happens, the next price move tends to occur quickly—so traders must be ready to act fast.

Bear Flag Stock Trading Strategy

Developing solid bear flag trading strategies is essential for traders aiming to capitalise on bearish continuation setups. Effective trading strategies for this pattern involve not only recognising the bear flag but also planning entry and exit points and managing risk effectively. The process starts with identifying a strong downtrend, then spotting a potential bear flag—characterised by a sharp decline (the flagpole) followed by a brief period of upward or sideways consolidation (the flag). Recognising a potential bear flag early allows traders to prepare for possible trade opportunities, though confirmation is needed before acting.

Once the pattern is established, monitor the price action closely. A decisive break below the lower boundary of the flag is a key signal for entry and exit points in short trades. Implementing stop-loss orders and using technical indicators can help manage risk effectively and protect against unexpected reversals. To improve the reliability of your trading strategies, consider using technical indicators such as moving averages, RSI, or MACD to confirm bearish momentum and help filter out the risk of a false breakout. Swing trading is also a relevant approach for this pattern, as it allows traders to capture price movements over short- to medium-term timeframes.

Using Fibonacci Retracements with Bear Flags

Fibonacci retracements are a valuable addition to any bear flag trading strategy, helping traders pinpoint key support and resistance levels within the pattern. By applying Fibonacci levels to the flagpole, the initial sharp decline, traders can identify potential areas where the price may pause or reverse during the flag portion.

Common retracement levels such as 38.2% or 61.8% often align with the flag’s upper boundary. If price action stalls near these levels, it may reinforce the likelihood of a breakdown.

Stop Loss Placement and Profit Targets

Always use stop-loss orders to manage risk. Place your stop-loss just above the upper trendline of the flag. Align profit targets with broader support zones and evaluate the risk-reward ratio before entering any trade.

Final Thoughts

Recognising a bear flag stock pattern early gives you an edge in anticipating future market moves. Whether you’re protecting long positions or planning a short entry, understanding this pattern’s structure, signal, and lifespan can help you stay ahead of the market.

It’s also important to recognise the bull flag pattern, a bullish continuation pattern that forms after a strong upward trend and moves in the opposite direction of the bear flag. Bull flags signal that the price is likely to continue rising after a brief consolidation. Additionally, identifying a failed bear flag can alert traders to a potential bullish pattern or reversal, providing valuable trading opportunities.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.