Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomAscending Triangle Pattern in Trading

Traders often spot the ascending triangle pattern when an uptrend pauses but buyers keep bidding higher into a fixed ceiling.

This article will explain what the ascending triangle pattern is, how to identify it step by step, and how to trade it with clear rules for breakout confirmation, entries, stop-loss placement, and measured targets.

What Is Ascending Triangle Pattern?

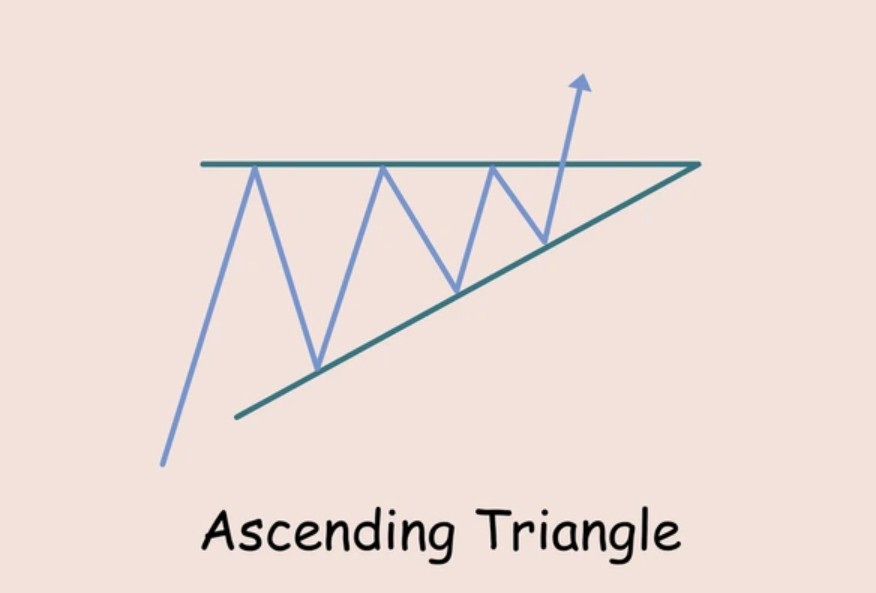

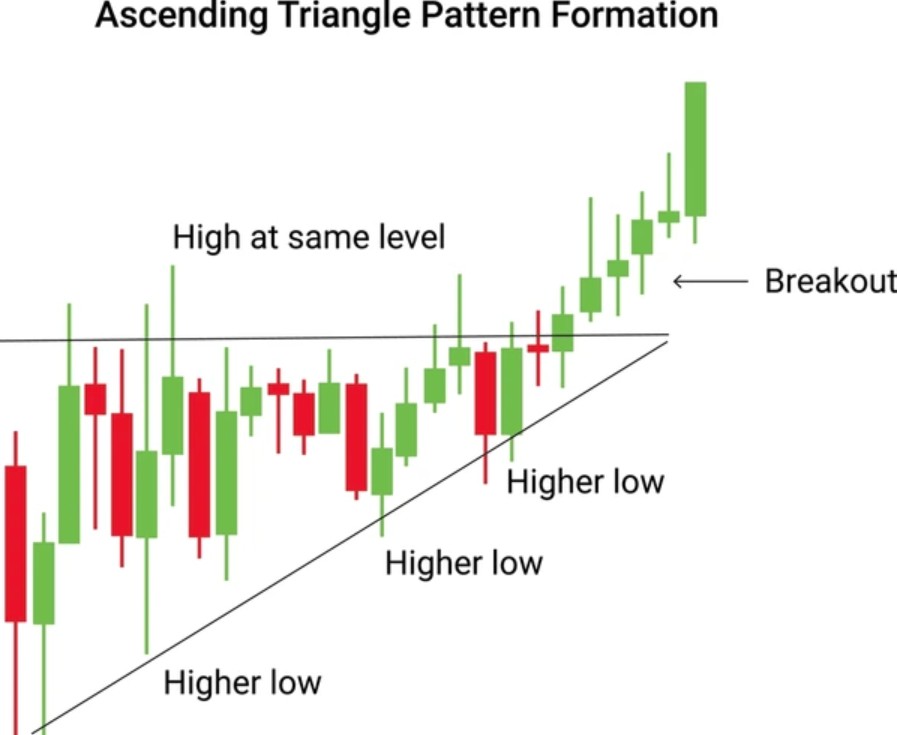

The ascending triangle pattern is a bullish chart formation in technical analysis that often signals the continuation of an existing uptrend. It is formed by a horizontal resistance line that connects at least two equal swing highs and an upward-sloping trendline that connects higher swing lows.

This structure reflects growing buying pressure as sellers repeatedly defend a fixed price level while buyers step in at increasingly higher prices. Over time, the price range tightens, and when resistance is finally broken often confirmed by a surge in trading volume, it can lead to a strong upward breakout.

How to Identify Ascending Triangle Pattern

To identify an ascending triangle pattern, you need to look for specific price action characteristics on a chart:

- Prior Trend: Ascending triangles typically form during an existing uptrend or sometimes after a consolidation phase, signaling a likely continuation of the bullish momentum. Recognizing the preceding trend is important because this pattern mainly acts as a bullish continuation signal.

- Horizontal Resistance Line: Look for at least two or more swing highs that reach roughly the same price level, creating a flat resistance line. This line represents a price level where sellers consistently step in to cap gains, preventing the price from moving higher temporarily.

- Rising Support Line: The bottom of the triangle is formed by an upward-sloping trendline that connects at least two higher swing lows. This shows that buyers are willing to buy at increasingly higher prices, pushing the price up step-by-step.

- Price Constriction: The combination of flat resistance and rising support causes the price to move within a narrowing range, which builds tension as the pattern develops.

- Volume Patterns: Volume typically contracts during the formation of the triangle, indicating indecision or consolidation. A strong volume surge on a breakout above resistance confirms that buyers have gained control.

How to Trade Ascending Triangle Pattern

Step 1: Confirm the Pattern Setup

- Check the chart for an existing uptrend or consolidation before the pattern.

- Identify the horizontal resistance line formed by at least two equal highs.

- Identify the rising support line connecting higher lows.

- Confirm that price is moving within this tightening range.

Step 2: Watch for Breakout Confirmation

- Wait for the price to close above the horizontal resistance line, a breakout signal.

- Look for increased trading volume to validate the breakout strength.

- Avoid entering on intraday spikes or wicks; a daily or higher timeframe close above resistance is more reliable.

Step 3: Enter the Trade

- Enter a long position immediately after the confirmed breakout close.

- Alternatively, some traders wait for a pullback/retest of the breakout level acting as support for a safer entry.

Step 4: Set Stop-Loss

- Place the stop-loss just below the most recent swing low inside the triangle or just under the rising trendline.

- This limits losses if the breakout turns out to be false.

Step 5: Define Profit Target

- Measure the height of the triangle (the vertical distance between the horizontal resistance and the lowest support point).

- Add this height to the breakout price to calculate a realistic profit target.

Step 6: Manage the Trade

- Monitor volume and price action; if volume dries up or price falls back below resistance, be ready to exit early.

- Consider trailing stops once the trade moves favorably to protect profits.

How To Set Profit Target & Stop Losses For Ascending Triangle Pattern

This method provides clear risk-reward levels, helping traders manage their trades systematically when trading ascending triangle breakouts.

Setting Profit Target

- Measure the height of the triangle, the vertical distance between the horizontal resistance and the lowest point of the rising support.

- Add this height to the breakout price (the price where the pattern breaks above resistance).

- This sum gives a realistic profit target where the price is likely to reach after the breakout.

Setting Stop Loss

- Place the stop loss just below the most recent swing low within the triangle or slightly below the rising support line.

- This helps limit losses if the breakout fails or the price reverses.

Advantages and Disadvantages of Ascending Triangle Pattern

In summary, the ascending triangle pattern offers a structured, high-probability bullish trading setup, but traders should be cautious of false breakouts and imperfect profit targets. Using volume confirmation, proper stop-loss placement, and disciplined trade management can maximize its effectiveness.

Advantages

Clear Structure and Signals

The pattern provides well-defined entry points, stop-loss levels, and profit targets. Traders can easily draw the horizontal resistance and rising support lines, making the setup straightforward to recognize and trade.

Bullish Bias with High Probability

Ascending triangles usually form during uptrends, making them reliable continuation patterns. Historically, many breakouts from this pattern lead to strong upward moves, increasing the odds of a profitable trade.

Volume Confirmation

The pattern often shows decreasing volume during formation and volume spikes on breakout. This helps traders confirm the strength and validity of the breakout, reducing false signals.

Versatile Across Timeframes

Ascending triangles appear on all timeframes from intraday charts to weekly charts, making them useful for both short-term and long-term traders.

Disadvantages

False Breakouts

Not every breakout results in a sustained upward move. Sometimes price breaks resistance briefly but then reverses back below the breakout level, causing losses if stop-losses aren’t well-placed.

Profit Target Is an Estimate

The typical profit target is calculated by adding the height of the triangle to the breakout price. However, price can overshoot or fall short of this target, so traders should remain flexible and use trailing stops or other exit strategies.

Volume Patterns Can Be Inconsistent

While volume usually contracts then expands on breakout, this isn’t guaranteed. Some breakouts happen on low volume, making validation trickier and increasing risk.

Requires Confirmation

Because the pattern can produce false signals, it’s important to wait for a confirmed close above resistance and ideally a retest before entering. This can cause missed opportunities or delayed entries for more conservative traders.

Differences Between Ascending Triangle and Other Triangles

Understanding these differences allows traders to identify the right pattern contextually and apply suitable trade strategies, improving the accuracy of entries and exits.

Ascending Triangle

- Shape & Lines: The ascending triangle has a flat horizontal resistance line at the top and an upward-sloping support line at the bottom. This creates a right-angled triangle pointing upwards.

- Bias: It is predominantly a bullish continuation pattern, signaling that buyers are gaining strength and likely to break resistance upward.

- Price Action: Price repeatedly tests the same resistance level, while buyers push higher lows, showing increasing demand.

- Volume: Volume typically contracts during formation and expands on breakout.

- Typical Use: Traders watch for a breakout above resistance to enter long positions with measured profit targets.

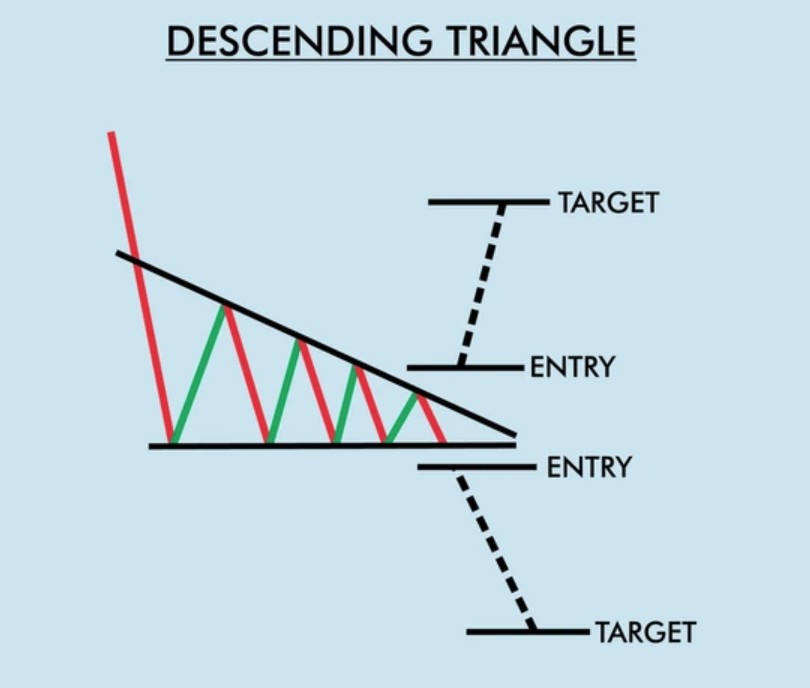

Descending Triangle

- Shape & Lines: Opposite of the ascending triangle, the descending triangle features a flat horizontal support line at the bottom and a downward-sloping resistance line at the top.

- Bias: It is generally a bearish continuation pattern, indicating sellers are gaining control, likely to break support downward.

- Price Action: Price tests a consistent support level, while lower highs show selling pressure increasing over time.

- Volume: Similar to ascending triangles, volume contracts during the pattern and expands on breakdown.

- Typical Use: Traders look for a close below support to enter short positions, setting stop-losses above recent highs.

Symmetrical Triangle

- Shape & Lines: The symmetrical triangle consists of two converging trendlines—both sloping toward each other at roughly equal angles, creating a balanced triangle.

- Bias: It is a neutral pattern with no inherent directional bias. The breakout can occur either upwards or downwards, depending on the preceding trend and market sentiment.

- Price Action: Price consolidates within narrowing boundaries, reflecting market indecision between buyers and sellers.

- Volume: Volume decreases as the pattern progresses, then spikes on breakout in either direction.

- Typical Use: Traders wait for a confirmed breakout either above or below the triangle before taking positions. Stop-losses and targets depend on breakout direction.

| Pattern | Upper Line | Lower Line | Typical Bias | Breakout Direction |

| Ascending Triangle | Flat resistance | Rising support | Bullish continuation | Usually upwards |

| Descending Triangle | Falling resistance | Flat support | Bearish continuation | Usually downwards |

| Symmetrical Triangle | Falling resistance | Rising support | Neutral | Can be either direction |

How to Know Ascending Triangle Pattern Breakout

To know an ascending triangle pattern breakout, look for these key signs:

- Price closes above the horizontal resistance line, not just intraday spikes or wicks.

- Trading volume increases significantly during the breakout, confirming strong buying momentum.

- Sometimes, price may retest the breakout level (previous resistance) as support before continuing upward.

- Use higher timeframes (daily or weekly) for more reliable breakout confirmation.

These signals help confirm a genuine breakout and reduce false signals.

Are Ascending Triangles Bullish?

Yes, ascending triangles are bullish patterns. They indicate increasing buying pressure with higher lows and a flat resistance level, often leading to an upward breakout.

Conclusion

The ascending triangle pattern is a reliable bullish continuation signal that helps traders identify potential breakout opportunities with clear entry, stop-loss, and profit target levels. By understanding how to spot and trade this pattern effectively, you can improve your chances of capitalizing on upward price movements.

At Ultima Markets, we provide advanced charting tools and real-time data that make identifying patterns like the ascending triangle easier and more precise. Whether you’re a beginner or an experienced trader, Ultima Markets equips you with the technology and resources to trade confidently and manage risk smartly.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.