Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteWhat Is the Applicable Federal Rate (AFR)?

The Applicable Federal Rate (AFR) is the minimum interest rate the IRS sets each month for loans, tax planning, and certain financial transactions. It ensures that loans made between individuals, families, or businesses are not structured with artificially low or zero interest just to avoid taxes.

For example, if you lend money to a family member at a rate below the AFR, the IRS may treat the “forgone interest” as taxable income or even a gift. This rule protects the tax system from abuse and keeps lending transactions fair and transparent.

How the Applicable Federal Rate (AFR) Is Determined by the IRS

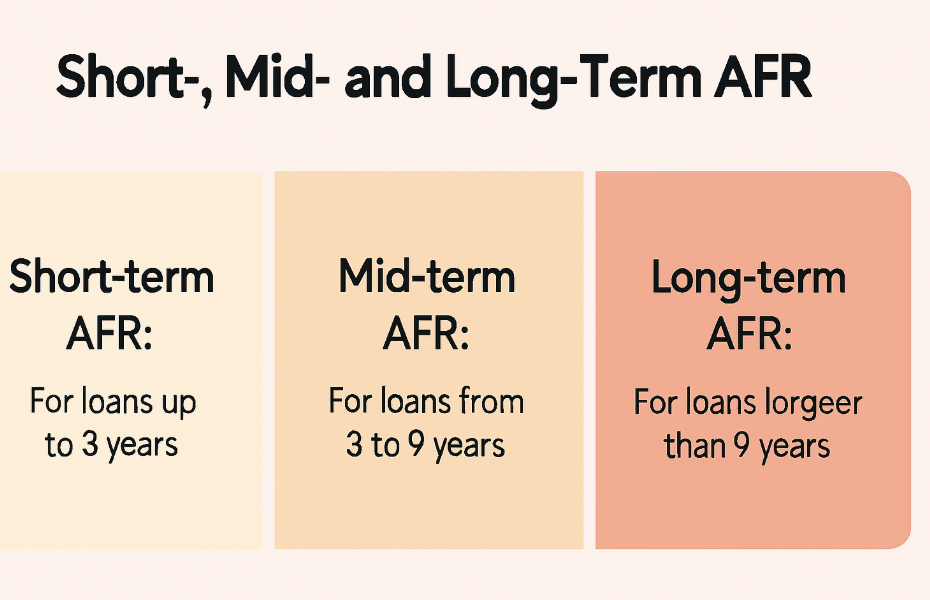

The IRS calculates AFRs by analyzing U.S. Treasury yields and other secure market instruments. Every month, the IRS publishes official AFR figures in a Revenue Ruling. These rates are categorized into:

- Short-term AFR: for loans up to 3 years.

- Mid-term AFR: for loans from 3 to 9 years.

- Long-term AFR: for loans longer than 9 years.

The IRS also publishes different compounding schedules such as annual, semiannual, quarterly, and monthly so taxpayers can match the correct rate to the structure of their loan.

Example (September 2025 AFRs):

- Short-term: ~4.00%

- Mid-term: ~4.04%

- Long-term: ~4.83%

Always confirm with the official IRS revenue ruling for the exact monthly figures.

Types of Applicable Federal Rates (AFRs)

Understanding the types of AFRs is essential for anyone dealing with private loans or estate planning.

Short-Term AFR

Applies to loans with maturities of 3 years or less. Often used in small business loans, family lending, or bridge financing.

Mid-Term AFR

Covers loans with maturities between 3 and 9 years. Common in installment sales or structured notes.

Long-Term AFR

Applies to loans with maturities greater than 9 years. These are typically used in estate planning and long-term financing agreements.

Each category helps prevent “below-market” loans and ensures that lenders and borrowers report a fair amount of interest for tax purposes.

Why AFR Matters for Taxes and Estate Planning

The AFR plays a key role in several financial scenarios:

- Gift tax prevention: If you lend money below AFR, the IRS may classify the missing interest as a gift.

- Income tax: Forgone interest may be treated as taxable income for the lender.

- Estate planning: AFRs are used to value intrafamily loans, private annuities, or installment sales, making them crucial in wealth transfer strategies.

- Original Issue Discount (OID): AFRs help calculate the correct discount rate for debt instruments issued below face value.

Failing to use the correct AFR can result in unexpected tax bills or compliance issues.

How the Applicable Federal Rate (AFR) Affects Forex

At its core, the Applicable Federal Rate (AFR) is a U.S. tax tool, not a market-driven interest rate. It’s used primarily for estate planning, gift taxation, and private loans. So unlike the Federal Funds Rate or Treasury yields, it doesn’t directly set the cost of borrowing in the economy.

That said, AFR can still have indirect ripple effects on forex markets:

Reflection of Broader Interest Rate Trends

AFRs are derived from U.S. Treasury yields. Since Treasury yields are closely linked to Federal Reserve policy and inflation expectations, movements in AFR often mirror shifts in the U.S. interest-rate environment.

For forex traders, higher AFRs usually coincide with a stronger U.S. dollar, because rising yields attract foreign capital. For example, if AFR climbs from 4% to 5% in a year, it’s typically because Treasury yields and Fed policy rates also rose, which historically supports USD strength in pairs like EUR/USD or USD/JPY.

Cross-Border Wealth Transfers and Capital Flows

AFR matters in wealth management and cross-border estate planning. When wealthy individuals move assets internationally, AFR helps determine valuations and tax implications. In large transactions, these flows can influence demand for U.S. dollars, even if temporarily.

For example, a multinational family office may structure a $100M intrafamily loan under AFR guidelines. The hedging or currency conversion needed to facilitate the deal can create short-term forex demand shifts.

Carry Trade Considerations

Carry trades depend on interest rate differentials between two currencies. While traders mainly watch central bank rates, AFR can provide an additional clue about the longer-term cost of capital in the U.S. For certain structured notes or offshore tax-driven strategies, AFR is used to set minimum returns, which can influence how much capital flows in or out of USD-denominated assets.

If AFR rises alongside Fed rates, the cost of holding USD assets rises, which may change carry trade preferences.

Investor Sentiment & Market Psychology

Even though AFR isn’t a headline macro number, its publication each month reinforces a theme, interest rates in the U.S. are rising or falling.

Traders who follow bond markets and AFR updates can use them as confirmation signals of broader monetary policy trends.

AFR itself won’t move forex markets day-to-day, but it tracks the same forces that drive the dollar: Fed policy, Treasury yields, and capital flows. Think of it as a tax lens on U.S. interest rates, if AFR is trending higher, it’s a clue that the interest-rate backdrop remains dollar-supportive.

Conclusion

The Applicable Federal Rate (AFR) may look like a niche tax concept, but its connection to Treasury yields and U.S. interest rate policy makes it relevant beyond estate planning. For forex traders, AFR trends can offer an indirect signal of the broader interest rate environment that drives the U.S. dollar.

While AFR won’t move currency pairs on its own, it reflects the same market forces that shape global forex flows. Federal Reserve policy, bond yields, and capital allocation. Understanding these links helps traders see the bigger picture and stay prepared when volatility hits.

At Ultima Markets, we believe knowledge is your best trading edge. By combining regulatory transparency with expert insights, we help traders navigate complex financial concepts like AFR and apply them to real-world market strategies.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.