Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

AMD Stock Price Prediction 2025-2030

Analysts forecast AMD stock could reach $183–$210 by 2025 and $300 to $427 by 2030, driven by growth in AI chips, server CPUs, and gaming processors. UBS and Bank of America target up to $210 in 2025, while Nasdaq projects $427 by 2030 if AMD gains more AI GPU market share.

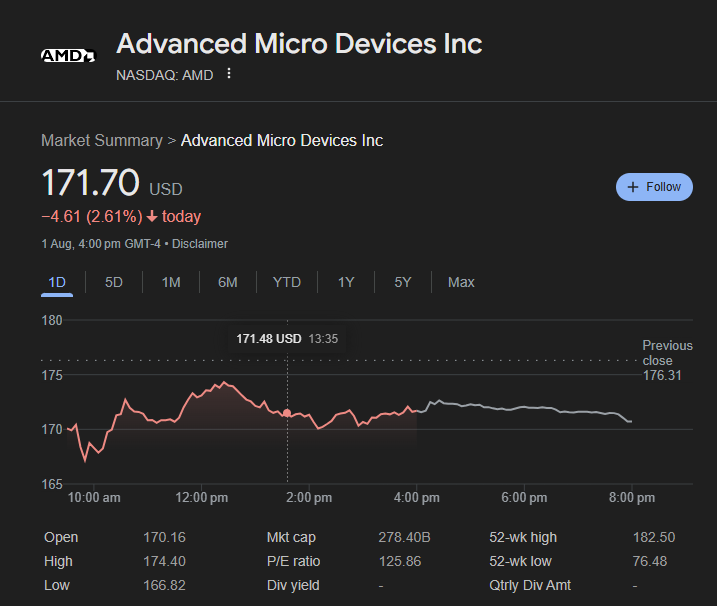

Advanced Micro Devices (NASDAQ: AMD) continues to capture attention from traders and investors due to its expanding presence in AI, gaming, and high-performance computing. With AMD stock now trading around $171.70, many are asking: What is AMD stock’s price prediction for 2025 to 2030?

What Is the Price of AMD Stock Today?

As of August 1, 2025, AMD stock is priced at $171.70, after falling 2.61% on the day. It hit an intraday high of $174.40 and a low of $166.82. The company’s latest earnings report showed continued growth in data center revenue and strong interest in its MI300 AI accelerators.

- Open: $170.16

- Market Cap: $278.40B

- P/E Ratio: 125.86

- 52-Week High: $182.50

- 52-Week Low: $76.48

What Is Driving AMD Stock Price?

The AMD stock price is being driven by strong demand for AI chips, growing market share in server CPUs, and expanding partnerships with major tech companies. As of 2025, AMD’s key business segments, artificial intelligence, data centers, and gaming are fueling its revenue growth and stock momentum.

AI Chip Development and Demand

One of the main factors driving AMD stock price is its entry into the AI accelerator market. AMD’s MI300X and MI300A chips are gaining adoption in large-scale data centers, competing directly with Nvidia’s H100. With AI infrastructure spending on the rise, AMD is well-positioned for long-term growth.

Server CPU Market Expansion

AMD’s EPYC processors continue to capture share from Intel in cloud computing and enterprise server deployments. These gains are reflected in AMD’s quarterly earnings, which consistently show revenue growth in the data center segment, a key driver of AMD stock performance.

Gaming and Custom Chips

The company remains a top supplier of custom chips for consoles like Sony PlayStation 5 and Microsoft Xbox Series X, generating steady income. This diversification supports AMD’s earnings base and helps stabilize AMD stock price even during broader tech volatility.

Strategic Cloud Partnerships

AMD is collaborating with cloud giants like Microsoft Azure, Meta, and Oracle to deliver high-performance compute for AI workloads. These partnerships enhance AMD’s visibility and increase investor confidence, further pushing AMD stock price upward.

Strong Financials and Market Sentiment

In Q2 2025, AMD reported $6.85 billion in revenue, up 9% year-over-year, with a 52% gross margin. This consistent performance contributes to bullish analyst ratings and helps support higher AMD stock valuations.

The AMD stock price is primarily driven by its rising presence in AI hardware, data center solutions, and strong strategic partnerships. These factors continue to boost investor sentiment and institutional interest in AMD stock in 2025

AMD Stock Price Prediction 2025

The AMD stock price prediction for 2025 ranges between $140 and $210, based on the latest analyst forecasts and financial performance. As of August 2025, AMD is trading at $171.70, with rising investor interest driven by its AI chip growth and strong earnings momentum.

Analyst Forecasts for 2025:

| Analyst / Institution | Target Price |

| UBS | $210 |

| Bank of America (BofA) | $200 |

| Morgan Stanley | $185 |

| Goldman Sachs | $140 |

| Consensus Estimate | $183.75 |

These projections suggest AMD stock could test key resistance levels near $180 to $190 by the end of 2025, especially if its MI300 AI chips continue gaining traction in the data center market.

AMD Stock Price Prediction 2030

The AMD stock price prediction for 2030 ranges between $300 and $427, depending on how successfully AMD expands its share in the artificial intelligence (AI) and high-performance computing markets. With strong fundamentals and increasing adoption of AMD’s AI chips, long-term analysts see significant upside potential.

Long Term Forecast for AMD 2030:

| Source | 2030 Price Estimate |

| 247WallSt (Base Case) | $300 |

| Nasdaq AI Growth Scenario | $427 |

| 247WallSt (Bull Case) | $880 |

These forecasts assume AMD captures at least 10–15% of the AI GPU market, maintains strong revenue growth from EPYC server CPUs, and continues to deliver innovation through its next-gen Zen and RDNA architectures.

How High Will AMD Stock Go?

If AMD continues scaling its MI300X chips and strengthens its partnerships with cloud leaders like Microsoft and Meta, analysts believe the stock could double or even triple from current levels. A successful AI rollout and consistent margin expansion could push AMD stock into the $400+ range by 2030.

From a technical standpoint, long-term traders project that AMD may follow a compounded annual growth rate (CAGR) of 15–20%, supporting a target price of $300–$427 under base-to-bullish conditions.

Is AMD a Good Long-Term Investment?

Many investors view AMD as a strong long-term stock due to:

- Its growing role in AI and machine learning infrastructure

- Diversification across CPUs, GPUs, gaming, and custom chip markets

- Competitive positioning vs. Nvidia and Intel

- Strong financial management and capital efficiency

While the stock may experience short-term volatility, its long-term outlook remains positive based on market trends and institutional projections.

Is AMD a Good Stock to Buy?

With steady revenue growth, increasing AI market share, and expanding cloud partnerships, many analysts rate AMD as a “Buy”. Its valuation remains attractive relative to Nvidia, and its diversified business model across CPUs, GPUs, and gaming chips provides long-term upside potential.

Conclusion

Based on the latest data and institutional forecasts, the AMD stock price prediction for 2025–2030 suggests strong growth potential. Analysts expect AMD to reach $183–$210 by 2025 and possibly $300–$427 by 2030, supported by its AI chip expansion, server CPU dominance, and deepening partnerships with cloud providers.

For traders and investors seeking exposure to the next phase of AI and semiconductor growth, AMD remains a compelling opportunity but timing, earnings results, and market conditions are critical factors.

At Ultima Markets, we help you navigate high-potential stocks like AMD with professional tools, real-time analytics, and expert market insights. Whether you’re trading short-term price moves or planning for the next decade, Ultima Markets gives you the edge to make informed decisions with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.