Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomAlphabet Inc Google Stock Price Prediction 2030

As we approach 2030, many investors are eager to know the Alphabet Inc. Google stock price prediction for the next decade. Given Google’s dominance in digital advertising, cloud computing, and AI, its future outlook holds substantial interest for traders and investors. This article explores the Google stock price prediction 2030, the factors driving its value, and expert predictions under different market scenarios.

Google Stock Price Performance

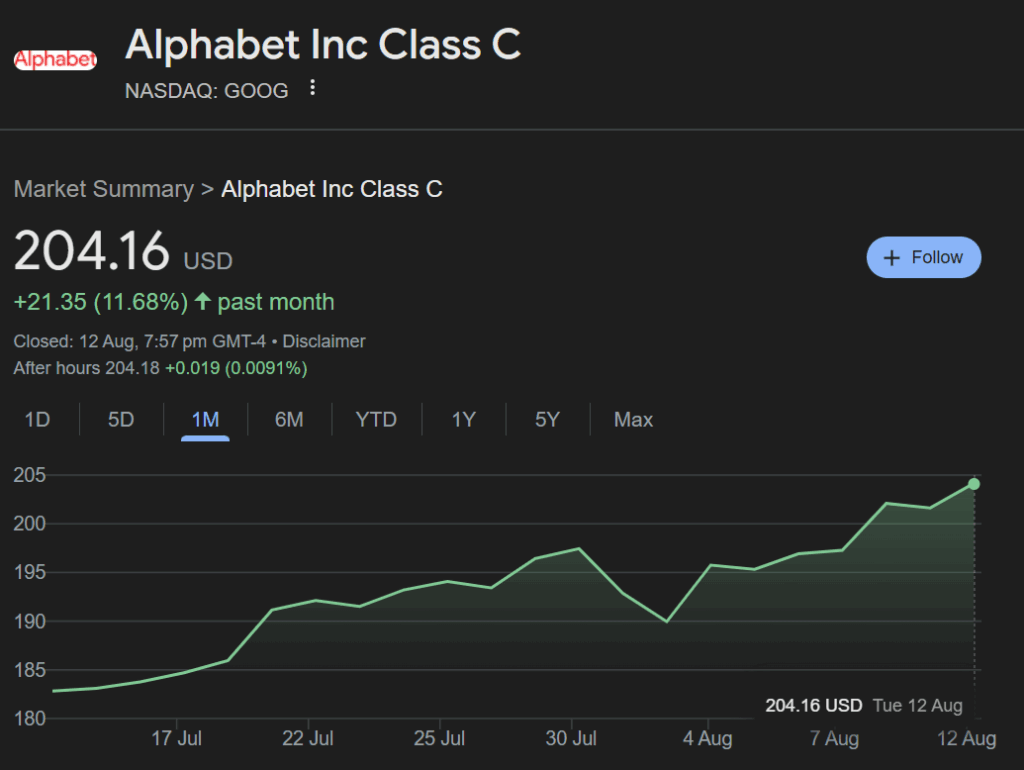

As of August 12, 2025, Alphabet Inc. (GOOGL) is trading at $204.16 USD. Looking ahead to 2030, many investors are keen to know the Google stock price prediction for the next decade. Given Google’s dominance in digital advertising, cloud computing, and AI, its future outlook holds substantial interest for traders and investors. This article explores Google’s stock price performance 2030, the factors driving its value, and expert predictions under different market scenarios.

Google Stock Price Prediction 2030

Stock price predictions, especially for a company like Alphabet Inc. (Google), are highly speculative and depend on various internal and external factors. The price can be influenced by market sentiment, regulatory changes, competition, and technological advancements. Let’s break down the three key scenarios:

Bear Scenario: The Downside Risk

In the bear scenario, we look at a situation where multiple negative factors affect Google’s stock. This could involve:

- Economic Slowdown: A global recession or financial crisis could slow down advertising spend, which is the core revenue stream for Alphabet. If businesses reduce marketing budgets during a downturn, Google could see lower ad revenues.

- Intensified Regulation: Google is currently under scrutiny by regulators, especially in the EU and the US. New antitrust regulations could impose heavy fines or force Google to divest certain assets, both of which would negatively affect its earnings and stock price.

- Increased Competition: Other tech companies, especially in the AI, search, and cloud sectors, could gain market share at Google’s expense. If Amazon, Microsoft, or emerging startups outperform Google in these sectors, the stock price could stagnate or fall.

- Declining Advertising Market: If digital advertising growth slows down, particularly with the rise of ad-blockers, privacy regulations, or user demand for less intrusive ads, Google’s ad revenue might not meet expectations, leading to a decline in stock price.

In this scenario, experts predict that the stock could drop by 10-15% by 2030, which would place the Google stock price prediction 2030 in the $265–$300 range. This prediction assumes that negative external pressures outweigh Google’s internal growth drivers.

Base Scenario: The Status Quo

The base scenario assumes that Alphabet continues its business operations as usual, with steady growth across its core segments, advertising, cloud computing, and AI. Here’s why this scenario could unfold:

- Steady Growth in Digital Advertising: Google remains the undisputed leader in digital advertising, particularly in search and YouTube. As digital marketing continues to grow, Google’s ad revenues are expected to grow steadily, albeit at a slower pace than in the past.

- Successful Cloud Expansion: Google Cloud continues to grow and gains market share in the cloud services industry, albeit at a slower pace compared to AWS and Microsoft Azure. This will provide a stable revenue stream and a boost to Google’s overall performance.

- Advancements in AI: Alphabet’s investments in AI are expected to pay off, but the growth might not be as explosive as in the bull scenario. Alphabet’s AI platforms, including Google Assistant, Google Cloud AI, and DeepMind, will gradually gain market share, contributing to a consistent increase in revenue.

- Global Economic Stability: Assuming the global economy remains relatively stable without significant economic downturns, Google will continue to benefit from its diversified business model.

In this moderate scenario, analysts predict that the Google stock price prediction 2030 could grow by 4-6% annually, reaching a $387–$440 range. This assumes steady growth without major disruptions but also without any huge breakthrough innovations.

Bull Scenario: The Upside Potential

In the bull scenario, we consider a situation where Google thrives and outperforms expectations, leading to an exceptional rise in stock price. Here’s what could fuel this scenario:

- Dominance in Artificial Intelligence: If Alphabet becomes the leader in AI technology and infrastructure, its stock could skyrocket. AI technologies like Google’s Gemini, AI-powered search improvements, and machine learning tools for enterprises could bring in significant revenue. Alphabet’s ability to commercialize AI services through Google Cloud and other products would drive massive growth in both the short and long term.

- Expansion in Cloud Services: If Google Cloud grows faster than expected, potentially surpassing AWS or becoming a serious challenger, it could significantly boost Alphabet’s earnings. The cloud computing sector is growing rapidly, and Alphabet is poised to gain a larger share of the market.

- Breakthrough Innovations: Alphabet could introduce new technologies, platforms, or products that revolutionize industries, much like the company did with Android, YouTube, and Google Search. If Alphabet successfully taps into emerging markets like quantum computing, 5G, or new ad technologies, it could see an explosive surge in stock price.

- Strong Global Economy: A thriving global economy with increased ad spending, higher enterprise adoption of Google Cloud, and strong consumer demand for tech products could all contribute to a substantial rise in stock price.

In this best-case scenario, the Google stock price prediction 2030 could appreciate by 10-12% annually, with the potential to reach prices between $650–$1,000. This would reflect the company’s leadership in key markets, increased revenue from AI and cloud computing, and continued dominance in digital advertising.

Key Factors Driving Google Stock Price

Several factors influence Google’s stock price and will play a pivotal role in determining its future performance:

- Advertising Revenue: The heart of Alphabet’s business, its advertising revenue, is the primary driver of Google’s stock price. As digital advertising continues to grow, particularly in mobile and video content, this will be a key contributor to price increases.

- Cloud Computing: Google Cloud is one of the company’s fastest-growing sectors. Competing with AWS and Microsoft Azure, Google’s cloud business is expected to significantly influence its future stock performance.

- Artificial Intelligence: Alphabet’s advancements in AI, with projects like Gemini, hold the potential to disrupt industries and create new revenue streams. As AI continues to develop, it may become one of the largest growth drivers for the company.

- Regulatory Scrutiny: Ongoing antitrust cases and government regulations may affect Google’s ability to operate freely in certain markets, impacting its stock performance.

- Global Trade and Tariffs: Global trade policies, including tariffs, can affect Google’s production costs and international revenue, particularly from advertising and cloud services.

How Tariffs Will Affect Google Stock

Tariffs affect Google stock by increasing production costs, reducing ad spending, creating compliance challenges, and impacting foreign exchange. While the company’s diversification helps mitigate some risks, trade tensions could still influence stock performance.

.Increased Production Costs:

Tariffs on Electronics: Tariffs on imported components, especially from China, could raise production costs for Google’s hardware, like Pixel phones and Nest devices. This may lead to higher consumer prices or reduced demand, though the impact is limited since hardware is a smaller portion of Google’s business.

Impact on Global Revenue from Advertising:

Ad Spending Slowdown: Trade tensions and tariffs can cause economic uncertainty, leading to businesses cutting back on advertising spend. Since advertising is Google’s largest revenue source, this could affect its earnings.

Regulatory and Compliance Risks:

Geopolitical Risks: Tariffs often signal broader geopolitical conflicts, which may disrupt Google’s operations in affected regions, increasing regulatory scrutiny and operational challenges.

Foreign Exchange Risk:

Currency Fluctuations: Tariffs can cause currency fluctuations, with a stronger US dollar potentially reducing Google’s international revenue when converted back into USD.

Overall Market Volatility:

Investor Sentiment: Tariffs can create market volatility, affecting investor sentiment and potentially leading to stock sell-offs, even for established companies like Google.

Should I Buy Google or Amazon Stock?

Comparing Google vs. Amazon stock is a common dilemma for investors. Here’s a quick breakdown:

- Alphabet (Google): Alphabet is a leader in digital advertising and AI, with a growing presence in cloud computing. It’s ideal for investors looking for stability and long-term growth.

- Amazon: Amazon has a stronghold in e-commerce and cloud services but faces higher operational risks. If you’re interested in exposure to e-commerce and logistics, Amazon might be a better pick.

Ultimately, the decision depends on your investment strategy whether you prioritize AI-driven growth (Google) or e-commerce (Amazon).

Is Google a Good Stock to Buy?

Based on Alphabet Inc.’s (Google) current position in 2025, it can be considered a good stock to buy for long-term investors. Alphabet’s diversification across several key sectors like advertising, AI, cloud services, and hardware, positions it for steady growth. However, investors should consider potential risks, such as regulatory challenges, market competition, and global trade uncertainties.

How is Google Stock Price Prediction 2030?

In conclusion, Google stock price prediction 2030 presents several potential outcomes depending on various economic, regulatory, and competitive factors. In the bear scenario, Google may see a decline in its stock price, potentially dropping to $265–$300 due to economic slowdowns and increased regulatory pressures. In the base scenario, the stock could experience steady growth, reaching $387–$440. Finally, in the bull scenario, Google could see significant upside, with prices rising to $650–$1,000, driven by advancements in AI and cloud services.

For Ultima Markets traders, staying informed about Google’s stock price performance and the broader market trends is crucial. With Ultima Markets, you can access advanced tools, real-time data, and in-depth market analysis to track Google’s stock and make well-informed trading decisions. Whether you’re anticipating a market downturn, a steady recovery, or a breakout scenario, Ultima Markets offers the resources to help you navigate these changes and align your strategy with the evolving market dynamics.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.