Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHow Alibaba Stock Price Affects Your Trading Strategy

Alibaba stock price serves as a key metric for this Chinese tech giant’s capital market performance. Whether tracking its Hong Kong shares (9988.HK) or US listings (BABA), price fluctuations reflect the market’s collective assessment of Alibaba’s financial health, business growth, and external factors.

As one of Asia’s highest-valued tech firms, Alibaba’s stock not only impacts investor confidence but also acts as a barometer for China’s e-commerce and cloud computing industry trends.

Factors Influencing Alibaba Stock Price

● Quarterly Financial Reports

● Macroeconomic Policies

● Regulatory Environment & Tech Sector Trends

For example, China’s intensified platform economy regulations previously caused Alibaba’s stock to plummet. The 2023 policy easing triggered a rebound, reflecting restored market sentiment.

Alibaba’s US vs. HK Share Price Divergence

Alibaba trades as ADRs (American Depositary Receipts) under BABA in the US and as 9988.HK in Hong Kong. While strongly correlated, short-term price gaps arise due to trading time zones, exchange rates, and investor base differences.

For instance, during USD strength, BABA may trade at a premium to 9988.HK, whereas 9988.HK often shows greater stability during China concept stock revaluation periods.

Alibaba Stock Price Technical Analysis and Forecasting Methods

Investors frequently utilize technical analysis to identify trends. Common tools include moving averages, RSI, and Bollinger Bands. For instance, a mid-2024 golden cross attracted substantial short-term capital inflows.

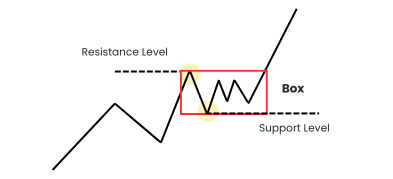

Additionally, key support/resistance levels remain focal points for technical traders.

Variables for Price Forecasting

Forecasting extends beyond charts to fundamental integration. Specifically, if quarterly reports indicate slowing cloud computing (AliCloud) growth, investors may downgrade ratings, pressuring the stock. Conversely, breakthroughs in the AI domain could trigger upward revaluation.

Alibaba Fundamentals: Revenue & Core Business Analysis

Per the 2023 annual report, Alibaba’s revenue reached RMB 868.7 billion, with core commerce at 57% and cloud computing at 9%.

Notably, while domestic e-commerce growth moderated, overseas operations (e.g., Lazada, AliExpress) and Cainiao Logistics emerged as robust new growth engines.

Can AI and Cloud Drive Stock Momentum?

In 2024, AliCloud opened its Tongyi API and integrated it across Alibaba ecosystem products, boosting enterprise user retention. Market optimism surrounds AliCloud’s commercial potential in AI training/deployment—a key factor in its recent stabilization.

Valuation Gap Analysis

Alibaba’s current P/E ratio of 11x trails peers like Amazon (PE 70x) and JD.com (PE 16x), signaling undervaluation amid bearish sentiment.

This raises market debate: Is Alibaba mispriced? Multiple institutions assign “Buy” ratings, forecasting 20%+ upside potential within six months.

Is Alibaba Suitable for Long-Term Investment?

For investors with moderate-to-high risk tolerance, Alibaba offers robust fundamentals and valuation advantages as China’s tech leader and AI transformation beneficiary. Utilizing Contracts for Difference (CFD) further enables flexible execution with leverage strategies.

Optimize Alibaba Trading Timing: Key of Selecting a Professional Platform

For traders, price movements signal entry/exit points beyond mere data. Choosing a platform with stable execution and analytical tools significantly enhances efficiency and risk control.

Ultima Markets’ tailored environment for stocks like Alibaba offers key advantages for investors:

| Trading Features | Ultima Markets Advantages |

| Multi-Market Access | Simultaneously track Alibaba’s HK and US stock trends |

| Advanced Charting | Technical indicators (e.g., MA, MACD, RSI) supported |

| Leverage & Order Controls | Flexible capital use with take-profit/stop-loss risk management |

| Bilingual Localized Support | Chinese-native interface for seamless operation |

| Demo and Real Trading in Parallel | Familiarize yourself with the process using a Demo Account before advancing to a Trading Account |

Combining technical analysis with event-driven strategies, traders can flexibly adjust their trading pace on the platform, gaining more options and adaptability whether for long-term positioning or short-term price spread capturing.

How External Factors Affect Alibaba’s Stock Price

Alibaba’s stock price is highly sensitive to external variables, including US-China relations, tech export controls, RMB trends, and overseas listing risks.

For example, after the SEC added Alibaba to the delisting watchlist in 2022, the stock price once plunged by 30%. However, the company later strengthened compliance and launched a buyback plan to rebuild market confidence.

China’s Economic Recovery and Stock Price Response

As domestic demand rebounds and policy stimulus gradually takes effect, Alibaba, as a key player in consumption and technology, saw its stock price recover steadily from late 2023 to early 2024.

Morgan Stanley forecasts that if China’s annual GDP growth remains above 5%, Alibaba’s stock price is likely to reflect the benefits of domestic demand recovery.

Frequently Asked Questions: Key Alibaba Stock Queries

Q1: How to navigate Alibaba’s short-term volatility?

A: Combine technical/fundamental analysis. For rapid response, utilize CFDs and leverage via a Demo Account to master market dynamics and order strategies.

Q2: Is Alibaba Stock Linked to AI-Concept Stocks?

A: AliCloud actively deploys AI cloud services. Its large-scale AI models power Taobao, DingTalk, and enterprise training tools, positioning Alibaba for AI-driven growth exposure.

Q3: Do Alibaba’s Share Buybacks Affect Its Stock Price?

A: Large-scale buybacks reduce outstanding shares and signal confidence, supporting the stock price. Alibaba’s HKD 91 billion repurchase in 2023 serves as a key example.

Conclusion

Whether tracking technical charts, fundamental data, or policy developments, Alibaba stock remains an asset worthy of in-depth research. Platforms like Ultima Markets empower flexible market navigation—through CFD execution, long-term investment, or Demo Account strategy testing.

Mastering Alibaba stock equates to grasping a segment of China’s tech future. Alibaba stock merits your sustained attention.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.