Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteJASMY Price Prediction for 2025, 2026–2030

JasmyCoin (JASMY) is often called Japan’s Bitcoin. Not because it mirrors Bitcoin’s role, but because it’s one of the first legally compliant blockchain projects to emerge from Japan. Launched by former Sony executives, Jasmy focuses on data democracy, giving individuals control over their personal information while allowing companies to securely access it through blockchain and IoT integration.

With nearly its entire supply of 50 billion tokens already circulating, JASMY’s value depends less on new issuance and more on real-world adoption, investor demand, and broader crypto market sentiment. The question investors are asking now is: where could the price of JASMY go over the next five years?

Jasmy Today: Market Snapshot

As of September 11, 2025 JASMY trades around $0.014–0.0145, has roughly 49.445 billion tokens circulating out of a 50 billion max supply and sits close to the top ~120 by market cap. Broader crypto sentiment is in neutral territory (Crypto Fear & Greed Index), and near-term swings remain tied to the risk mood across digital assets.

At first glance, this might suggest stagnation, but Jasmy has several factors working in its favor. Its use case around personal data protection remains highly relevant in an era of privacy concerns, and its strong presence in the Japanese market, which is one of the most regulated in the world, gives it credibility that many other altcoins lack.

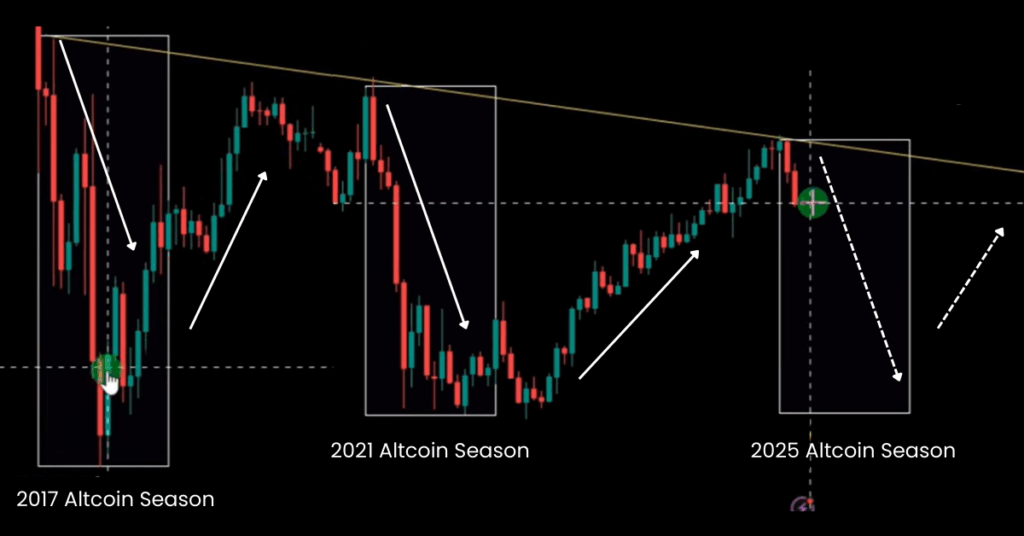

Add to this the possibility of an upcoming altcoin season if Bitcoin dominance starts to drop, and it becomes clear why analysts still see potential upside. With that foundation, let’s explore where Jasmy could head next.

Jasmy Price Prediction 2025-2030

Jasmy Price Prediction 2025

Forecasts for 2025 suggest Jasmy could end the year significantly higher than today’s levels.

- September 2025: Expected range $0.0140 – $0.0182 (ROI ~26%)

- October 2025: $0.0186 – $0.0245 (ROI ~70%)

- November 2025: $0.0239 – $0.0262 (ROI ~82%)

- December 2025: $0.0259 – $0.0352 (ROI up to 144%)

End-2025 projection: $0.025 – $0.035

Short-Term Technical Insights

Traders following Jasmy’s daily chart point to a bullish pennant forming near the current price zone. If the token can break above $0.017 and hold that level as support, momentum could push it toward the $0.02 mark. That level is seen as critical: a clean break above $0.02 could usher Jasmy into a new uptrend and potentially validate the higher price targets for year-end.

This technical optimism is reinforced by a MACD bullish divergence spotted on broader altcoin/BTC charts, a signal that often precedes strong rallies in altcoins.

On the macro side, a possible Federal Reserve rate cut in September 2025 may also fuel risk appetite, adding another tailwind. Together, these short-term factors suggest Jasmy could be on the cusp of an explosive move if conditions align.

Jasmy Price Prediction 2026

- Range: $0.0165 – $0.0342

- Average: ~$0.0247

- Outlook: A year of consolidation. July could be the strongest month, with potential highs near $0.034.

Jasmy Price Prediction 2027

- Range: $0.0148 – $0.0262

- Average: ~$0.0186

- Outlook: Sideways trading expected, with November offering the most bullish scenario (~$0.026).

Jasmy Price Prediction 2028

- Range: $0.022 – $0.076

- Average: ~$0.043

- Outlook: A potential breakout year. If adoption rises, Jasmy could climb past $0.07, delivering over 400% gains from current levels.

Jasmy Price Prediction 2029

- Range: $0.050 – $0.076

- Average: ~$0.065

- Long-term floor: Holding above $0.05 would mark maturity and stronger stability for the token.

Jasmy Price Prediction 2030

- Range: $0.064 – $0.069

- Average: ~$0.066

- Outlook: Stability at higher levels. Some forecasts suggest bullish cases up to $0.10–0.11.

What Could Drive Jasmy Higher?

Jasmy’s main strength lies in its real-world utility. The more individuals and businesses adopt its personal data locker system, the greater the token’s demand will be. Strategic partnerships, especially within Japan’s highly regulated market, could act as catalysts for adoption. On top of fundamentals, altcoin rallies driven by falling Bitcoin dominance have historically boosted projects like Jasmy, positioning it to benefit during broader crypto cycles.

Risks to Consider

Like all altcoins, Jasmy comes with significant risks. Its history of volatility means sharp drawdowns are always possible. The project also faces competition from other blockchain platforms tackling data privacy and IoT. Regulatory changes could help or hinder its path, and adoption remains uncertain. If the platform fails to attract real users and businesses, optimistic forecasts may not hold.

Conclusion

Jasmy represents Japan’s unique contribution to the blockchain and IoT sector. Forecasts suggest JASMY could reach $0.025–0.035 by the end of 2025, before gradually climbing toward $0.07–0.11 by 2030 in bullish cases.

Short-term technicals, such as a bullish pennant and resistance at $0.017–0.02, offer reasons for optimism if the breakout occurs. However, investors should balance that outlook with awareness of volatility and execution risk.

For long-term believers, Jasmy may be a speculative but promising play on the future of data sovereignty in a digital world.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.