Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomA Guide to W Pattern Trading Made Simple

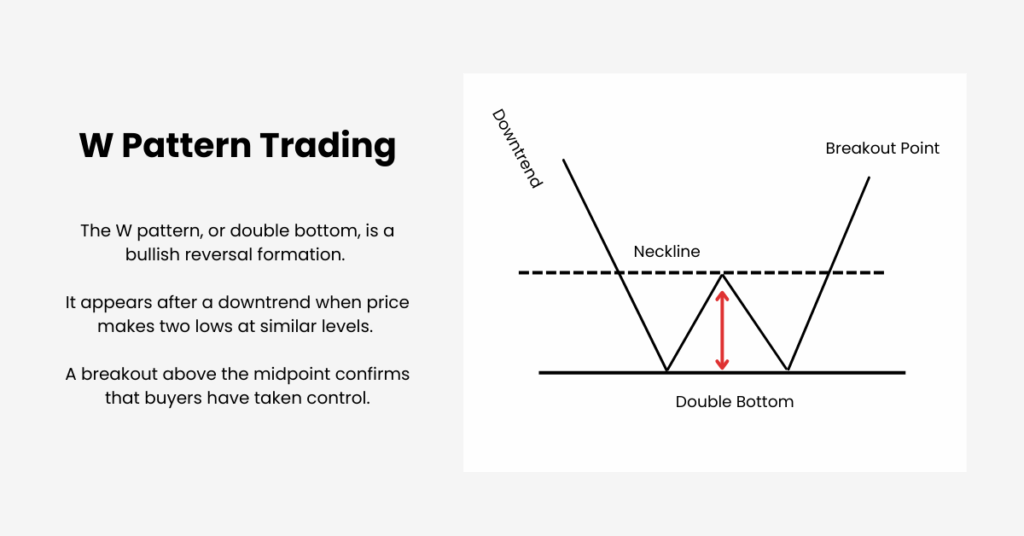

If you want to catch bullish reversals early, the W trading pattern, often called the double bottom, is one of the most effective tools in technical analysis. This formation signals that sellers are losing momentum while buyers are stepping back in. By mastering W pattern trading, traders can identify when a downtrend is exhausting and prepare to take advantage of the shift toward bullish momentum.

What Is the W Trading Pattern?

The W pattern is a bullish reversal formation that develops after a decline. As its name suggests, the pattern resembles the letter “W.” Price first forms a bottom, rebounds to a midpoint high, retests support with a second bottom, and then confirms the reversal by breaking above the midpoint.

In simple terms, the W pattern shows that sellers tried twice to push the price lower but failed, giving buyers the upper hand.

How to Identify the W Pattern

Spotting the W pattern trading setup requires patience and attention to detail:

- Look for a clear downtrend leading into the formation.

- Identify the first bottom followed by a rebound to resistance.

- Watch for a second bottom near the same level, ideally with smaller candles or rejection wicks showing weakening selling power.

- Confirmation comes when price breaks and closes above the midpoint high.

Balanced, symmetrical W patterns tend to be more reliable than elongated or lopsided shapes. The cleaner the structure, the stronger the signal.

The Psychology Behind W Pattern Trading

At its core, the W pattern reflects the tug-of-war between buyers and sellers. The first bottom occurs when sellers dominate, driving prices down and shaking out weak positions. As the market rebounds, early buyers and short-covering provide a temporary lift, but uncertainty remains.

When price returns to form the second bottom, sellers make another attempt to push lower. This time, however, the decline stalls because fewer participants are willing to sell at such depressed levels. Support holds, suggesting that the market is no longer as bearish as before.

The breakout above the midpoint is the final stage of the psychological cycle. Buyers step in decisively, convinced that the worst of the decline has passed. Their renewed confidence shifts momentum to the upside, making the W pattern one of the clearest signs of a bullish reversal.

How to Trade the W Pattern

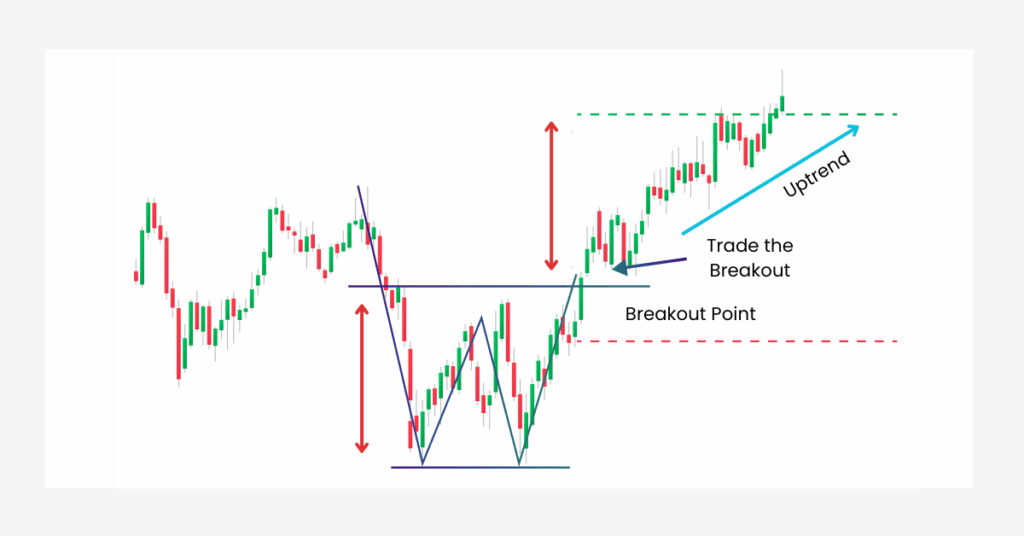

W pattern trading involves a systematic approach:

- Wait for Confirmation

Enter only after price breaks and closes above the midpoint resistance to avoid false reversals. - Entry Point

Place a long order on the breakout or on a retest of the broken midpoint level. - Stop-Loss Placement

Protect your trade by setting a stop just below the second bottom. - Take-Profit Target

Measure the distance between the bottoms and the midpoint, then project that upward from the breakout point. This gives a logical target while keeping risk-to-reward favourable.

Using Indicators for Extra Confidence

While the W pattern can stand on its own, traders often strengthen their strategy by looking for signs that confirm bullish pressure is building. One way is to watch for higher lows on smaller timeframes leading into the second bottom. This often shows that buyers are quietly stepping in earlier.

Another method is to track volume behaviour around the lows. Rather than just looking at the breakout, observe whether selling volume is drying up during the second bottom. A decline in selling activity often precedes a stronger reversal.

Some traders also use trendline breaks on the right side of the W to time entries. When price breaks a descending trendline before the midpoint breakout, it suggests that the shift in sentiment has already begun.

By paying attention to these subtle signals, traders can filter out weaker setups and focus on Ws with stronger conviction behind them.

Strengths and Limitations of W Pattern Trading

One of the strengths of the W pattern is its simplicity. It is easy to identify, works across multiple markets and timeframes, and is based on clear market psychology. When confirmed with indicators like volume, it becomes a powerful reversal tool.

However, it’s not without limitations. False breakouts can occur, especially when volume is low. The pattern can also take time to form, requiring patience from traders. Most importantly, disciplined risk management is essential—without stops in place, sudden reversals can erase gains quickly.

Key Takeaways

The W trading pattern is a cornerstone of bullish reversal strategies. To trade it effectively, focus on:

- Waiting for a confirmed breakout above the midpoint.

- Using volume and Fibonacci levels to strengthen the signal.

- Managing risk with protective stops and realistic profit targets.

By following these steps, you can use the W pattern to shift from defensive trading to capturing upside momentum with confidence.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.