Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Forex Chart Patterns: 10 Key Setups for Traders

Chart patterns are an essential part of chart pattern analysis, which helps traders anticipate future price

movements based on historical data. These formations provide valuable insights into market sentiment,

allowing traders to identify opportunities and manage risk effectively.

Mastering forex chart patterns can give traders a competitive edge, whether they are day traders, swing

traders, or long-term investors. In this guide, we’ll explore the most important trading patterns, how they

work, and how to apply them in real-world trading.

What Is a Chart Pattern?

A chart pattern is a visual formation on a price chart that signals a potential trend continuation or

reversal. These patterns occur due to repeated market behaviour, reflecting shifts in supply and demand.

Traders use chart pattern analysis to predict price movements and improve their decision-making.

Recognising these patterns early can help execute trades with better timing. While there are no patterns

that can guarantee success, combining them with technical indicators and trendline patterns can enhance

trading accuracy.

Understanding the Different Types of Forex Patterns

Forex chart patterns fall into three main categories, each helping traders refine their chart pattern analysis

and make informed decisions.

Reversal Patterns

Reversal patterns signal a shift in trend direction. They form when buying or selling pressure

weakens, leading to a potential trend change. Identify these forex patterns early to anticipate new

market movements.

Continuation Patterns

Continuation patterns suggest a brief pause before the existing trend resumes. They indicate

market consolidation, where traders take a moment to reassess before pushing the price further in

the same direction. Spot these trading patterns to stay in profitable trades longer.

Bilateral Patterns

Bilateral patterns reflect market indecision, meaning the price could break out in either direction.

Traders wait for confirmation signals, such as a breakout, before entering a position. Use these

trendline patterns to determine key breakout points for better trade execution.

10 Important Chart Patterns for Trading

Mastering forex chart patterns helps traders identify potential trend reversals and continuations for more

strategic trade execution. These patterns provide insight into market sentiment, making chart pattern analysis a key component of technical trading.

Reversal Patterns

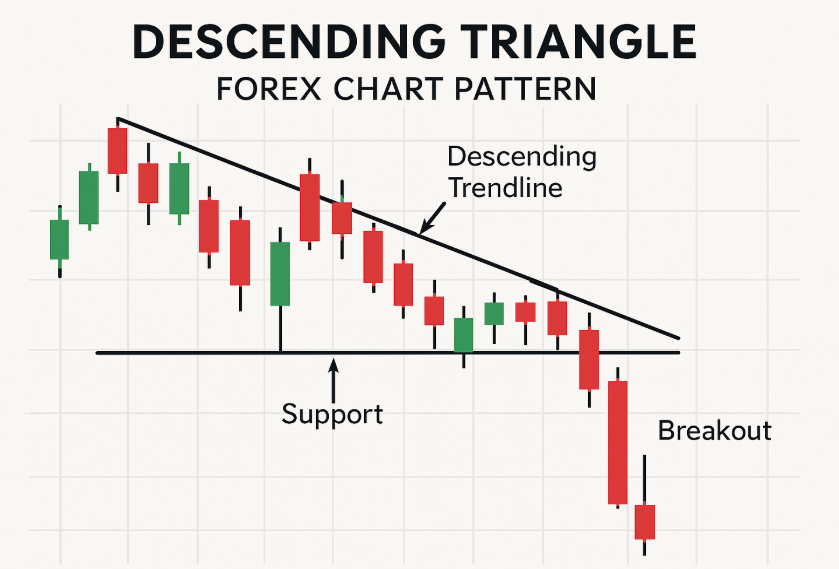

- Descending Triangle – The bearish counterpart of the Ascending Triangle, with lower highs

pressing against a flat support level, awaiting a breakdown.

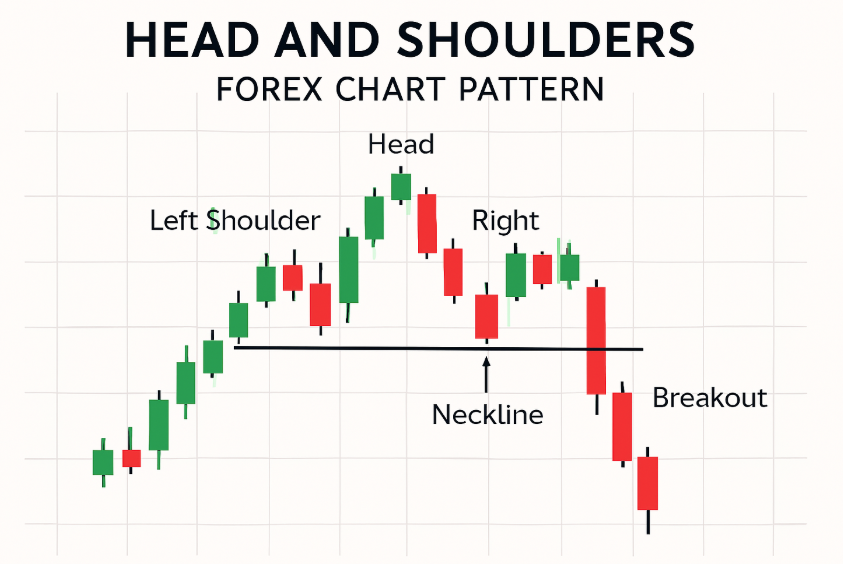

- Head and Shoulders – A classic reversal pattern that signals the end of an uptrend. A break

below the neckline confirms a bearish shift.

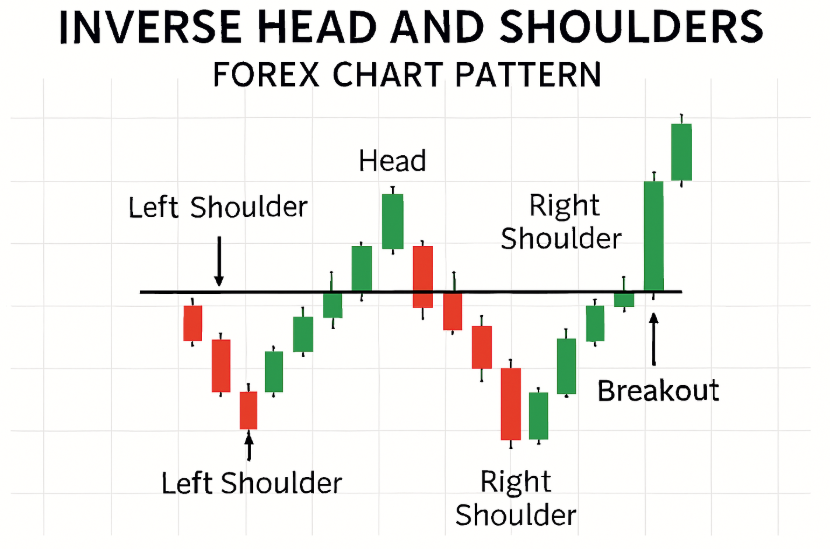

- Inverse Head and Shoulders – The opposite of the Head and Shoulders pattern, signalling the

transition from a downtrend to an uptrend once the neckline is breached.

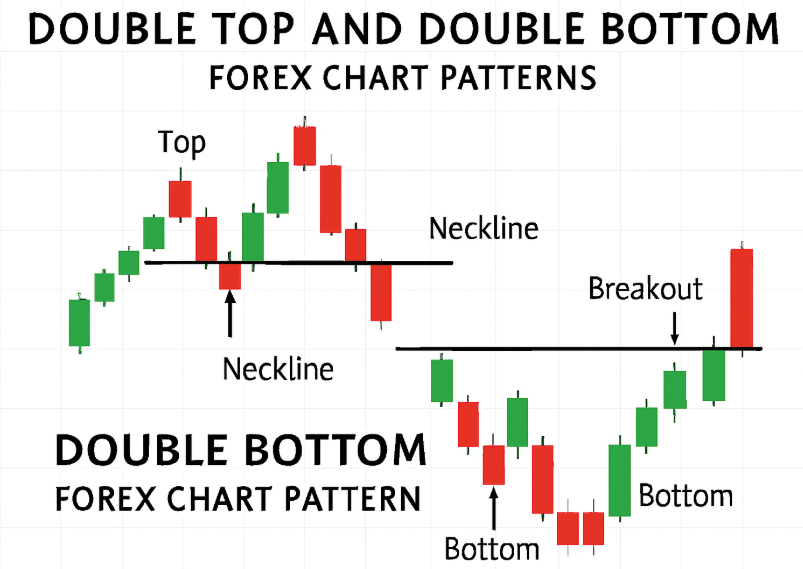

- Double Top and Double Bottom – These formations indicate a failed attempt to break resistance

(Double Top) or support (Double Bottom), leading to a potential trend reversal.

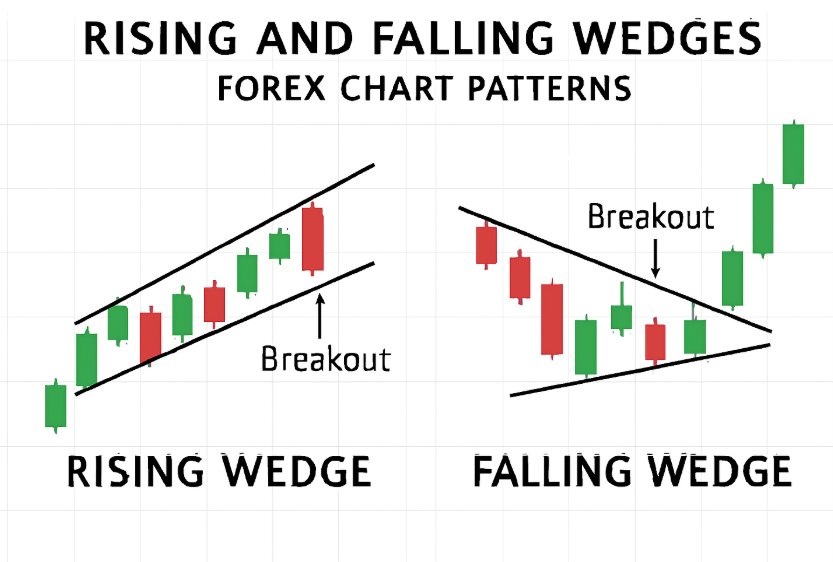

- Rising and Falling Wedges – These trendline patterns suggest a slowing trend before a

breakout. Rising Wedges typically precede bearish reversals, while Falling Wedges signal bullish

reversals.

Continuation Patterns

- Rising and Falling Wedges – Unlike their role in reversals, Wedges can also act as continuation

patterns when forming within an ongoing trend. A breakout in the prevailing trend direction

confirms continuation.

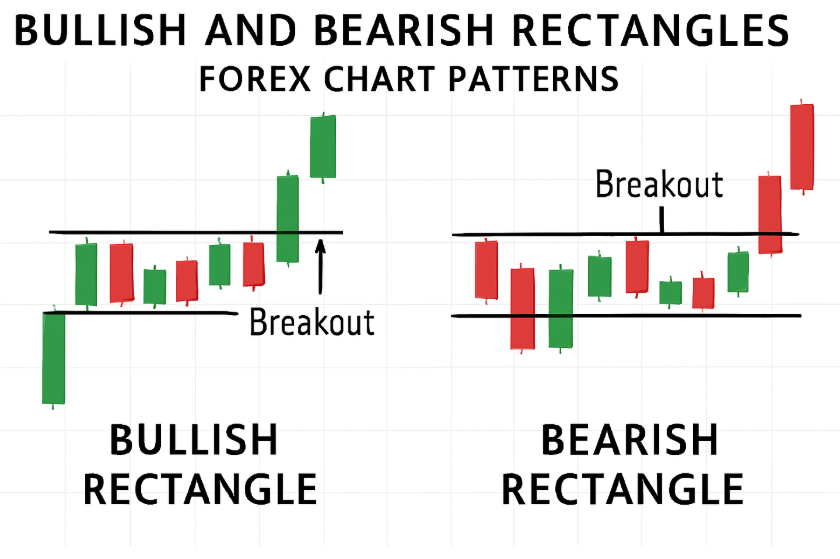

- Bullish and Bearish Rectangles – A trading pattern where the price moves within parallel

support and resistance lines before breaking out in the direction of the existing trend.

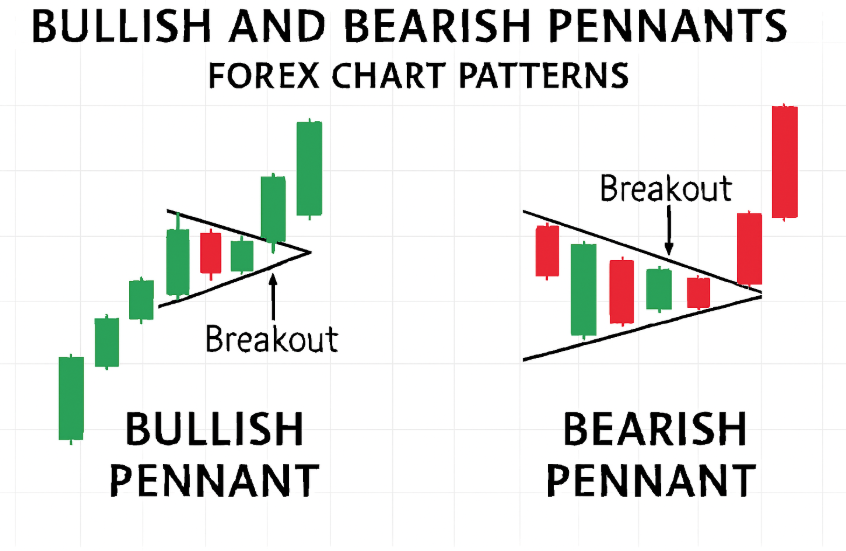

- Bullish and Bearish Pennants – Small forex patterns resembling Symmetrical Triangles, forming

after sharp price movements and indicating potential breakouts.

Bilateral Patterns

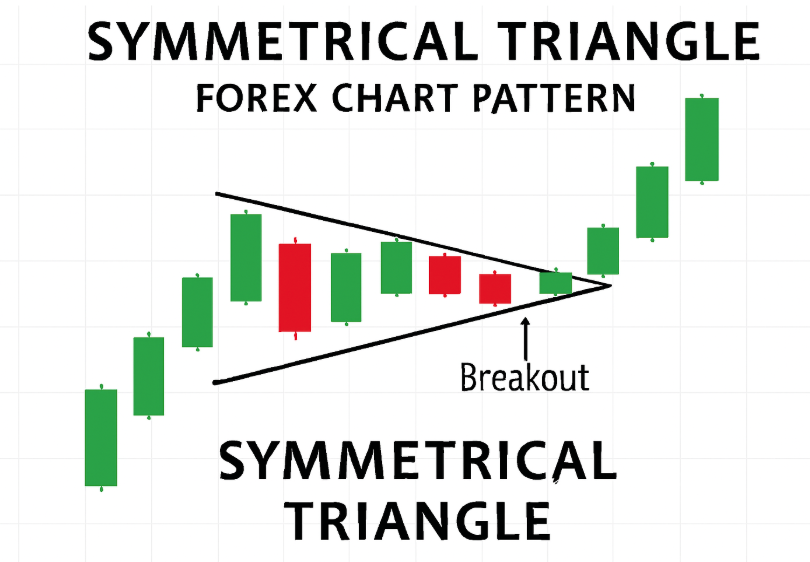

- Symmetrical Triangle – A pattern where price consolidates between converging trendlines,

signalling an impending breakout in either direction.

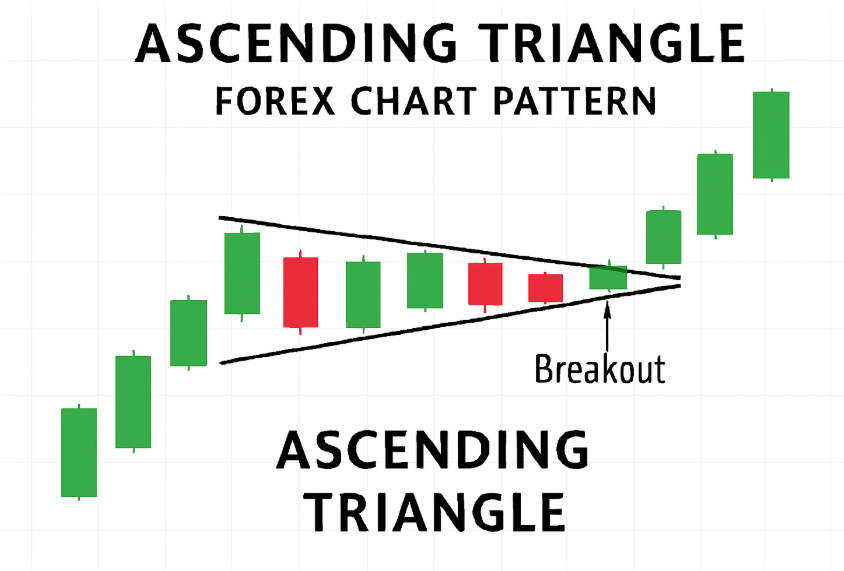

- Ascending Triangle – A typically bullish pattern featuring a horizontal resistance level and rising

lows, requiring a breakout confirmation.

How to Apply Chart Patterns in Forex Trading

Recognising forex chart patterns is only the first step, knowing how to trade them effectively is what

makes the difference. To maximise their potential, traders must follow these key steps:

Validate Chart Patterns Before Trading

A trading pattern is only reliable when confirmed with additional chart pattern analysis tools like

volume, moving averages (MA), or relative strength index (RSI). To reduce false signals, breakout

strength, trend direction, and market conditions should align before entering a trade.

Use Stop-Losses to Protect Your Trades

Placing stop-loss orders beyond key trendline pattern levels helps minimise losses from sudden

price reversals. For example, in a Double Top, a stop-loss above the peaks prevents excessive

downside risk if the price retests resistance.

Set Profit Targets Based on Chart Patterns

Profit targets are typically determined using the pattern’s measured move. In a forex pattern like a

Head and Shoulders, the expected price movement equals the distance between the head and

neckline, offering a logical exit strategy.

Master Chart Patterns for Smarter Trading

Learning to identify forex chart patterns can significantly improve a trader’s ability to predict price

movements. Whether focusing on reversal, continuation, or bilateral patterns, recognising key setups

helps traders make better decisions and manage risk effectively.

For traders looking to refine their chart pattern analysis, Ultima Markets offers real-time market insights

and advanced charting tools. Start trading with confidence today, unlock new opportunities and enhance

your trading performance with Ultima Markets!

FAQs

How reliable are forex chart patterns?

While no pattern is foolproof, combining chart pattern analysis with technical indicators can

improve accuracy. The reliability depends on volume, breakout strength, and market conditions.

Can chart patterns be used for short-term trading?

Yes, forex patterns apply to all timeframes. Scalpers and day traders use them for short-term

setups, while swing traders look at longer patterns for sustained trends.

What is the difference between a trendline pattern and a chart pattern?

A trendline pattern helps identify the market direction, while a chart pattern signals potential

reversals or continuations within that trend.

How do I know when a pattern has failed?

A trading pattern fails when the price moves in the opposite direction after breaking key levels.

Using stop-losses prevents large losses when this happens.

Are chart patterns effective in all market conditions?

Patterns work best in trending markets. In choppy or low-volume conditions, forex chart patterns

may be less reliable and require extra confirmation.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.