1 May 2024

Ultima Markets – The Rollover Schedule of Futures in May

The Rollover Schedule of Futures in May

|

Symbol |

Description |

Rollover Date |

Current Contract |

Next Contract |

|---|---|---|---|---|

FRA40ft |

France 40 Index Future |

2024-05-15 |

24-May |

24-Jun |

CL-OIL |

Crude Oil West Texas Future |

2024-05-16 |

24-Jun |

24-Jul |

VIX |

Volatility |

2024-05-17 |

24-May |

24-Jun |

LongGilt |

UK Long Gilt Futures |

2024-05-24 |

24-Jun |

24-Sep |

CHINA50ft |

CHINA50 Future |

2024-05-28 |

24-May |

24-Jun |

USNote10Y |

US 10 YR T-Note Futures Decimalised |

2024-05-28 |

24-Jun |

24-Sep |

UKOUSDft |

Brent Oil Future |

2024-05-29 |

24-Jul |

24-Aug |

HK50ft |

Hong Kong 50 Future |

2024-05-29 |

24-May |

24-Jun |

EUB30Y |

Euro – BUXL Futures |

2024-05-31 |

24-Jun |

24-Sep |

EUB2Y |

Euro – Schatz Futures |

2024-05-31 |

24-Jun |

24-Sep |

EUB10Y |

Euro – Bund Futures |

2024-06-04 |

24-Jun |

24-Sep |

EUB5Y |

Euro – BOBL Futures |

2024-06-04 |

24-Jun |

24-Sep |

• Internal transfers will be suspended during the half-hour before and after the rollover.

• Investors are advised to carefully manage their positions or adjust the take-profit and stop-loss settings before the rollover.

• Liquidity providers might adjust the rollover schedules base on the dynamic nature of market conditions. The up-to-date execution data should be subject to information on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com.

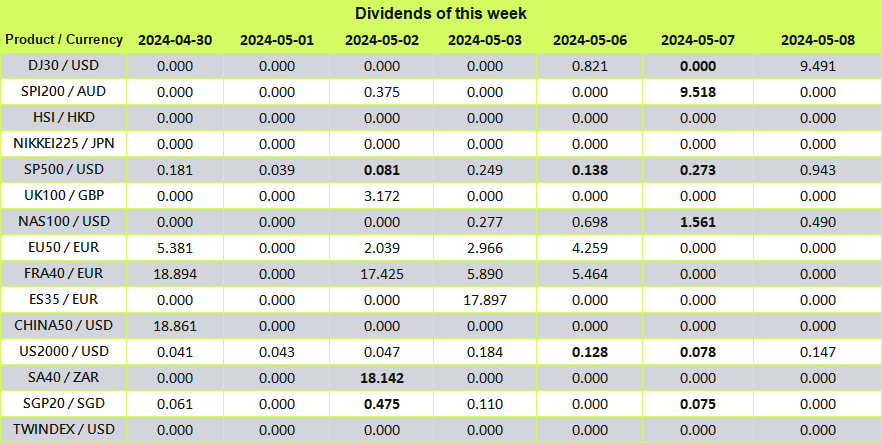

30 April 2024

Ultima Markets Index Dividend Adjustment Notice

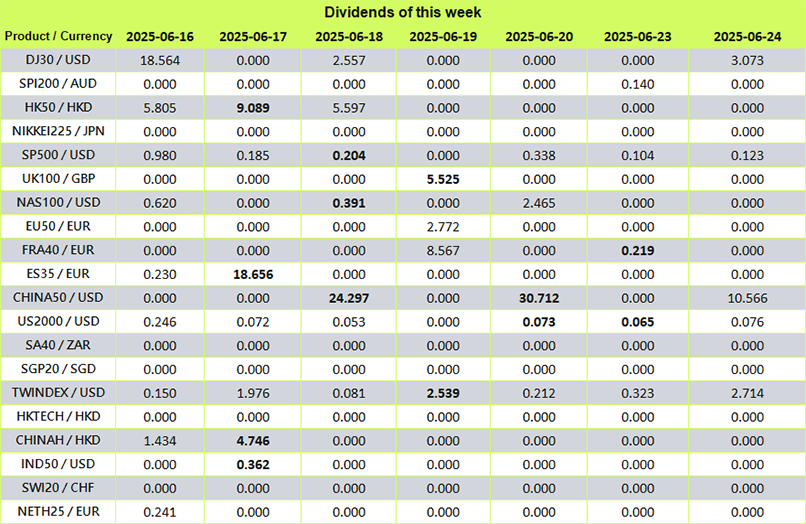

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

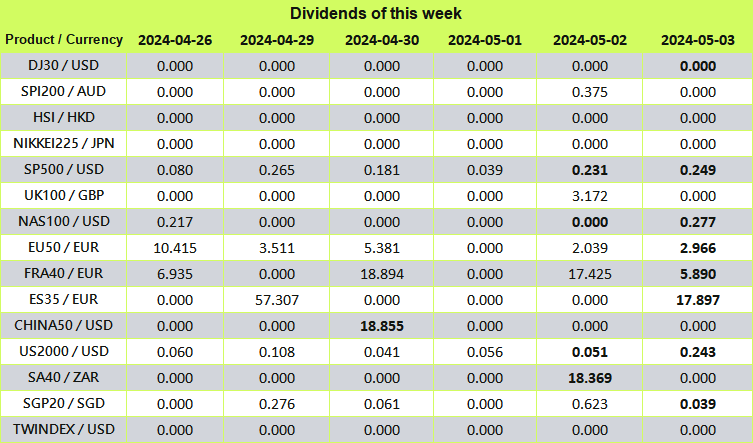

29 April 2024

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

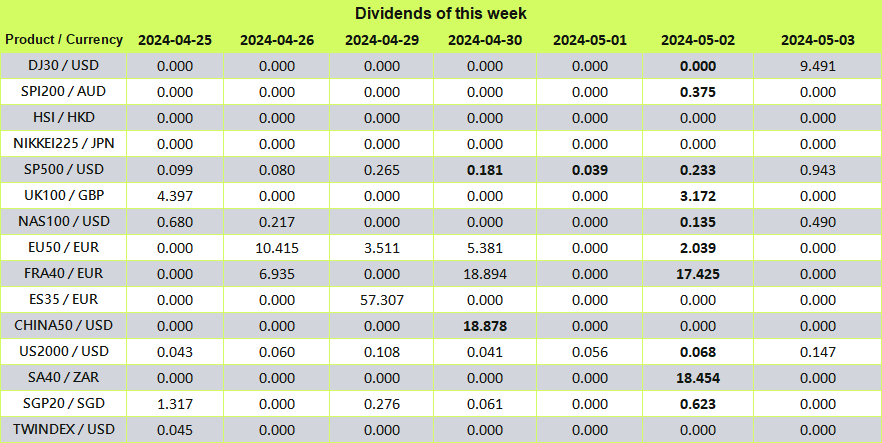

26 April 2024

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

25 April 2024

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

Ultima Markets Index Dividend Adjustment Notice

Filters:

No Results

Please try a different search term.

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

Ultima Markets The Adjustments for BVSPX

4 June 2025

From 16th, June 2025

|

Product |

Previous Leverage |

Leverage after updating |

|---|---|---|

|

BVSPX |

20:1 |

50:1 |

• The margin requirements for the above products will increase/decrease with the leverage adjustment. The margin level may be affected; please pay attention to your trading strategy and account risk.

• Due to the inherent uncertainty in the market, please refer to the MT4 software as the primary source for executing trades and monitoring market conditions.

• During both the update and adjustment period, as well as after the update, positions in clients' portfolios can continue to be held without any impact.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

Leverage Adjustment During News Releases Daily Market Close

3 June 2025

All affected accounts will have Client Leverage and Fixed Leverage adjusted to 200:1.

Note: If your existing leverage is lower than 200:1, it will remain unchanged.

MT4 and MT5

Forex, Gold, Silver, Oil, and Indices

15 minutes before and 5 minutes after major economic news releases.

From 1 hour before market close on Friday to 30 minutes after market open on Monday

FOMC Rate Decision, CPI, PMI, NMI, PPI, GDP, PCE, Retail Sales, NFP (Non-Farm Payrolls), ADP (Private Employment), Crude Oil Inventories.

• Positions opened during the specified periods will be subject to 200:1 leverage.

• After the specified period ends, positions will automatically revert to the account’s original leverage setting.

Should you have any questions or need further clarification, please do not hesitate to contact our Support Team at info@ultimamarkets.com.

Thank you for your continued support.

Leverage Adjustment During News Releases Daily Market Close

29 May 2025

Leverage Adjustment Details:

1. Adjusted Leverage:

• All affected accounts will have Client Leverage and Fixed Leverage adjusted to 200:1.

• Note: If your existing leverage is lower than 200:1, it will remain unchanged.

2. Affected Products: Forex, Gold, Silver, Oil, and Indices

3. Affected Platforms: MT4 and MT5

4. Effective Time Periods:

• 15 minutes before and 5 minutes after major economic news releases.

• From 1 hour before market close on Friday to 30 minutes after market open on Monday

5. Applicable News Releases Include (but are not limited to):

• FOMC Rate Decision, CPI, PMI, NMI, PPI, GDP, PCE, Retail Sales, NFP (Non-Farm Payrolls), ADP (Private Employment), Crude Oil Inventories.

⚠️ Important Notes:

• Positions opened during the specified periods will be subject to 200:1 leverage.

• After the specified period ends, positions will automatically revert to the account’s original leverage setting.

This temporary measure is essential for maintaining system performance and minimizing risks during periods of heightened market movement.

Should you have any questions or need further clarification, please do not hesitate to contact our Support Team at info@ultimamarkets.com.

Thank you for your continued support.

Ultima Markets – New Products Launch

27 May 2025

From Monday, June 09th , 2025

|

Symbol |

Description |

Leverage |

Quote/ Trade Time (GMT+3) |

|---|---|---|---|

IND50 |

India 50 Index |

200:1 |

Mon. – Fri. 06:45 - 13:00 |

CHINAH |

Hang Seng China |

200:1 |

Mon. – Fri. 04:15 - 07:00 ; |

NETH25 |

Netherlands 25 Index |

200:1 |

Mon. – Fri. 09:00 - 23:00 ; |

SWI20 |

Swiss 20 Index |

200:1 |

Mon. – Fri. 09:00 - 20:00 ; |

• The trading hours listed in the table above are based on the server's Daylight Saving Time, GMT+3 (Note: Greater China Region is GMT+8).

• For more details about those products, please refer to the specifications on the MetaTrader software/application.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com.

Ultima Markets–The Adjustments for US Shares

26 May 2025

From 9th, June 2025

|

Product |

Previous Leverage |

Leverage after updating |

|---|---|---|

|

US share CFDs |

20:1 |

33:1 |

• The margin requirements for the above products will increase/decrease with the leverage adjustment. The margin level may be affected; please pay attention to your trading strategy and account risk.

• Due to the inherent uncertainty in the market, please refer to the MT4 software as the primary source for executing trades and monitoring market conditions.

• During both the update and adjustment period, as well as after the update, positions in clients' portfolios can continue to be held without any impact.

If you have any questions or require assistance, please do not hesitate to contact info@ultimamarkets.com

Leverage Adjustment During News Releases Daily Market Close

13 May 2025

Leverage Adjustment Details:

1. Adjusted Leverage:

• All affected accounts will have Client Leverage and Fixed Leverage adjusted to 200:1.

• Note: If your existing leverage is lower than 200:1, it will remain unchanged.

2. Affected Products: Forex, Gold, Silver, Oil, and Indices

3. Affected Platforms: MT4 and MT5

4. Effective Time Periods:

• 15 minutes before and 5 minutes after major economic news releases.

• From 1 hour before market close on Friday to 30 minutes after market open on Monday

5. Applicable News Releases Include (but are not limited to):

• FOMC Rate Decision, CPI, PMI, NMI, PPI, GDP, PCE, Retail Sales, NFP (Non-Farm Payrolls), ADP (Private Employment), Crude Oil Inventories.

⚠️ Important Notes:

• Positions opened during the specified periods will be subject to 200:1 leverage.

• After the specified period ends, positions will automatically revert to the account’s original leverage setting.

This temporary measure is essential for maintaining system performance and minimizing risks during periods of heightened market movement.

Should you have any questions or need further clarification, please do not hesitate to contact our Support Team at info@ultimamarkets.com.

Thank you for your continued support.