Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

SNB Leads Global Central Banks in Rate Cuts Amid Economic Pressures

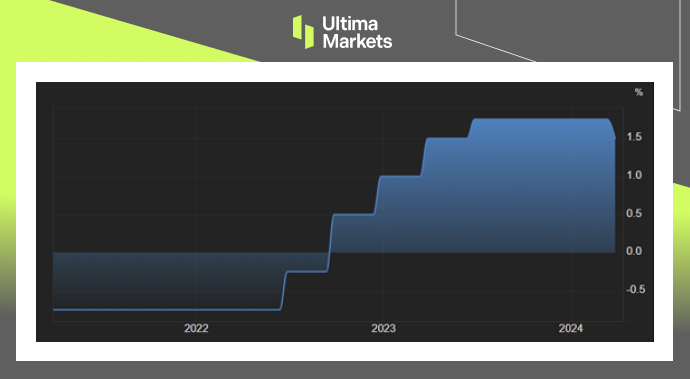

In March 2024, the Swiss National Bank unexpectedly decided to lower its primary interest rate by 0.25 percentage points to 1.5%. The action represented the institution’s first reduction in nine years, setting a precedent as the first major central bank to initiate a loosening of monetary policy. This development ensued as Swiss inflation dropped to 1.2% in February, extending a nine-month trend of prices within the SNB’s target zone of 0-2%, reflecting maintained price equilibrium.

The central bank acknowledged the diminishing inflationary trends and the Swiss franc’s real-term appreciation over the preceding year as influencing factors in its decision. With expectations that inflation will continue to align with the stability range in the coming years, the policymakers will keep a watchful eye to ensure it does so.

Projections by the SNB estimate that average annual inflation rates will hover at 1.4% for 2024, decline slightly to 1.2% for 2025, and then to 1.1% for 2026. Concurrently, economic expansion is predicted to be subdued in the near term, with this year’s growth projections standing at approximately 1%.

In the wake of the Swiss National Bank’s move, the Swiss franc depreciated, surpassing the 0.895 mark against the US dollar, reaching its lowest point since November 13th.

(Policy Rate Levels,Swiss National Bank)

(USDCHF Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server