Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

ADP Preview: The First Test After the “Hawkish Hold”

Ultima Markets Daily Market Insights – February 4, 2026

The markets are currently in a “wait-and-see” mode, especially with the Dollar holding its breath after a strong 4-day rally. Following the Federal Reserve’s decision to hold rates steady and emphasize a “solid” economy, traders are desperate for data to confirm or deny Powell’s optimism.

Today brings the first major piece of that puzzle: the ADP Non-Farm Employment Change. With the Dollar holding its post-Fed gains and Gold rebounding after last week’s “Flash Crash,” today’s data could trigger the next volatility breakout given the delays of the Friday’s NFP.

ADP Preview: Why It Matters

The ADP Employment Report is set to release at 8:15 AM ET. The Market expects a print of 48K (Prior: 48K). Why does it matter?

- The “Fed Check”: The Fed removed the “downside risk to employment” warning from their statement last week. A strong ADP print validates this hawkish stance (given NFP is out of picture this week), potentially fueling a further Dollar rally.

- The Downside Risk: Conversely, a weak ADP would reignite fears that the labor market is cracking faster than the Fed admits, potentially sending the Dollar tumbling and Gold surging back toward $5,300.

While ADP is not considered the primary labor market data to watch, it is the only labor market report to have for the week as Non-Farm Payroll were once again delayed.

Apart from that, the ISM Services PMI released today is also set to provide a “Fed Check.” Following Monday’s Manufacturing PMI, which posted a strong rebound, if the Services PMI poses the same strength, it will also improve the “Fed hold for longer” sentiment.

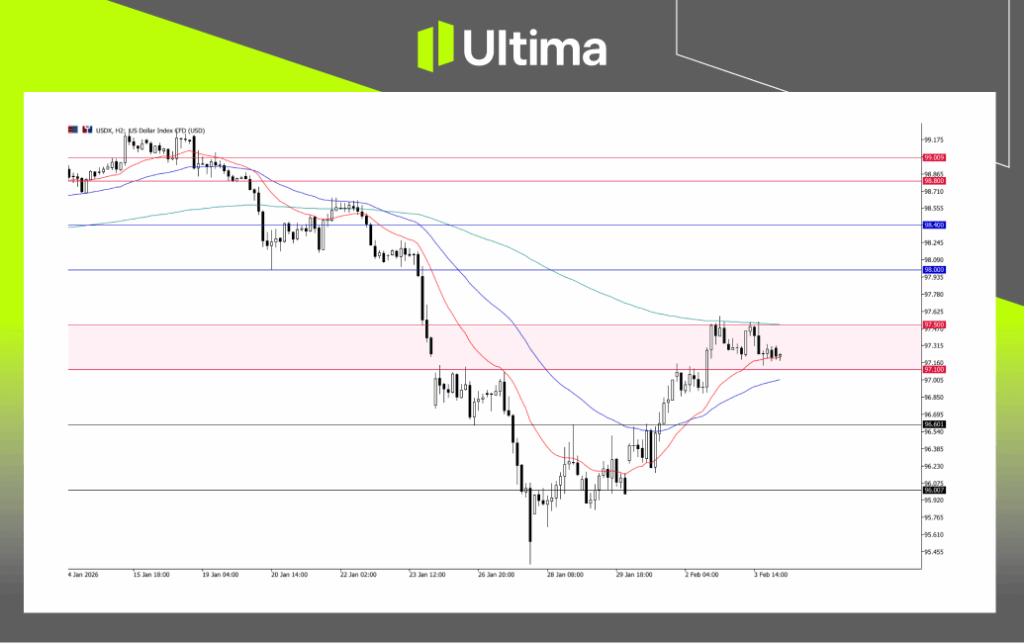

US Dollar Outlook: Holding the High Ground

The US Dollar (USDX) has stabilized above 97.50, maintaining the recovery triggered by the Fed’s “Hold.”

Without an immediate rate cut in March or even until June, the yield advantage remains with the USD for now, a narrative which has unwound the earlier “short-dollar” trade.

USDX, H2 Chart | Ultima Markets MT5

Technically, the US Dollar rebounded from 96.00 earlier, forming a short-term bullish reversal. Regaining the 97.00 level further validates that a bullish continuation in the Dollar is likely.

However, over the broad outlook, the US Dollar remains on a downtrend setup, with 97.50 remaining the major resistance. For the outlook today:

- Bullish Scenario: A break above 97.50 (especially if driven by strong data) may open the path to 98.00 – 98.20.

- Bearish Scenario: If data misses, watch the 97.10 support. A loss of this level may suggest the recent rebound was just a “dead cat bounce,” potentially leading to a further downside move.

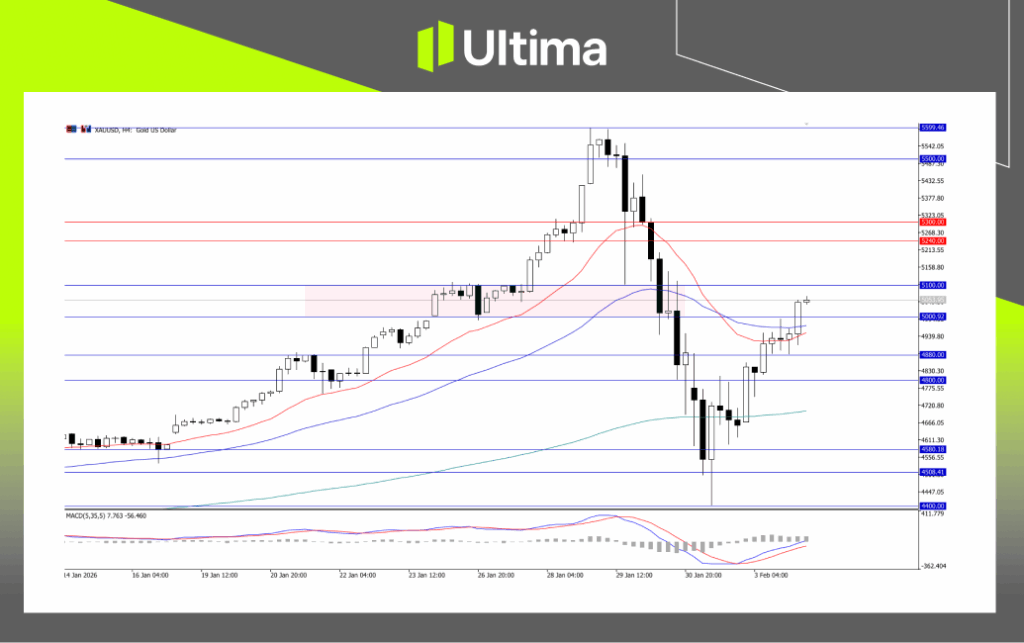

Gold Outlook: The “Aftershock Rebound”

After plunging from record highs of $5,595 to near $4,400 last week, Gold staged a strong rebound toward the $5,000 mark, currently trading near $5,050.

The volatility has compressed, and it seems buyers are defending the $4,500 floor. However, the sustainability of this buyer momentum is still in doubt. Usually, a rebound after a sharp crash within a broad uptrend suggests a potential period of consolidation.

XAUUSD, H4 Chart | Ultima Markets MT5

Technically, Gold could now be trapped within a range.

- Resistance: $5,100 – $5,000 remains the immediate ceiling. A breakout above this level is needed to signal that the correction is over and bulls are regaining control, or at least suggest Gold should hold above $5,000.

- Support: As for now, $4,600 is the critical support/buying zone, while $4,800 – $4,880 remains a major zone to validate that buyers are still dominating the broader trend.

For the near-term outlook, Gold could be waiting for a catalyst. It needs a weak labor market (bad data) to justify a move back up. Strong data is the enemy right now.

What to Watch Today

ADP Non-Farm Employment Change (8:15 AM ET): Expect immediate volatility in Gold and USD/JPY upon release.

ISM Services PMI (10:00 AM ET):

- Forecast: 53.5.

- Impact: This is just as important as ADP. If the Services sector (the biggest part of the US economy) slips into contraction (<50), it screams “Recession” and could weaken the Dollar significantly.

Fed Speakers: Several Fed officials are scheduled to speak. Watch for any comments clarifying the “June Cut” timeline. Any hawkish rhetoric will keep pressure on Gold.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server