Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomWhat Happened to the Currency of Iran?

The currency of Iran, the Iranian rial (IRR) has long been at the center of economic turbulence in Iran, but in recent years, its decline has reached alarming levels. While it hasn’t technically hit zero, the rial’s value is so close to it that it is increasingly regarded as functionally worthless.

The combination of sanctions, runaway inflation, chronic mismanagement, and nationwide unrest has turned the rial into a shadow of its former self. Let’s dive into the factors contributing to the collapse of the currency of Iran, its current state, and why it feels like the currency of Iran has become zero.

Factors Behind the Rial’s Collapse

Sanctions

The impact of international sanctions cannot be overstated. Beginning with the 1979 revolution, and escalating after the U.S. left the nuclear deal in 2018, sanctions crippled Iran’s ability to export oil, access global markets, and stabilise its economy. The loss of foreign revenue triggered inflation and caused the rial to plummet.

Inflation and Mismanagement

Runaway inflation has also played a critical role. With rates often exceeding 40% annually, basic goods became more expensive at an alarming rate. Alongside this, economic mismanagement and poor governance have prevented Iran from diversifying its economy, leaving it reliant on oil exports. This compounded the rial’s decline.

The Iran-Iraq War (Rhia)

The Iran-Iraq War (1980-1988), also known as Rhia, had a long-lasting effect on Iran’s economy. The war drained the nation’s resources, forcing the government to print more money to finance military spending. This caused inflation and further weakened the rial. The war also led to international sanctions, isolating Iran from global trade, further undermining its currency.

Current Unrest and Conflict

While Iran is not currently engaged in a full-scale war, ongoing regional conflicts and domestic unrest have worsened the economic situation. The 2025–2026 protests sparked by rising inflation, the depreciation of the rial, and severe economic hardship have further destabilised the country. These protests reflect public frustration over the rial’s collapse, as prices soar and savings evaporate.

Additionally, military tensions with Israel and other regional powers have increased economic uncertainty, making it even harder for Iran to attract foreign investment. These geopolitical tensions and domestic unrest only add fuel to the fire, pushing the rial to its current crisis point.

How Weak Is the Iranian Rial Today?

The scale of the rial’s depreciation is staggering. Here’s how it compares to other global currencies:

- 1 USD = ~1.4 million IRR (on the open market)

- 1 EUR = ~49,000 IRR

- 1 IRR = $0.0000010 USD (1 millionth of a dollar)

At these exchange rates, the rial has essentially lost almost all its purchasing power, especially when compared to major global currencies like the USD or EUR. To put it into perspective, 100,000 IRR is only worth about $0.10 USD. This is a clear indication of just how far the rial has fallen.

The Iranian Rial Hit Zero

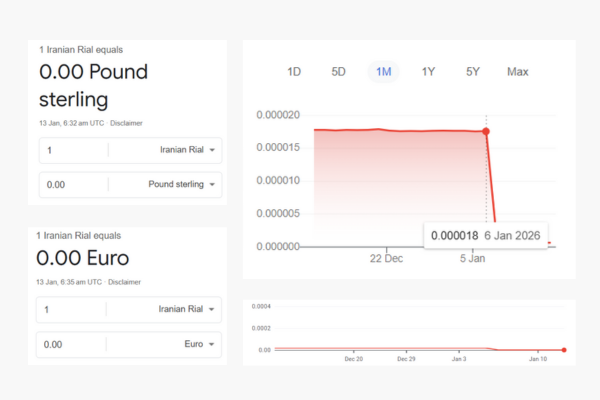

Interestingly, when you search for the exchange rate of 1 IRR on platforms like Google, it may appear as though 1 Iranian rial equals zero when converting to major currencies like EUR and GBP. This is because the rial’s value is so low that Google rounds it down to zero for easier display.

For example, 1 IRR might show as 0 EUR or 0 GBP, but when converted to currencies like the Japanese yen (JPY) or the Chinese yuan (CNY), you will see values like 0.00014 JPY or 0.00000 CNY for 1 IRR. While these values are still tiny, they demonstrate that the rial’s value is measurable, albeit extremely low.

This rounding effect shows how little the rial is worth on the global market, and how functionally worthless it has become in real-world exchanges.

What Does It Mean When Money Stops Working?

When a currency loses value rapidly, it stops serving its basic functions:

- Savings Evaporate: As inflation outpaces wages, savings lose value. Many Iranians turn to foreign currencies like USD or gold for protection.

- Prices Reset Weekly: In a hyperinflationary environment, prices change weekly, creating constant instability. Basic goods are often priced in foreign currencies, not rials.

- Temporary Medium of Exchange: Money becomes a temporary exchange rather than a store of wealth. Iranians spend rials immediately to avoid further devaluation.

What Is Being Done to Address the Crisis?

Iran has explored a few measures to mitigate the impact of the rial’s collapse. One of the most prominent attempts has been redenomination: removing zeros from the currency to make it seem more manageable.

However, this move is largely symbolic, as it doesn’t restore the rial’s underlying value. A 1,000,000 rial note might be redenominated as a 1 new toman note, but the actual purchasing power of the currency doesn’t improve.

Despite these efforts, the rial remains in a state of collapse, with little hope of immediate recovery unless Iran can secure economic reform, improve governance, and see a reduction in sanctions.

Is the Currency of Rial Worthless Now?

The currency of Iran hasn’t technically hit zero, but for many Iranians, it might as well have. With 1 IRR = $0.0000010 USD, and prices skyrocketing, the rial has become a symbol of economic despair. The causes of this collapse are multifaceted, involving sanctions, inflation, mismanagement, and structural economic weaknesses.

When money stops functioning as a store of value and medium of exchange, the entire economic system begins to unravel. For Iranians, the rial has gone from being a practical means of trade to a currency that measures despair more than value.

Until fundamental changes take place in both Iran’s internal economic policies and its relationships with the global community, the rial is unlikely to recover. For now, it remains a stark reminder of the destructive power of prolonged economic mismanagement and political isolation.

FAQ

The rial has collapsed due to sanctions, inflation, and economic mismanagement, leading to a dramatic loss in purchasing power.

As of early 2026, 1 USD equals around 1.4 million IRR, with the rial’s value so low it often rounds to zero in major currencies.

The rial hasn’t reached zero, but its value is so low ($0.0000010 USD per IRR) that it’s effectively worthless in everyday transactions.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.