Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomGreg Abel Net Worth: Berkshire Shares?

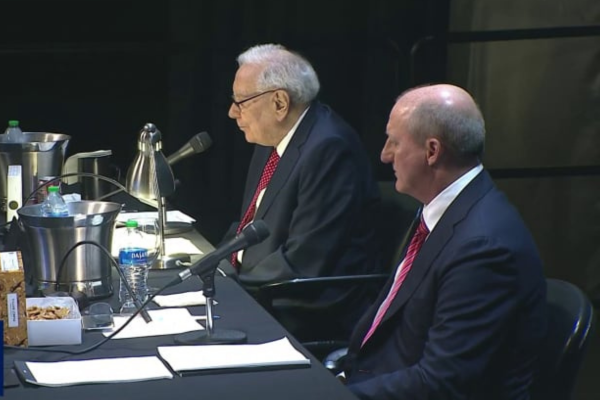

When Warren Buffett stepped down as CEO of Berkshire Hathaway at the end of 2025, attention immediately shifted to his successor: Greg Abel. Abel had been publicly identified as the next CEO for years, but Buffett’s official retirement has made two questions suddenly very practical for investors and shareholders:

- What is Greg Abel’s net worth?

- How does Buffett’s retirement change Berkshire Hathaway’s future?

In this article, we breakdown Greg Abel’s wealth, what drives it, and what the Buffett-to-Abel transition could mean for Berkshire going forward.

Greg Abel Net Worth: Is he a Billionaire?

Greg Abel’s net worth isn’t disclosed as a single official number, but credible reporting suggests he’s at or near billionaire status. This is largely due to:

- A major liquidity event involving Berkshire Hathaway Energy (BHE), and

- A substantial personal stake in Berkshire Hathaway stock.

For example, Reuters has reported Abel “could be a billionaire” after Berkshire bought out his BHE stake, and noted he owns roughly $170 million of Berkshire stock (valuation depends on share price at the time).

How Greg Abel Made His Money

1) Berkshire Hathaway Energy Stake Sale

The single largest public wealth event linked to greg abel net worth is Berkshire Hathaway Energy.

In 2022, Berkshire said its energy unit bought out Abel’s 1 percent stake for $870 million. Reuters reported the same amount.

That figure does not equal his net worth today because taxes and reinvestment choices matter. Still, it is one of the rare hard numbers that anchors most discussions of greg abel net worth.

2) Berkshire Hathaway Share Ownership

Abel also holds Berkshire shares.

Berkshire’s 2025 proxy statement lists Abel’s beneficial ownership (as of March 5, 2025) as 228 Class A shares and 2,363 Class B shares, with footnotes explaining certain holdings are through trusts/custodial arrangements.

Separately, Reuters has described Abel as holding nearly $170 million worth of Berkshire stock (again, value fluctuates with the stock).

Why this matters: Berkshire shareholders often care less about “celebrity net worth” and more about whether the CEO is financially aligned with owners. Abel’s stake makes him meaningfully exposed to Berkshire’s long-term performance.

3) Greg Abel’s Salary and Compensation at Berkshire

Abel’s annual pay is also significant, especially compared with Buffett’s famously modest CEO salary.

Berkshire’s 2025 proxy statement shows Abel received total compensation of $21,017,250 for 2024, including a $21,000,000 salary (with small additional amounts in “all other compensation”).

For context, the same proxy statement reports Buffett’s CEO compensation remained about $405,111 for 2024 (salary plus security-related costs).

Why People Search “Greg Abel Net Worth” Right Now

Greg Abel’s net worth became a breakout topic because Buffett’s retirement made Abel more than a “successor-in-waiting.” As of January 1, 2026, he is effectively the CEO responsible for:

- Berkshire’s operating empire (railroads, energy, manufacturing, consumer brands), and

- The company’s capital allocation decisions. Especially what to do with an enormous cash pile.

In other words, Abel’s wealth is part biography, part signal: investors want to understand who is now in charge.

How Buffett Retirement Can Affect Berkshire Hathaway In 2026

Leadership transitions rarely change Berkshire overnight. The bigger impact is what markets begin to price in as the new CEO’s priorities become clearer.

Capital Allocation Becomes The Central Story

The most important Berkshire question in 2026 is not personality. It is capital allocation.

The Wall Street Journal described Abel inheriting the stewardship of Berkshire while facing a defining decision around the company’s $358 billion cash pile.

Investors will watch whether Berkshire under Abel:

- pursues large acquisitions

- increases buybacks

- stays patient and waits for better pricing

- considers a dividend, which would be culturally notable for Berkshire

The Equity Portfolio May Get More Attention

Berkshire’s equity portfolio has long been associated with Buffett. Reuters noted uncertainty around future management of Berkshire’s $283.2 billion equity portfolio after leadership changes, adding another layer of scrutiny for 2026.

Even if Berkshire’s philosophy stays consistent, the market will pay attention to who makes the final calls and how the company communicates those decisions.

Operations Should Feel Familiar To Subsidiaries

On the operating side, Abel is not walking into a new organisation. Reuters reported Abel joined Berkshire through the MidAmerican acquisition and has overseen the non insurance businesses since 2018. That makes him a known quantity to Berkshire’s operating companies.

What Investors Will Watch Under Greg Abel In 2026

If you are linking Greg Abel net worth to Berkshire’s future, the practical investor checklist is straightforward.

Berkshire Cash Deployment

The market wants to see how Abel approaches a cash pile of this scale, especially if equity valuations remain elevated and acquisition opportunities stay scarce.

Buyback Discipline

Share repurchases are often a signal of management’s valuation framework. Any shift in buyback activity will be interpreted as a clue about how Abel views Berkshire’s intrinsic value.

Big Deal Behaviour

Berkshire historically avoided forced deals. The first large acquisition decision under Abel will be a defining moment, whether he acts or continues to wait.

Communication Style

Abel keeps a lower profile than Buffett. That does not have to be a negative, but shareholders will want clarity on capital allocation logic and on how Berkshire thinks about scale, risk, and return in a slower growth era.

Conclusion

The Greg Abel net worth is best viewed as a signal of how long Abel has been embedded in Berkshire’s leadership and how financially aligned he is with shareholders.

The buyout of his Berkshire Hathaway Energy stake, combined with meaningful Berkshire share ownership and disclosed CEO level pay, explains why his personal wealth is now part of the public conversation.

For Berkshire, the real story after Buffett’s retirement is not whether the culture changes overnight. It is whether Abel can deliver the same discipline on capital allocation, especially with a cash pile that has become a defining strategic challenge for 2026.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.