Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomPut Call Parity in Options Trading

Put call parity (PCP) is a fundamental concept in options trading that highlights the relationship between the prices of European put and call options. This principle is crucial for options traders as it ensures fair pricing and prevents arbitrage opportunities. In this article, we will explore what put call parity is, its underlying assumptions, practical applications, and its limitations in real-world trading.

What is Put Call Parity?

Put call parity is a financial concept that connects the prices of European put and call options that have the same underlying asset, strike price, and expiration date. Simply put, it shows that the price of a call option minus the price of a put option should equal the difference between the price of the underlying asset and the present value of the strike price.

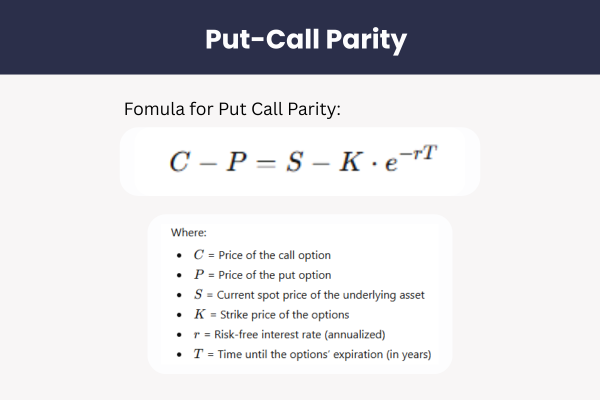

The formula for put call parity in the context of European options is:

Put call parity ensures that no arbitrage opportunities exist between these two options. If the relationship is violated, it signals a mispricing in the market, and traders can exploit this discrepancy for risk-free profit.

The Assumptions Behind Put Call Parity

For put call parity to hold true, several assumptions must be in place:

- European Options: The options must be European-style, meaning they can only be exercised at expiration, not before.

- No Dividends: The underlying asset should not pay any dividends. If it does, the formula must be adjusted to account for the dividends paid out during the life of the option.

- Frictionless Markets: There must be no transaction costs or market frictions (e.g., bid-ask spreads, slippage).

- Same Strike and Expiration: Both the put and call options must have the same strike price and expiration date.

These assumptions are important to understand, as they represent an idealized scenario. In real markets, there may be deviations due to factors such as transaction costs, dividends, and liquidity constraints.

Practical Applications of Put Call Parity

Put call parity has several practical applications for traders. One of the most significant uses is in the creation of synthetic positions. A synthetic position allows traders to replicate the payoff of an asset using other instruments. For example, a synthetic long position can be created by buying a call option and selling a put option with the same strike price and expiration. This combination mimics the payoff of owning the underlying asset, without actually purchasing the asset.

Another application of PCP is in hedging strategies. Traders who are long on a stock can use put options to hedge against downside risk. By understanding the relationship between put and call options, traders can ensure that the price of their options remains consistent with the price of the underlying asset.

Real-World Deviation and Limitations

While put call parity is a useful theoretical concept, it has limitations in real-world markets. The most significant deviations occur due to:

- Dividends and Carrying Costs: When an underlying asset pays dividends, the price of the put and call options must be adjusted to account for the present value of the dividends. Similarly, assets that incur storage or financing costs require adjustments to the formula.

- Transaction Costs and Liquidity Constraints: In real markets, there are transaction costs such as commissions, bid-ask spreads, and liquidity constraints, which can cause deviations from the theoretical parity.

- American Options: Unlike European options, American-style options can be exercised before the expiration date. This introduces additional factors to consider, such as the time value of the option and the possibility of early exercise.

- Market Frictions: Volatility, slippage, and other market frictions can cause small but significant deviations from the ideal put call parity relationship.

These real-world complexities mean that put call parity is more of a guiding principle than a strict rule. Traders should be aware of these limitations and adjust their strategies accordingly.

Arbitrage Opportunities and Put Call Parity

One of the key implications of put call parity is the potential for arbitrage opportunities. If the prices of put and call options deviate from the relationship outlined by put call parity, traders can take advantage of the mispricing to create risk-free profit.

For example:

- If the price of the call option is too high relative to the put option, a trader can sell the call and buy the put to profit from the price discrepancy.

- Conversely, if the price of the put option is too high relative to the call option, the trader can sell the put and buy the call.

Arbitrage opportunities like this arise when market frictions or mispricings occur, and they can be an attractive strategy for risk-free profits, especially in highly liquid markets.

Conclusion

Put call parity is an essential concept for traders who deal with options. It ensures that options prices remain fair and consistent, preventing arbitrage opportunities and enabling traders to create synthetic positions. However, real-world market conditions such as dividends, transaction costs, and liquidity can cause deviations from the idealized formula. Traders should be aware of these limitations and adjust their strategies accordingly.

By understanding and applying the principles of put call parity, traders can make more informed decisions, implement effective hedging strategies, and potentially identify arbitrage opportunities in the market. Whether you’re a beginner or an experienced options trader, mastering put call parity is crucial for navigating the world of options trading efficiently.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.