Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomPCE Showdown: Markets at a Crossroad Ahead of the Fed

Daily Market Insights – December 5, 2025, Brought to you by Ultima Markets.

Today’s market attention is firmly on the delayed September PCE Price Index—the Federal Reserve’s preferred gauge of inflation—which is set to dominate market moves following this week’s mixed labor market signals.

The Mixed Labor Signal

Extreme uncertainty has been fueled by contradictory labor data, making the PCE release a critical reference point for gauging the Fed’s policy outlook ahead of the December 10 meeting:

- Weak ADP: The ADP report showed a contraction of 32,000 private payrolls, reinforcing expectations for a December rate cut.

- Positive Initial Jobless Claims: Initial Jobless Claims fell to a multi-year low of 191,000, highlighting that the labor market remains historically tight and resilient.

- Weak Challenger Job Cuts: U.S. employers announced 71,321 job cuts in November 2025—the highest for the month since 2022—marking the eighth month this year where job cuts exceeded the prior year.

Taken together, these reports present a mixed labor outlook. While the low jobless claims point to resilience, the weak ADP and elevated Challenger layoffs underscore underlying labor-market concerns.

Inflation Showdown: PCE Data Details

The September PCE report is the last major piece of evidence the Fed will have before its December meeting, making it the ultimate test of the economy’s health despite the data being delayed. Markets are particularly focused on the Core PCE Price Index, which excludes volatile food and energy components:

- Core PCE YoY: 2.9% (unchanged from prior month)

- Core PCE MoM: 0.2% (unchanged from prior month)

For the Fed to proceed confidently with a December rate cut, the Core PCE trend must show moderation below 2.9%. Any upside surprise could undermine current market expectations, potentially trigger a sharp reassessment of rate-cut bets and impact the U.S. Dollar, equities, and risk assets.

US Dollar in Binary Risk

The US Dollar Index (DXY) is now coiled for a major breakout, with its near-term direction highly dependent on the upcoming September PCE Price Index and, ultimately, the Fed’s policy decision next week.

USDX, H4 Chart Analysis | Ultima Markets MT5

- Softer PCE (<2.9%) – This would reinforce the Fed’s dovish pivot and the case for supporting the weak labor market. The Dollar Index is expected to break below 99.00, accelerating the bearish trend toward 98.00.

- Hotter-than-expected PCE (>2.9%) – Persistent inflation concerns would force the Fed to adopt a more cautious stance on easing. The US Dollar could spike sharply above 99.00, potentially reversing the week’s losses ahead of the FOMC meeting.

Other Key Events: Canada’s Job Report

The PCE data is undoubtedly the focus of the day in financial markets, but aside from that, the Canada Employment Change and Unemployment Rate are set to dominate the focus for the Canadian Dollar (CAD).

- Job Data: The Canadian labor market is expected to show modest growth, with employment change forecasted at 0–10K jobs and the unemployment rate projected to tick up slightly to 7% from 6.9%.

- BoC Context: The Bank of Canada (BoC) has less policy flexibility than the Fed. A surprisingly strong report (e.g., +30K jobs) could push traders to price out near-term BoC rate cuts, boosting the attractiveness of the CAD.

- USD/CAD Implication: A stronger-than-expected jobs report would reinforce the broader anti-Dollar trend seen this week, putting additional downside pressure on USD/CAD heading into the weekend.

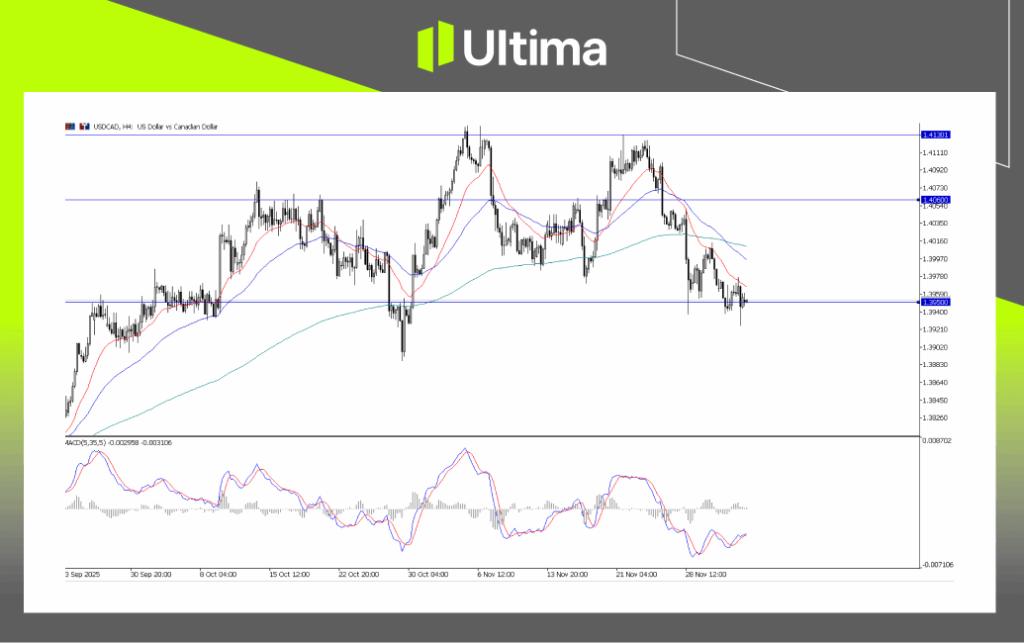

USDCAD, H4 Chart | Ultima Markets MT5

Technically, USDCAD has formed a recent double-top pattern. A decisive break below the 1.3950 level would open the door for a bearish extension, potentially accelerating downside momentum toward the next support zones.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server