Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Policy Pause & Valuation Fears: Sentiment Shifts to Caution

Today’s market opens on a cautious note, reflecting the fallout from last week’s sharp equity correction and the growing likelihood that the Federal Reserve may pause its easing cycle in December. Investor sentiment has shifted decisively from earlier “Risk-On” optimism toward a more defensive “Risk-Off” stance.

Fed Policy Shift: Cut Expectations Drop

The most significant driver behind recent repositioning is the rapid decline in expectations for a December rate cut.

According to the CME FedWatch Tool, the probability of a 25bps cut has collapsed from nearly 95% a month ago to roughly a coin-flip (around 50%) now.

Several Fed officials delivered distinctly hawkish remarks last week, including Cleveland Fed President Beth Hammack, Dallas Fed President Lorie Logan, and Kansas City Fed President Jeffrey Schmid:

- Hammack: “It’s not obvious that monetary policy should be doing more right now.

- Logan: Another cut would be “hard to support” unless inflation declines more convincingly or the labor market weakens further.

- Schmid: Dissenting against the October cut, he warned that further easing would not resolve structural labor issues driven by technology and immigration but would risk inflation credibility.

Meanwhile, Chair Jerome Powell remains cautiously neutral, emphasizing a data-dependent approach following the October cut. In contrast, Governor Stephen Miran (a dovish dissenter) continues to argue that larger cuts are still warranted.

Market Implication: The reduced likelihood of additional stimulus is a structural headwind for risk assets and continues to support the U.S. Dollar, while pressuring high-valuation and high-beta market segments.

Equities & Risk: Correction Signal Weakness

Last week’s steep equity sell-off confirmed deeper valuation vulnerability and technical fragility.

- Valuation Jitters: The Nasdaq’s >2% decline was driven by renewed fears of excessive pricing in AI-linked stocks. Major tech names such as Nvidia and AMD faced heavy selling, reinforcing the market’s sensitivity to profit-taking.

- Risk Aversion Returns: With conviction fading, investors are rotating out of speculative tech into defensive sectors. This shift is likely to persist until major earnings (including Nvidia this Wednesday) or incoming macro data restore confidence.

Market Awaits Data: The market’s next direction hinges entirely on the delayed U.S. economic data (NFP, CPI) expected to be released soon now that the shutdown has ended. Until then, traders are likely to remain on the sidelines.

US Dollar Outlook: 99-Levels Holds

The U.S. Dollar Index (USDX) is currently displaying a tug-of-war dynamic. On one side, hawkish Fed rhetoric and weakness in risk assets are supporting safe-haven demand for the Dollar. On the other, uncertainty surrounding the timing and impact of delayed economic data is limiting upside momentum.

For now, the Fed’s hawkish tone remains the dominant force, keeping the Dollar’s structural uptrend intact.

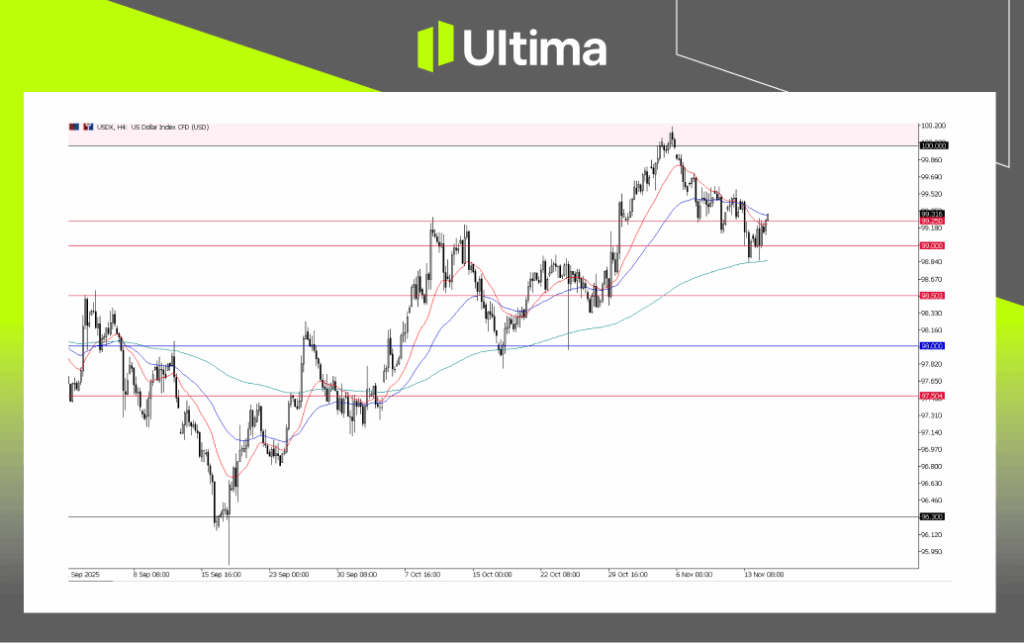

USDX, H4 Chart | Ultima Market MT5

Technically, the Dollar continues to find support above the 99.00 level, which has reinforced its ongoing uptrend. As long as this level holds, the near-term outlook still favors a move back toward 100.00.

Key Events: Tech Earnings & Economic Data

Monday’s session is expected to be relatively quiet with no major releases, but the broader market is entering a high-stakes week dominated by both economic data and a pivotal corporate earnings event that could shape sentiment across the tech sector and broader risk assets.

- Nvidia Earnings (Wednesday, Nov 19): Nvidia’s Q3 FY2026 earnings, scheduled for release after the U.S. market close, is the most closely watched event of the week.

- Impact: A strong “beat and raise” outcome could reignite the tech rally. However, any disappointment—particularly in guidance—would reinforce valuation concerns and potentially trigger a deeper sell-off across the Nasdaq.

Meanwhile, the long-delayed NFP and CPI reports are also expected to be released this week, injecting additional macro uncertainty into the policy outlook and overall market direction.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server