Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomAre SMCI Earnings at Risk? Why the Stock Fell

Super Micro Computer has been one of the market’s most talked-about AI hardware names, but SMCI stock has entered a sharp correction. After a series of disappointing results and a high-profile investor exit, the company is facing renewed scrutiny over the stability of SMCI earnings.

With the stock falling 5.9%, then 7.44%, and now more than 33% over the past month, investors are asking: What caused the decline? Are SMCI earnings at risk?

Here’s a clear breakdown of the factors behind the sell-off.

SMCI Stock Fell Sharply After Earnings Miss

The decline started with a weaker-than-expected earnings report.

Key numbers:

- Revenue: $5.02B (vs. $6–$7B guidance)

- YoY change: –15.5%

- EPS: $0.35 (vs. $0.46 expected)

- Last year’s EPS: $0.73

This marked the sharpest slowdown since the start of the AI boom. With both revenue and margins slipping, the market quickly reassessed expectations for SMCI earnings.

This earnings miss triggered the first leg of the sell-off in SMCI stock.

Margins Are Compressing

Falling margins are another major reason SMCI earnings are under pressure.

SMCI’s gross margin has declined for four straight quarters, driven by:

- Higher GPU and component costs

- More expensive design upgrades

- Integration delays

- Intense pricing pressure from Dell, HPE, and Lenovo

- Ramp-up costs for new AI rack platforms

Management also expects margins to drop another 300 basis points next quarter.

For a company valued for high growth, margin compression directly weakens confidence in SMCI earnings.

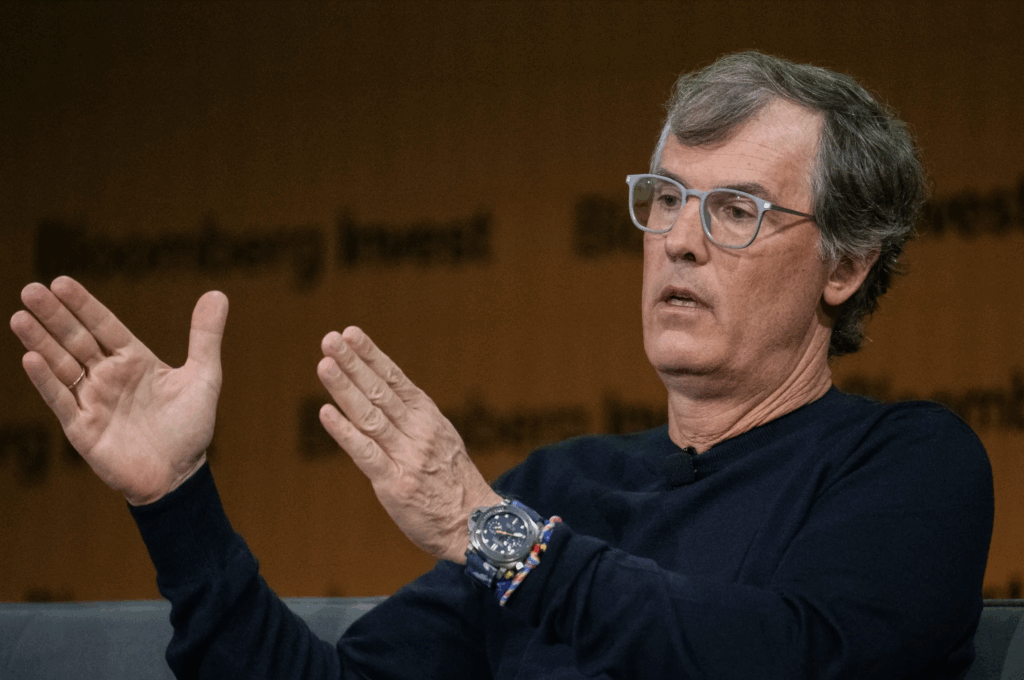

Philippe Laffont’s Exit Sparked Additional Selling

Sentiment took another hit when news broke that Philippe Laffont’s Coatue Management fully exited its SMCI position in Q2. His exit sparked an immediate 5.9% morning drop, followed by a 7.44% intraday decline.

Laffont is known for his focus on profitability and sustainable growth. His exit highlighted the same concerns investors have been tracking on SMCI’s declining margins, slowing revenue and rising competitive pressure.

Large funds often move early, and his decision reinforced the idea that SMCI’s earnings trajectory has weakened. Investors viewed his move as confirmation that near-term SMCI earnings may struggle.

Analysts Turn More Cautious on the SMCI stock

Following the earnings miss, multiple banks lowered their outlook for SMCI stock:

- Goldman Sachs: $34 (Sell)

- Mizuho: $45 (Neutral)

- Needham: $51 (Buy)

- Raymond James: $50 (Outperform)

Overall, the stock now holds a Hold consensus, reflecting the split between short-term caution and long-term optimism for SMCI earnings.

Insider Selling Added More Pressure

In the past 90 days:

- Insiders sold 90,000 shares

- The SVP and CFO both reduced their positions

This selling came at a time when SMCI stock was already falling, reinforcing concerns that management expects near-term challenges in SMCI earnings.

AI Valuation Cooling Is Hurting High-Growth Names

Beyond company-specific challenges, the broader AI sector has also cooled. The Nasdaq recently slipped as investors took profits from high-growth names after a strong early-year run.

Even companies reporting record results such as Palantir saw their shares drop, showing the market has become more selective.

When sentiment shifts away from high-valuation growth stocks, companies with declining margins tend to experience sharper pullbacks. High-valuation names like the SMCI stock fits this pattern, adding another layer of downward pressure on the SMCI earnings outlook.

Long-Term Demand for AI Infrastructure Is Still Strong

While short-term earnings risks are clear, the long-term outlook is more optimistic. SMCI continues to benefit from surging demand for AI hardware, which now accounts for more than three-quarters of its revenue.

Several positive catalysts stand out:

- SMCI has received over $13 billion in orders tied to Nvidia’s Blackwell Ultra GB300 GPU platform

- Management expects Q2 revenue to rebound sharply to $10–$11 billion

- The company raised its full-year FY2026 revenue outlook from $33 billion to at least $36 billion

- New design wins, larger AI rack orders, and expanded manufacturing capacity (including in Malaysia) position SMCI for stronger scale efficiency

This growth pipeline suggests that once short-term margin pressure eases, SMCI earnings could stabilize and potentially accelerate again.

Are SMCI Earnings Truly at Risk?

Short-Term: Yes

Because:

- Revenue is slowing

- Margins are falling

- Guidance is cautious

- Competition is intensifying

- Analysts reduced targets

- SMCI stock fell 33% in a month

- Institutional and insider selling increased

Long-Term: The outlook is still strong

Because:

- AI server demand remains robust

- New product cycles support higher revenue

- Large Blackwell orders offer visibility

- Expanded manufacturing boosts scale efficiency

- FY2026 guidance suggests a major rebound

To sum, short-term pressure on SMCI earnings is clear, but long-term growth remains intact.

Conclusion

SMCI is experiencing its most challenging period since the AI hardware boom began. Slowing revenue, falling margins, and cautious sentiment have placed short-term pressure on SMCI earnings, and recent declines show that investors are reassessing risk.

However, SMCI still sits at the center of one of the fastest-growing markets in technology. With billions in new AI infrastructure orders, expanded manufacturing, and a stronger product road map for 2026, the company has a credible path to reaccelerate growth.

For now, the stock reflects a market caught between short-term caution and long-term optimism. The next few quarters will determine which narrative wins.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.