Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomU.S. Shutdown Resolution Clears Way; Dollar Awaits Decisive Move

Daily Market Insights – November 12, 2025, Brought to you by Ultima Markets.

Shutdown Progress: Resolution Imminent

Today’s market narrative is dominated by a decisive easing of U.S. political risk, as the longest federal government shutdown in history (Day 42) is finally nearing its end — marking a major win for global risk sentiment.

The Senate successfully passed a bipartisan funding bill earlier this week, and the measure now heads to the House of Representatives for a final vote later today (Wednesday, November 12, U.S. time). With President Trump signaling his full support, the government’s reopening now appears imminent.

The removal of this major political overhang has sharply boosted risk appetite. U.S. stock futures extended gains for a second straight session on Tuesday, while safe-haven demand for the Japanese yen continued to fade. However, gold remained resilient, outperforming alongside a softer U.S. Dollar.

Data Blackout Ends: What’s Next?

With the government set to reopen, market attention will rapidly shift from politics to the flood of delayed economic data — a wave of reports that will immediately challenge the current market and policy outlook.

- The Coming Flood: Federal statistical agencies, shuttered for weeks, are now racing to publish backlogged releases. This will unleash a barrage of key economic indicators that were originally meant to guide policymakers through the last two months.

- Expected Release Schedule: Based on historical precedent, the Bureau of Labor Statistics (BLS) typically releases the delayed Non-Farm Payrolls (NFP) report within two to five business days after reopening. That means the September jobs data could hit markets as early as the end of this week — or more likely, early next week.

Crucially, some reports — particularly the October CPI — may be of compromised accuracy, as government workers were unable to collect sufficient pricing data during the shutdown. This potential data distortion will complicate the Federal Reserve’s policy assessment.

The rapid influx of data will immediately test the Fed’s stance. Markets are watching closely to see whether the reports reveal clear labor market weakness (supporting a potential December rate cut) or sticky inflation (which could delay easing). Chair Powell is expected to remain cautious until the data is fully digested.

FX Outlook: Dollar Consolidation and Event Risk Ahead

The anticipated reopening of the U.S. government — and the coming deluge of delayed data — is setting up the Dollar for a volatile trading phase.

The greenback is consolidating within a narrow range, supported by expectations that the Fed will stay on hold in the near term. While the US Dollar Index (USDX) continues to struggle around the 100.00 psychological level, its underlying technical structure remains constructive.

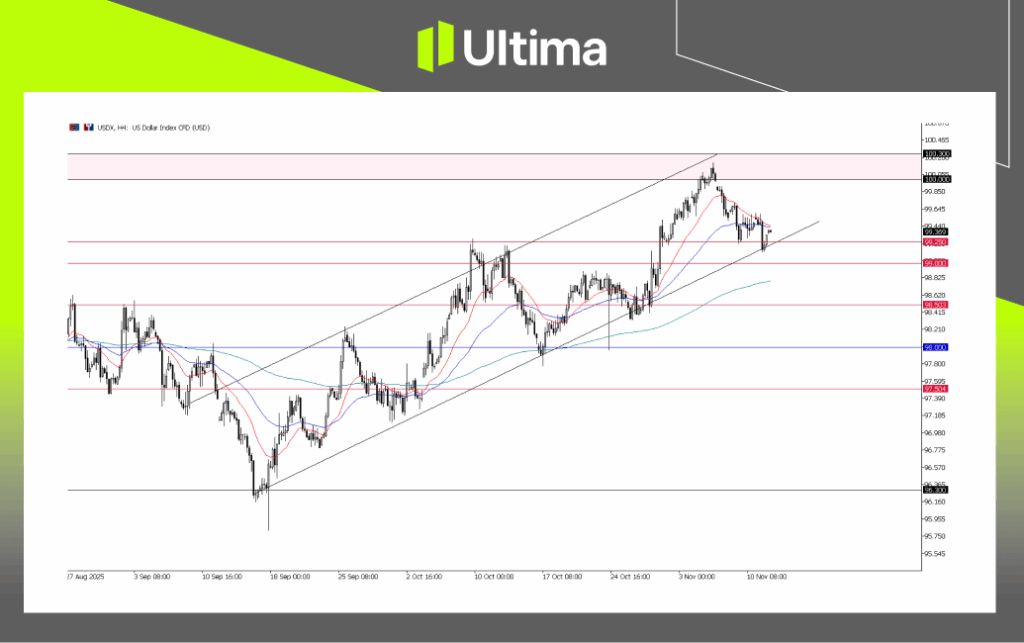

USDX, H4 Chart | Ultima Market MT5

The recent uptrend in the U.S. Dollar remains technically intact, with 100.00 acting as strong resistance and 99.00 serving as key support. As traders await the data releases for direction, the Dollar is likely to remain in bullish consolidation mode above the 99.00 zone — with potential for renewed upside still potential toward the 100-mark.

EURUSD: Pressure Below 1.1600

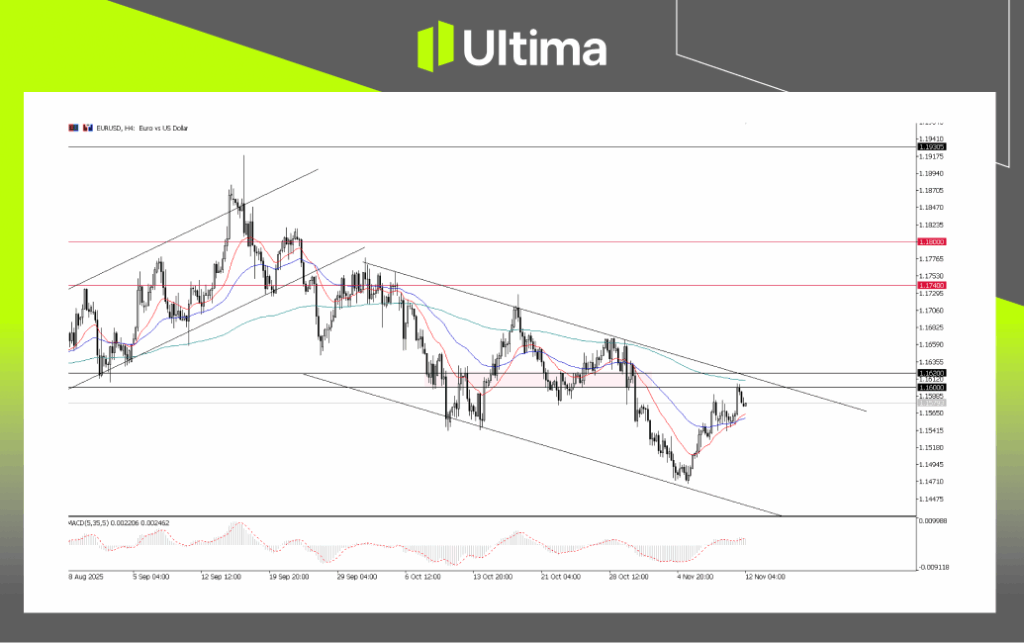

EURUSD, H4 Chart | Ultima Market MT5

Technically, EUR/USD continues to trade within a well-defined downtrend channel, with recent price action suggesting a potential leg lower:

- The pair remains under pressure below the key psychological level of 1.1600, which now acts as a resistance-turned-cap.

- With markets in a holding pattern ahead of key U.S. data releases, EUR/USD is likely to stay sensitive to technical dynamics, with any failure to regain momentum above 1.1600 reinforcing the bearish bias.

GBP/USD: Double Top Reversal Intact

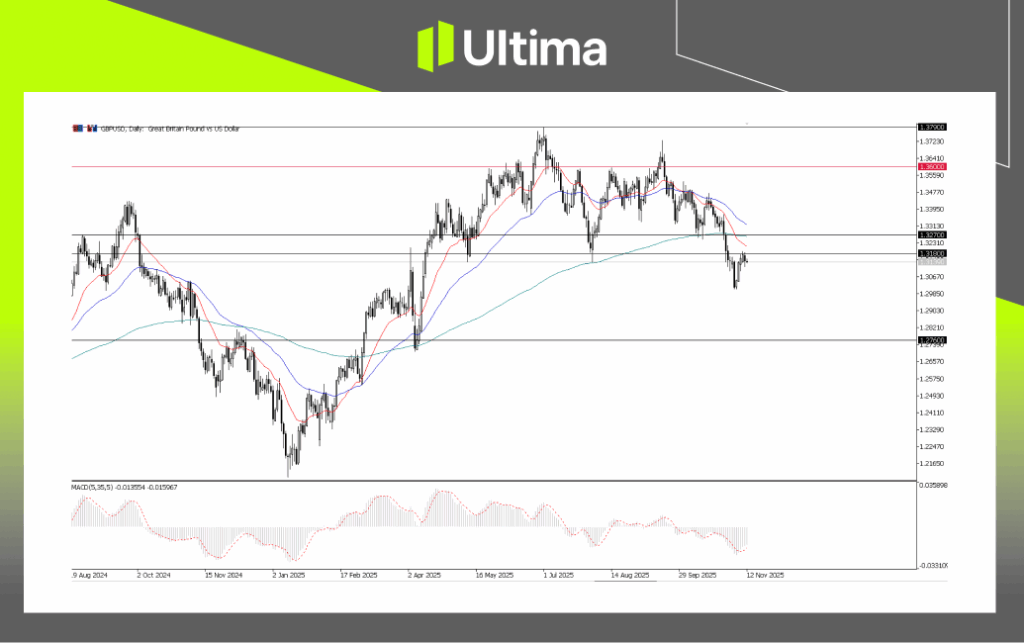

GBPUSD, Daily Chart | Ultima Market MT5

The recent double-top reversal pattern in GBP/USD remains valid following the confirmed break below the 1.3200–1.3180 neckline. Although a short-term rebound has occurred, the pair continues to trade below the neckline, keeping the bearish structure intact.

Outlook: The Bank of England’s dovish hold and the UK’s mixed economic and inflation outlook continue to weigh on sentiment. Unless the pair reclaims 1.3200 decisively, downside pressure is likely to persist in the near term.

Daily Market Takeaways

The imminent end of the U.S. government shutdown marks a key turning point for global markets—removing a major source of uncertainty while reopening the flow of crucial economic data. However, this transition may be far from smooth. The upcoming “data flood” will play a decisive role in shaping the Federal Reserve’s near-term policy outlook and could spark volatility across the U.S. Dollar and broader risk assets.

For now, the Dollar’s outlook remains uncertain, with traders likely to stay in a wait-and-see mode ahead of key data releases. The 99.00–100.00 range on the USDX remains the critical technical zone, and how the market reacts to the returning data will determine whether the Dollar resumes its uptrend or enters a deeper correction.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server