Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomThe Klaviyo IPO: A Promising Tech Stock

Klaviyo, the marketing automation platform that has revolutionized the way e-commerce brands engage with their customers, made waves in the tech market with its Initial Public Offering (IPO). Since the Klaviyo IPO, it has captured significant attention, and for good reason. The company is on a robust growth trajectory, with impressive performance metrics that position it as a key player in the marketing technology industry.

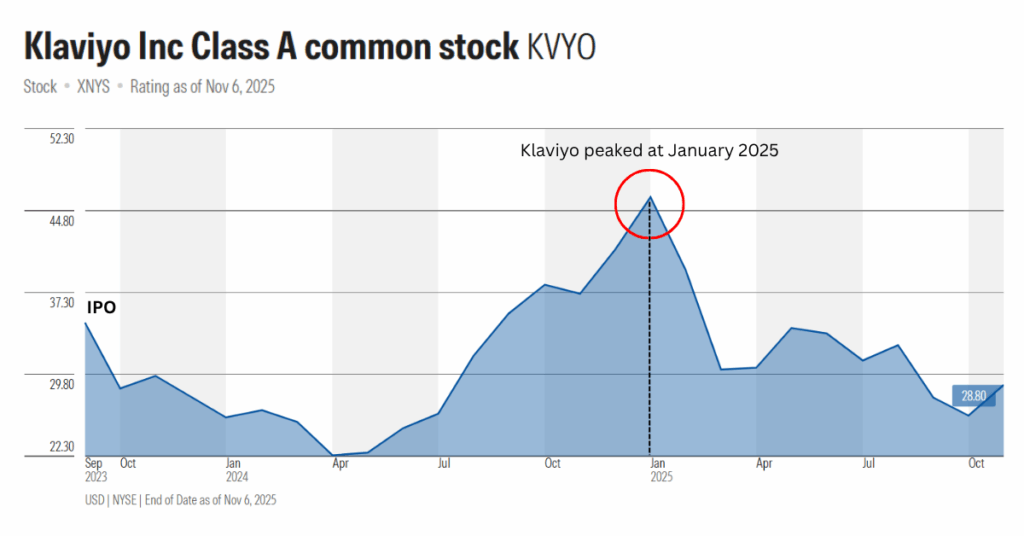

Despite its post-IPO success, the stock has experienced fluctuations, including a notable peak in January 2025, followed by a pullback. In this article, we explore the Klaviyo IPO, examining the company’s performance, the reasons for its post-peak decline, and whether Klaviyo still represents a promising investment in 2025.

Klaviyo IPO: Key Details and Financial Performance

On September 20, 2023, Klaviyo launched its IPO at $30 per share. The Klaviyo IPO successfully raised $576 million through the sale of 19.2 million shares. This valuation placed the company at $9.2 billion at the time of its public debut. The IPO was well-timed, as Klaviyo’s strong financials and growth outlook made it an attractive investment even in a cautiously recovering tech IPO market.

Post Klaviyo IPO: How Did It Perform?

Since the Klaviyo IPO, the company has demonstrated impressive financial growth. Below, we break down the key metrics and factors driving the company’s post-IPO performance.

Revenue Growth and Key Metrics

Since the Klaviyo IPO, the company has demonstrated strong financial performance. Klaviyo’s revenue for 2024 reached an impressive $937 million, marking a 34% year-over-year increase. The company also saw a solid performance in Q4 2024, with $270 million in revenue, up by 34% compared to the previous year.

One of the critical metrics that investors closely monitor is dollar-based net revenue retention (DBNR), which stood at 108% for Q4 2024. This metric indicates that existing customers are not only staying with the platform but also increasing their spend, further validating the effectiveness of Klaviyo’s tools in driving customer engagement and retention.

Growing Customer Base and Market Expansion

Klaviyo’s customer base continues to expand at a rapid pace. The platform now supports over 167,000 brands, with 10,000+ new customers added in Q4 alone, a 17% year-over-year increase. This growth speaks to the increasing reliance on Klaviyo’s services by businesses looking to enhance their customer relationships through personalized marketing automation.

Additionally, Klaviyo is actively expanding its global footprint. Revenue in the EMEA (Europe, Middle East, and Africa) region grew by 49% in Q4 2024, signaling its successful push into international markets.

Strategic Partnerships and Industry Relevance

Klaviyo’s growth isn’t limited to its expanding customer base and revenue. The company has been making strategic moves to solidify its position as a leader in marketing automation. In 2024, Klaviyo entered into a key partnership with WooCommerce, becoming the preferred marketing automation partner for WooCommerce users. This partnership allows Klaviyo to tap into the vast ecosystem of e-commerce merchants who rely on WooCommerce to run their online stores, expanding its reach and enhancing its integration into the broader e-commerce landscape.

These partnerships and integrations further elevate Klaviyo’s market position, providing added value to its customers while also driving revenue growth.

Investor Confidence and Market Sentiment

Klaviyo’s IPO has been met with strong investor confidence, as evidenced by its 30 hedge fund holders, a clear indication of institutional interest in the company. The stock has received positive sentiment from analysts, with its growth potential being recognized across the financial community. Klaviyo’s consistent revenue growth and high customer retention make it an attractive stock for long-term investors.

Despite the market uncertainty surrounding the broader IPO environment, the company has demonstrated that it is resilient and well-positioned to thrive. As market conditions improve, Klaviyo is expected to continue to attract investor interest, potentially becoming one of the top IPO stocks to watch in 2025.

Why Did Klaviyo’s Stock Peak in January 2025?

Klaviyo’s stock surged to new highs in January 2025, largely driven by strong earnings, positive market sentiment, and a technical breakout. The company reported impressive earnings growth of 67% in adjusted EPS, as well as continued revenue gains. Additionally, the stock’s breakout past key technical levels attracted more buyers, contributing to the upward momentum.

The Pullback After January 2025

However, after reaching a peak, Klaviyo’s stock experienced a pullback, which is a common occurrence in the stock market, especially for companies that experience sharp increases in price. There are several reasons why this drop happened:

- Profit-Taking: After a significant rise, investors often sell to lock in profits, leading to a temporary decline in the stock price.

- Volatility in Growth Stocks: As a relatively new public company, Klaviyo’s stock remains volatile and prone to fluctuations, particularly in an uncertain market environment.

- Market Conditions: Broader economic factors, such as changes in interest rates, market sentiment, and tech stock performance, may have also impacted Klaviyo’s stock price after its peak.

Is Klaviyo Still a Buy After the Drop?

While the drop in Klaviyo’s stock may seem concerning, it’s essential to evaluate the company’s fundamentals and growth prospects before making any conclusions. Here’s why Klaviyo could still represent a buying opportunity:

- Strong Revenue Growth: The company’s 34% year-over-year increase in revenue in 2024 suggests that its core business is thriving.

- High Customer Retention: The 108% DBNR indicates that existing customers are not only staying with Klaviyo but are also spending more, which is a positive sign of long-term business sustainability.

- Valuation: If Klaviyo’s stock price has fallen but remains in line with its strong fundamentals, the drop could offer a more attractive entry point for long-term investors, especially if the company continues to expand internationally and form strategic partnerships.

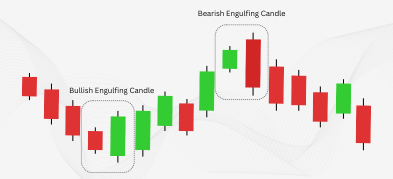

- Technical Support Levels: If the stock finds support at key levels, this could provide an opportunity for a rebound. Investors often look for these technical setups as buying signals.

- Institutional Support: Klaviyo has strong hedge fund backing, which further supports its growth potential.

What’s Next for Klaviyo?

Looking forward, Klaviyo’s growth is expected to continue, particularly in the international markets and through strategic partnerships like its collaboration with WooCommerce. The company’s innovative approach to marketing automation and its ongoing ability to attract new customers and increase spend from existing ones could position it well for the future.

As Klaviyo continues to expand its customer base, grow its revenue, and build on strategic partnerships, the potential for long-term growth remains high. For investors looking at the post-IPO performance of Klaviyo, the recent dip could present an opportunity to buy the dip and invest in a company with strong fundamentals at a more attractive price.

Conclusion

Despite the post-peak drop in Klaviyo’s stock, the company’s strong financials, impressive revenue growth, and high customer retention suggest that it could still be a strong long-term investment.

As with any stock, it’s crucial for investors to carefully assess the company’s performance, valuation, and market conditions before making a decision. However, based on its consistent revenue growth, strong customer retention, and strategic partnerships, Klaviyo could still be a top pick for those looking to invest in the future of marketing automation.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.