Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Understanding Short Covering in Trading

In the world of trading, short covering plays a crucial role in price movements, particularly when traders are forced to buy back shares to close their positions. While closely related to short selling, short covering is a distinct process that can have significant implications on the market. In this article, we will explore what short covering is, how it works, and why it matters to traders and investors alike.

What Is Short Covering?

Short covering is the process of buying back borrowed shares that were initially sold short to close out a short position. When a trader sells short, they borrow shares from a broker, sell them on the open market, and hope to buy them back at a lower price later to return to the lender.

However, if the price of the asset rises instead of falling, the trader is forced to buy back the shares at a higher price to limit their losses. This act of buying back the shares is called short covering.

While short selling and short covering are closely related and often mistaken for the same thing, they are distinct actions:

- Short selling is when a trader borrows shares and sells them, betting that the price will decrease.

- Short covering is when a trader buys back those shares to close the short position, typically due to rising prices or to lock in profits.

How Does Short Covering Work?

The Short Selling Process

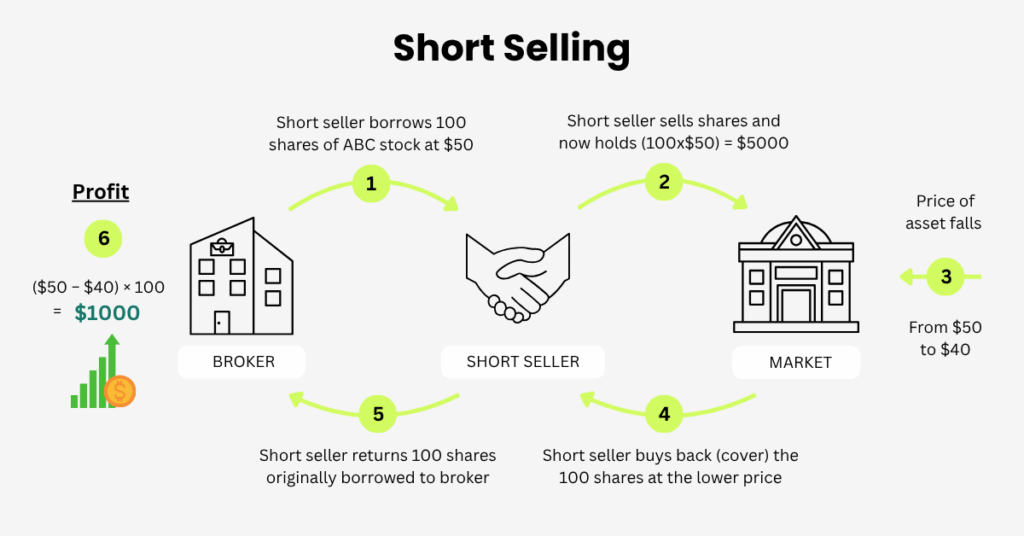

To understand short covering, it’s important to first grasp the short selling process. When a trader short sells a stock, they borrow shares from a broker and sell them at the current market price. The trader’s goal is to buy back the shares at a lower price later, returning them to the lender and keeping the difference as profit.

For example, imagine a trader short sells 100 shares of a stock at $50 each. If the price falls to $40, the trader can buy the shares back for $40 each, return them to the broker, and pocket the $10 per share difference as profit.

The Need for Short Covering

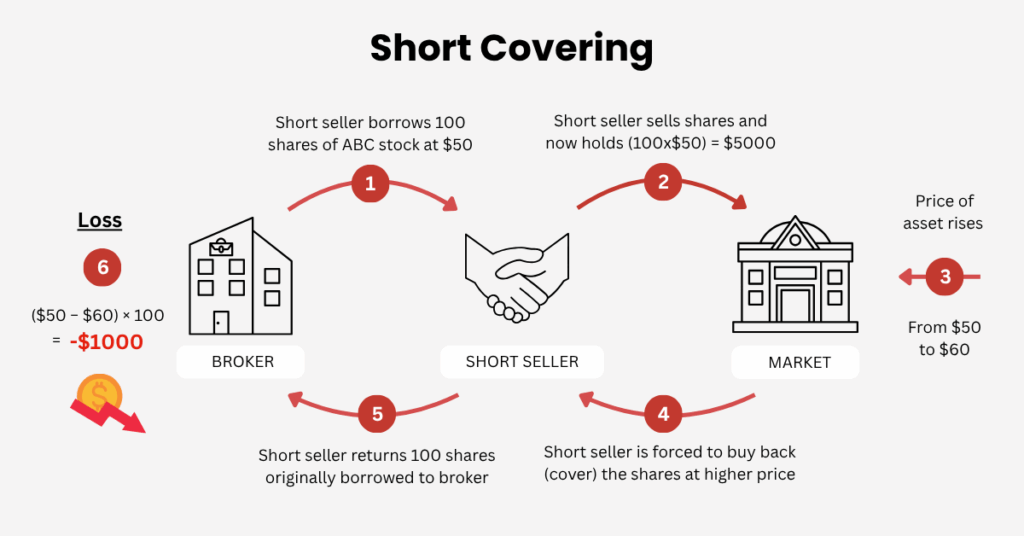

Short covering happens when the price of the asset rises unexpectedly, and the trader must buy back the shares at a higher price to close the position. This could be due to a variety of factors, such as positive news about the company or the overall market, causing the asset’s price to increase.

For instance, if the stock the trader shorted rises to $60 instead of dropping, they will be forced to buy back the shares at a higher price to limit their losses. If they don’t cover their position in time, their losses could grow further.

Short Covering vs. Short Squeeze: What’s the Difference?

While short selling and short covering are closely related, they are often confused with short squeezes. A short squeeze occurs when a heavily shorted stock sees a sharp increase in its price, forcing a large number of short sellers to cover their positions simultaneously. This can create a self-reinforcing cycle where rising prices prompt more short covering, pushing the price even higher in a short amount of time.

A short squeeze typically happens when the asset experiences a sudden, unexpected price increase, often due to positive news or market sentiment. The more short sellers that cover their positions, the more the price can rise, creating a “feedback loop.”

Why Does Short Covering Matter?

Short covering can have several significant effects on the market and trading behavior:

1. Price Volatility

When a large number of short sellers begin covering their positions, it can lead to upward pressure on the price of the asset. As traders buy back shares to close their short positions, this added demand can drive the price higher, leading to increased volatility in the market. This phenomenon can be especially pronounced in stocks that are heavily shorted, as the act of covering can escalate the price increase.

2. Market Sentiment

Short covering can signal a shift in market sentiment. When traders cover their short positions, it may indicate that they no longer believe the asset’s price will fall. If short covering is widespread, it could signal increased confidence in the stock, potentially attracting long traders and investors looking to capitalize on the momentum.

3. Profit Opportunities for Long Traders

For long traders, this strategy can present profit opportunities. If a heavily shorted stock begins to rise, it could be an indication that a short squeeze is imminent. Traders who spot this could consider going long on the stock, anticipating further price increases.

4. Risk for Short Sellers

While short covering can present opportunities for long traders, it poses significant risks for short sellers. If the price of the asset rises unexpectedly, traders who have short positions may face substantial losses. If they are forced to cover at higher prices, their losses can escalate quickly, especially in volatile or unpredictable markets.

How to Spot Potential Short Covering

Traders can look for several key indicators to spot potential short covering opportunities:

- High Short Interest: A high short interest ratio indicates that a large number of shares are being borrowed and sold short. If the price starts to rise unexpectedly, this could lead to widespread short covering, causing the price to rise even more.

- Rising Prices and Volume: If a stock with high short interest begins to see upward price movement and increased trading volume, it could signal that short covering is occurring. Traders should watch for significant price changes and volume spikes as potential indicators.

- Short Interest Ratio: This ratio shows how many days it would take for all short positions to be covered, based on average daily trading volume. A high ratio indicates that it may take a long time for all shorts to cover, creating the potential for a squeeze.

- Positive News or Earnings Reports: Positive company news, earnings surprises, or favorable market conditions can trigger short covering. Traders who shorted the stock may need to cover their positions in light of new developments that suggest the asset’s value is increasing.

Conclusion

Short covering plays a vital role in the trading ecosystem, particularly for traders who engage in short selling. While it is a necessary part of managing a short position, it can also have broader market implications, including increased price volatility and shifts in market sentiment.

For long traders, recognizing this pattern as a potential signal of rising prices can provide valuable profit opportunities. However, this strategy also represents a significant risk for short sellers, particularly if prices rise unexpectedly and force them to cover their positions at a loss.

By understanding how short covering works and learning to spot potential opportunities, traders can better navigate the complexities of the market and make more informed decisions. As with any trading strategy, effective risk management is key to capitalizing while minimizing potential losses.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.