Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomAnkr Price Prediction for 2025 to 2030

Ankr is a decentralized infrastructure platform that powers some of the largest blockchain projects in the world. By providing high-performance node operations and staking solutions, Ankr has become an essential part of the Web3 ecosystem. As the demand for decentralized finance (DeFi) and blockchain services continues to rise, the Ankr price prediction for 2025 to 2030 has garnered significant attention.

In this article, we explore Ankr’s price prediction, factors that could influence its value, and the key drivers behind its potential price growth in the coming years.

What is Ankr?

Founded in 2019, Ankr offers a suite of decentralized infrastructure services, including staking, RPC (Remote Procedure Call) services, node hosting, and more. The platform has powered some of the most significant players in the blockchain space, including Microsoft, Binance, and Polygon, thanks to its scalable and efficient infrastructure solutions. Ankr’s ability to support over 75 blockchains and provide services such as blockchain creation and Web3 APIs has made it one of the leading infrastructure providers in the space.

Ankr’s platform is vital for Web3 development, and it offers seamless staking experiences, boasting over 83 million total value locked (TVL). These capabilities position Ankr to benefit from the increasing demand for blockchain services. As the demand for decentralized services grows, the Ankr price prediction remains a key topic of discussion.

Ankr’s Strong Market Position and Partnerships

Ankr is a trusted partner for some of the biggest names in crypto, including Polygon, Binance, and Avalanche. This demonstrates its credibility and the importance of its infrastructure in maintaining blockchain networks’ stability and scalability. These high-profile partnerships significantly enhance Ankr’s visibility and help cement its role as a critical infrastructure provider for DeFi and other blockchain applications.

Microsoft, Binance, and 10Cent are just a few of the major players using Ankr’s services. Ankr’s global network spans across 30 regions, handling over 8 billion RPC requests every month. This scalability and reliability are key factors that contribute to Ankr’s long-term growth potential, which is reflected in the strong institutional trust it enjoys.

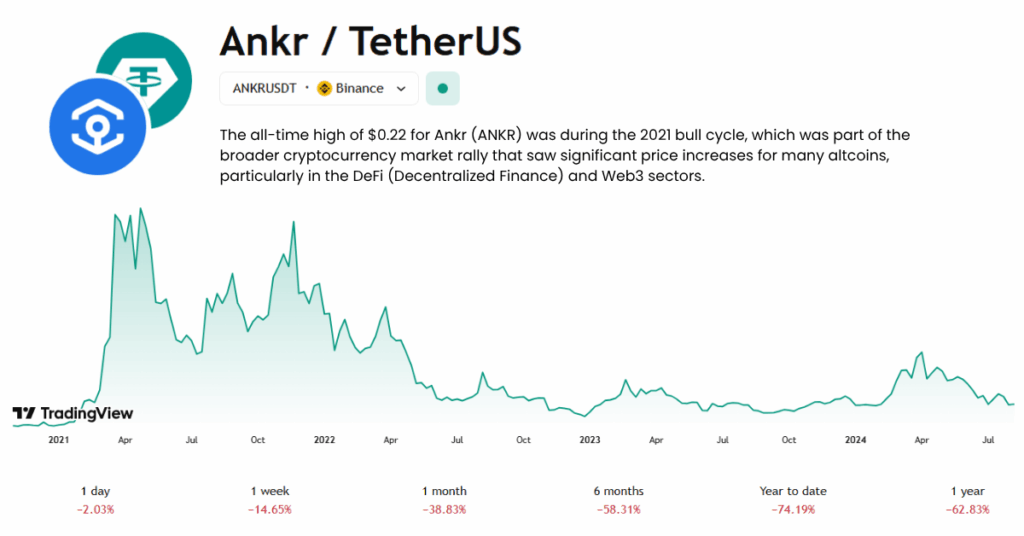

Ankr’s Price History and Previous Highs

Ankr’s performance during the last bull cycle is noteworthy. The token reached an all-time high of $0.22 during the previous crypto market boom. This high represents a 100x increase from its early days when it traded at just 0.0017 cents. Despite the volatility, Ankr has shown it has the potential to deliver strong returns during bullish market phases. However, the current market cycle may be more moderate, which impacts the likelihood of reaching previous highs in the short term.

What Could Drive Ankr’s Price in 2025?

- Blockchain Adoption and DeFi GrowthAs the adoption of blockchain and decentralized finance grows, Ankr stands to benefit. The platform’s staking and infrastructure services are key components of many blockchain ecosystems, and with more projects turning to decentralized solutions, Ankr’s services will likely see increased demand. This demand could result in upward pressure on Ankr’s price.

- Strategic Partnerships

Ankr’s alliances with giants like Polygon, Avalanche, and Binance are important for driving growth. These partnerships not only give Ankr exposure but also provide new opportunities for scaling its infrastructure services. Ankr’s ability to integrate seamlessly with other major networks could lead to a surge in adoption, further boosting its token value. - Technological Innovations

Ankr is investing in new infrastructure solutions, such as DePIN (decentralized physical infrastructure networks), which could further expand its market reach. The success of these innovations will likely be a key factor in Ankr’s price trajectory, as it opens up new revenue streams and opportunities in the rapidly growing Web3 ecosystem. - Regulatory Environment

Regulatory clarity for blockchain platforms is still evolving. If positive regulations emerge, it could bolster Ankr’s position in the market. However, any regulatory setbacks could pose risks, making it important for Ankr to adapt to changing legal landscapes.

Ankr Price Predictions for 2025 and Beyond

Short-Term Outlook for 2025

The Ankr price prediction for the remainder of 2025 suggests that the token will see minimal price movement, with a forecast of $0.008929 by December 2025. Predictions suggest a 2.17% increase, reaching a price of $0.008929 by December 2025. Despite this limited growth, the token’s price could fluctuate between support levels at $0.007579 and resistance levels at $0.009163.

In the short term, market sentiment is bearish, with a Fear & Greed Index reading of 27 (indicating fear in the market). This suggests that while the market is currently cautious, any major positive developments could push Ankr toward the higher end of its predicted range.

Long-Term Outlook from 2026–2030

Looking ahead, the Ankr price prediction for the long-term remains optimistic, especially if the platform continues to expand and innovate. Ankr’s ability to scale its infrastructure and maintain strategic partnerships will be pivotal to its price growth. By 2026, analysts expect Ankr to see minimal growth, hovering around $0.008929. However, if the broader blockchain space grows and Ankr expands its user base and service offerings, its price could reach $0.05–$0.06 in a more optimistic scenario by the end of the decade.

In the long term (2030), Ankr’s price could potentially surge, assuming the company continues to innovate and its platform becomes central to the DeFi and blockchain space. A price of $0.10 or more is possible if Ankr succeeds in its expansion strategy and becomes a core infrastructure player.

Can Ankr Reach $1?

While Ankr has shown strong growth in previous bull cycles, reaching $1 is highly unlikely in the foreseeable future. Analysts believe that Ankr would need to achieve 11,343% growth to reach $1, a feat that seems improbable without massive market changes or new revolutionary products. Based on the current outlook, Ankr’s highest expected price in 2025 is around $0.008929.

Technical Analysis and Key Levels

Based on the latest technical analysis, Ankr’s 50-day SMA and 200-day SMA indicate downward pressure, with resistance at $0.009163 and support at $0.007579. The RSI (Relative Strength Index) of 33.84 indicates a neutral market, suggesting that Ankr is neither overbought nor oversold, but it may face resistance before making significant gains.

Conclusion

Ankr’s position in the Web3 infrastructure market is strong, backed by key partnerships, technological advancements, and adoption in the blockchain space. While the price predictions for 2025 are conservative, with modest growth expected, Ankr’s long-term outlook remains positive, especially if it continues to scale its services and capture a larger share of the DeFi market.

However, as with any cryptocurrency, market volatility and regulatory changes will play a significant role in shaping Ankr’s price. Investors should be aware of both the upside potential and the risks inherent in the crypto market when considering Ankr as a part of their portfolio.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.