Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomBoE Decision in Spotlight: Pound Awaits Policy Signal, Dollar Strength Persists

Daily Market Insights – November 6, 2025, Brought to you by Ultima Market

Bank of England Decision in Focus

The Bank of England’s (BoE) policy decision today is one of the key market events of the week, as it marks the final major central bank announcement of this cycle. The outcome is expected to directly influence the British Pound (GBP) and set the tone for upcoming sessions.

Markets are deeply divided over the decision — between holding rates steady at 4.0% or cutting by 25 bps to 3.75%. The BoE faces a difficult balancing act: inflation remains stubbornly high at 3.8% (September), while weak GDP growth increases pressure to ease policy.

- Hold at 4.0%: This outcome would signal that the BoE remains more concerned about persistent inflation than short-term growth. The Pound could strengthen modestly in the near term.

- 25 bps Cut: A rate cut would confirm the BoE’s pivot toward supporting a slowing economy. However, this would likely trigger a sharp decline in GBPUSD as rate differentials widen against the Pound.

Beyond the rate decision, markets will pay close attention to the vote split, new economic projections, and the tone of the Monetary Policy Report — all of which will shape expectations for the BoE’s December and Q1 2026 meetings.

At this stage, even a “dovish hold” (holding rates but signaling readiness to cut) could still weigh on GBPUSD sentiment.

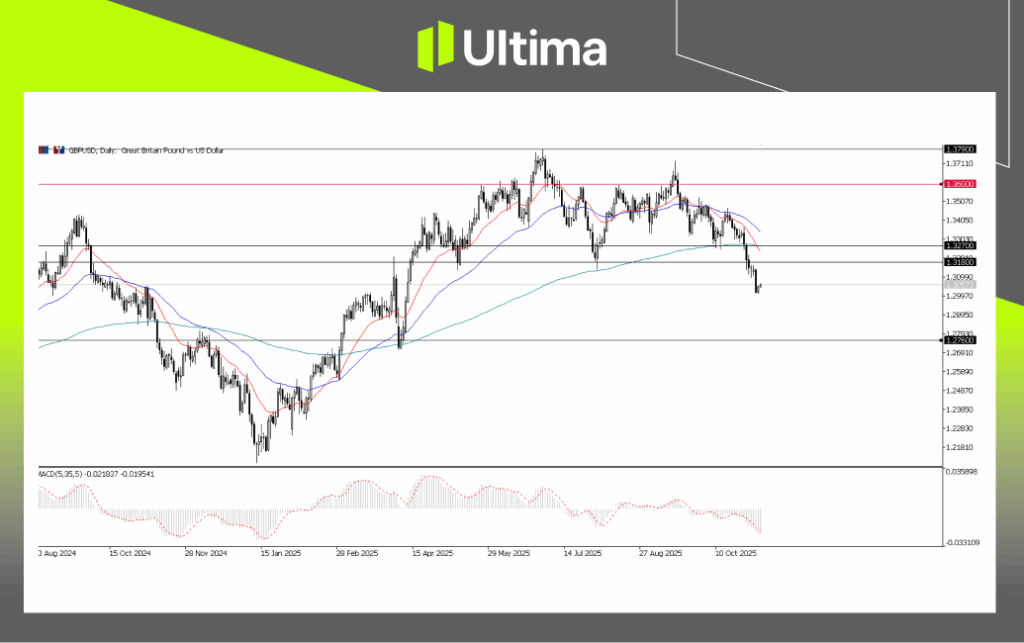

GBPUSD Technical Outlook

GBPUSD, Daily Chart | Ultima Market MT5

GBPUSD has broken below the key 1.3180 support, marking a seven-month low and confirming a bearish breakout.

Technically, the pair remains vulnerable as long as it fails to reclaim the 1.3180–1.3200 zone — a critical psychological resistance area.

- Below 1.3180: Downside bias dominates, with potential targets toward 1.3050 and 1.2950.

- Above 1.3200: Only a sustained rebound above this zone would neutralize the current bearish bias.

Macro Outlook

If the BoE opts to hold rates, a short-term GBP rebound is possible. However, the bigger picture remains fragile, with the economy caught between stubborn inflation and sluggish growth — a scenario edging toward “stagflation”.

Even in the event of a temporary bounce, the broader directional bias remains neutral to bearish, as the BoE is widely expected to begin an easing cycle in the coming months. Volatility is likely to spike following the announcement, but sustained GBP strength appears limited.

U.S. Dollar Dominance Remains

The U.S. Dollar Index (DXY) continues to trade near recent highs, underpinned by persistent safe-haven demand and lingering optimism following last week’s “hawkish cut” by the Federal Reserve. The central bank’s cautious tone signaled that monetary easing will proceed gradually, reinforcing the dollar’s relative strength against its peers.

Meanwhile, the October ADP National Employment Report offered mixed but mildly supportive data for the greenback:

- Jobs Added: 42,000 (vs. market expectations of 22,000)

- Previous Month: Revised loss of 29,000

The data suggest that while the U.S. labor market remains softening, it is not collapsing as feared after September’s contraction. This modest rebound helped reaffirm the Fed’s stance that further rate cuts will depend on incoming data rather than a preset path.

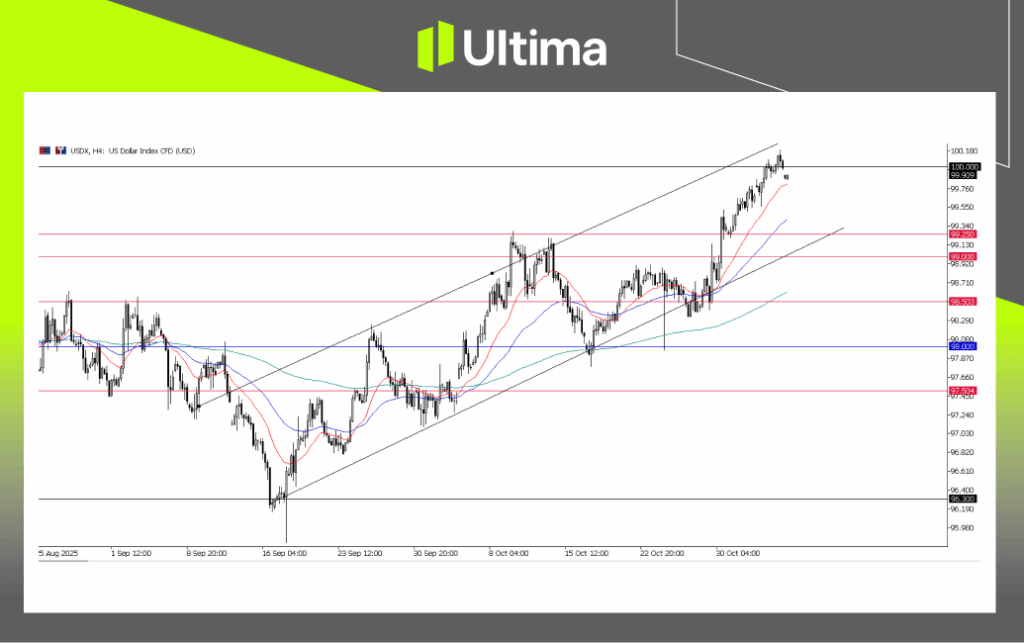

USDX, H4 Chart | Ultima Market MT5

On the technical front, the US Dollar Index briefly pushed above the 100.00 level before retracing slightly, showing signs of short-term resistance. However, the broader structure remains bullish, supported by ongoing policy divergence and risk-aversion flows.

For GBPUSD, this dollar resilience implies that any short-term rebound could still present selling opportunities within a broader downtrend — a “sell-the-rally” environment likely to persist unless the BoE delivers a decisive policy surprise.

Quick Market Updates

Apart from the primary focus, here are updates on key market events:

- US Shutdown Breaks Record: The U.S. government shutdown is now the longest on record—day 36–increasing the immediate economic drag and uncertainty.

- Gold Stabilizes, But Lacks Momentum: Following the massive safe-haven unwinding after the U.S.-China truce, Gold is now finding a technical floor but remains fundamentally challenged.

- U.S. Stock Recovery in Focus: After the recent sharp valuation-driven correction, the U.S. stock market is showing signs of stabilizing ahead of today’s key labor data.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server