Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomGlobal Equities Under Pressure as Carry Trade Unwind Tempered Sentiment

Daily Market Insights – November 5, 2025, brought to you by Ultima Markets

Today’s market narrative is defined by a significant global correction in equity markets, fueled by mounting concern overstretched valuations in the tech sector, coupled with the latest policy signals from the Fed and the prolonged U.S. political impasse.

Global Equity Correction: Valuation Jitters

U.S. and Asian markets experienced a sharp sell-off overnight, marking the steepest decline in global equities in recent months.

The correction is primarily driven by fears over stretched valuations in the Tech and AI sectors. Warnings from top Wall Street executives about the risk of a market pullback have amplified investor caution.

The Nasdaq 100 futures are leading the decline after high-profile stocks failed to impress investors with their latest forecasts. Specifically, disappointment over outlooks from companies like Advanced Micro Devices (AMD) and Super Micro Computer Inc. caused widespread pressure. Tech giants such as Nvidia and Microsoft also experienced sharp losses, confirming the broad retreat from the market’s most expensive sector.

Macro Headwinds: Record Breaking US Shutdown

The uncertainty is compounded by the political crisis in Washington, coupled with the policy outlook from Fed.

- Record Duration: The U.S. Government Shutdown officially surpassed the previous record overnight (entering its 35th day), becoming the longest full government shutdown in U.S. history.

- Economic Impact: The lack of government funding is a substantial drag on Q4 GDP growth and has completely paralyzed official data releases, leaving the market highly vulnerable to rumors and speculative trading.

- Fed Pressure: The continuation of the shutdown reinforces the need for the Fed to maintain a cautious stance due to the data blackout.

Outlook Summary: The current sharp sell-off suggests a necessary cooling period after an aggressive AI-driven rally. Until the market receives clarity from either a major political breakthrough in Washington or a definitive upward guidance from tech leaders (like Nvidia’s upcoming earnings), sustained volatility and a defensive posture are likely to prevail.

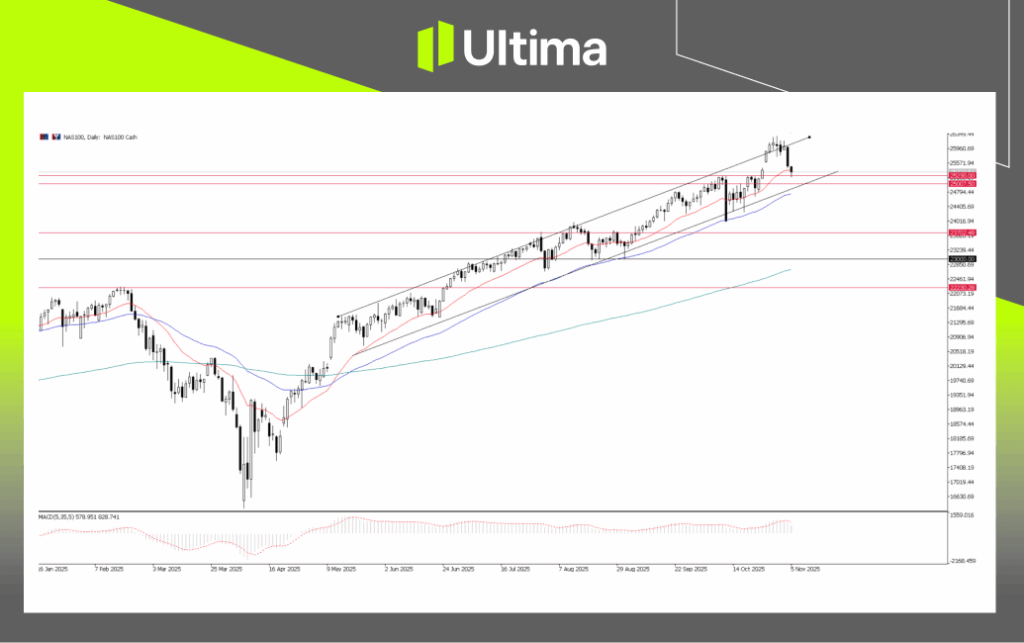

NAS100 Index, Daily Chart | Ultima Market MT5

Despite recent weakness, the Nasdaq 100’s broader uptrend remains intact, as the current pullback continues to trade within the established ascending channel. The overall structure still favors a bullish bias unless key supports are breached.

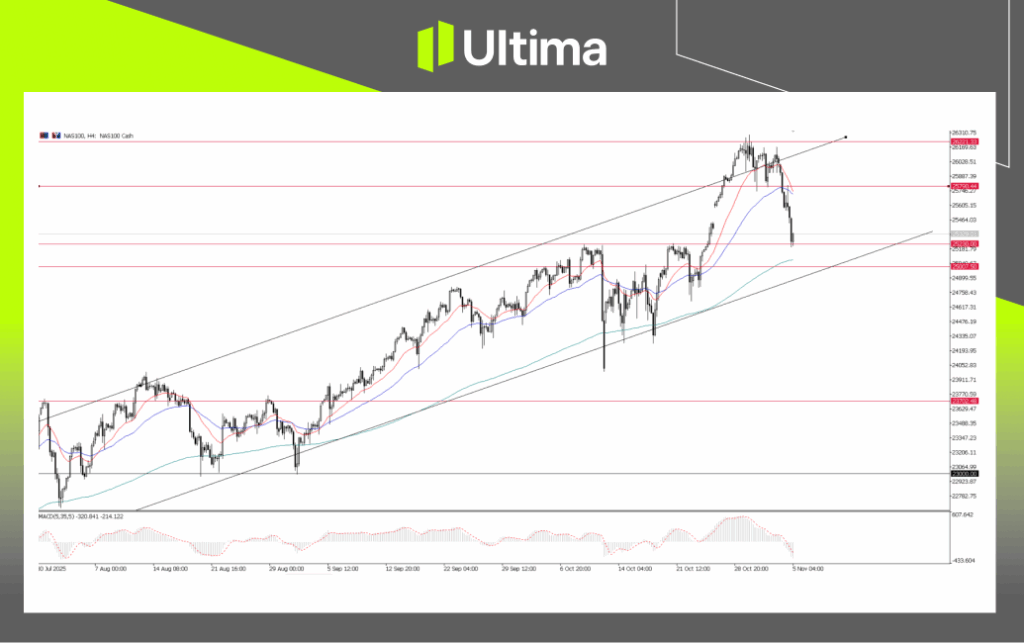

NAS100 Index, 4-H Chart | Ultima Market MT5

In the near term, however, a deeper corrective move appears likely. The index has struggled to regain momentum after breaking below the 25,800 level, now acting as resistance.

Key support lies around 25,000 and along the lower trend channel. A successful hold at this area would preserve the broader uptrend structure.

Conversely, a decisive break down below 25,000—or beneath the channel support—could trigger a more extended corrective phase, particularly if current macro headwinds intensify.

Yen Regains Safe-Haven Appeal as Carry Trades Unwind

The Japanese Yen (JPY) emerged as one of the strongest performers in the FX market yesterday, reclaiming its traditional safe-haven status as global equity markets faced a broad sell-off.

Following the sharp decline across U.S. and Asian equities, the Yen led G10 gains, with USD/JPY reversing sharply from its recent multi-month high near 153.40.

The move reflects a pronounced risk-off shift in global sentiment. The surge in JPY highlights a classic unwind of carry trades, where investors reverse positions funded by low-yielding currencies like the Yen. This dynamic not only strengthens JPY but also tends to amplify global risk-off moves, as leveraged positions in higher-yield assets are rapidly unwound.

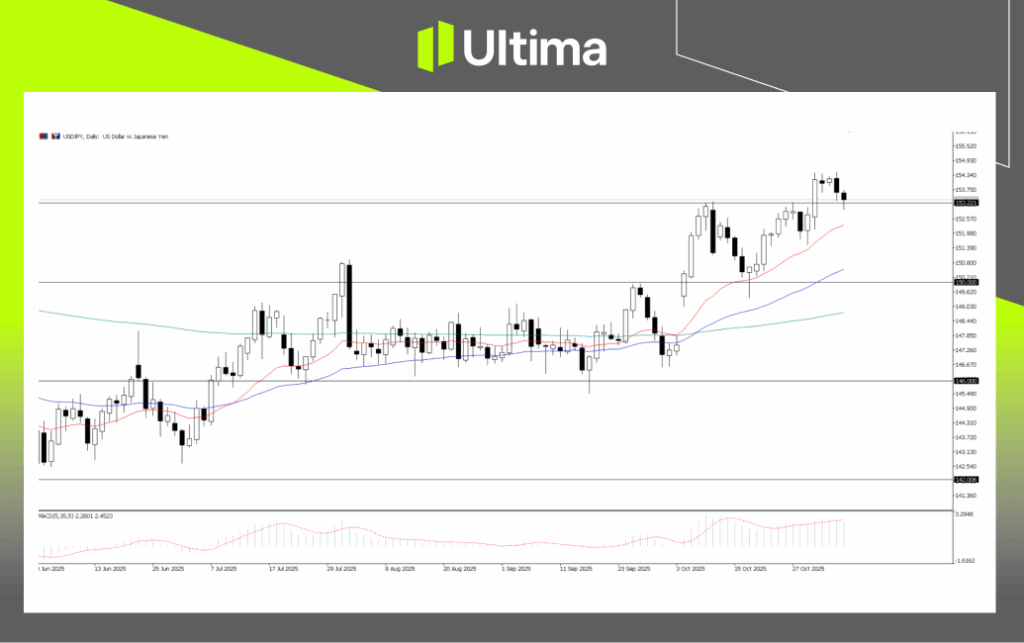

USDJPY, H4 Chart | Source: Ultima Market MT5

The Yen’s strength against the Dollar — despite the latter’s broad resilience — highlights notable momentum in JPY demand, which is also reflected across other Yen pairs.

In recent months, the Yen had struggled to benefit even during equity market pullbacks. However, the latest surge signals a potential shift in market dynamics, suggesting that the current phase of carry trade unwinding may be deeper and more prolonged. This could also imply that the ongoing equity correction and broader risk-off sentiment may intensify if the trend continues.

Daily Market Outlook

Global markets are facing renewed pressure as equity valuations come under scrutiny and investors rotate out of high-risk assets. The recent correction—led by the technology sector—marks a healthy but necessary pause following months of relentless gains.

While the broader uptrend in major indices such as the Nasdaq 100 remains technically intact, the combination of stretched valuations, a prolonged U.S. government shutdown, and tighter liquidity conditions from the Fed suggests near-term volatility will persist.

At the same time, the sharp rebound in the Japanese Yen points to a potential unwinding of carry trades, a development that often precedes broader equity pullbacks. If this dynamic continues, it could signal a deeper correction phase in risk assets before the next leg higher can resume.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server