Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomHow Selling Puts Works? Why Traders Use It?

When most traders think about options, they picture buying calls for upside or buying puts for protection. But selling puts is a powerful and often misunderstood strategy that can generate steady income or help you buy quality stocks at a lower price.

Let’s break down what selling puts means, how it works, and when to use it with practical examples and real market context.

What Is Selling Puts?

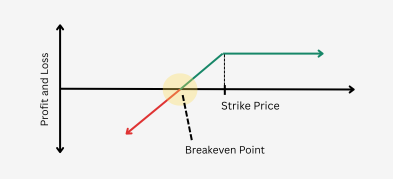

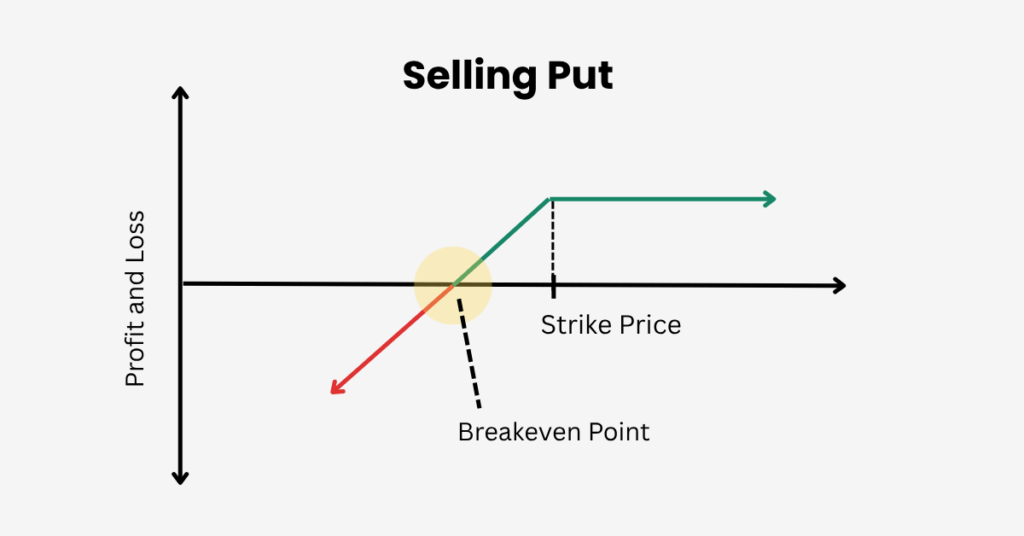

Selling puts means writing a contract that gives another trader the right, but not the obligation, to sell you a stock at a specific price (the strike price) before the contract expires.

In return, you receive an upfront premium. This is your reward for taking on the obligation. If the stock stays above the strike until expiration, the option expires worthless, and you keep the premium as profit.

Essentially, selling puts is a bullish-to-neutral strategy. You benefit when the stock stays stable or rises, and even if it dips slightly, you might still buy it at a discount.

How Does Selling Puts Work?

Here’s a step-by-step breakdown of how selling puts actually functions:

- Choose a Stock

Pick a company you’re comfortable owning if the price drops. - Select a Strike Price and Expiry Date

Choose a strike below the current price (an out-of-the-money put) for a balance of safety and income. - Sell the Put and Collect the Premium

The premium is credited upfront. This is your potential income from the trade. - Wait for Expiry

- If the stock stays above the strike, the put expires worthless, and you keep the premium.

- If it drops below, you may be assigned and must buy the shares at the strike. Your effective purchase price = strike − premium.

Example

Suppose Company ABC trades at $50. You sell a $45 put for $2 per share.

- If ABC closes above $45, you keep the $200 premium.

- If it drops below $45, you buy 100 shares at $45. Your effective cost is $43 ($45 − $2), which is a 14% discount from the original price.

Why Traders Sell Puts

Selling puts serves two main purposes: generating income and acquiring shares at a discount.

1. Premium Income

In quiet or slightly bullish markets, most puts expire worthless, allowing traders to collect steady income.

2. Buy Stocks at a Discount

Instead of placing a limit order to buy a stock, you can sell a put at that price and get paid while you wait. If assigned, you buy the stock cheaper.

3. Capture the Volatility Premium

Studies show that implied volatility (what options are priced at) is often higher than realized volatility (what actually happens).

This means sellers consistently earn a “volatility premium”, like collecting insurance payments from investors seeking protection.

According to Quantified Strategies, short-term put writing on broad indices often captures this edge over time, though frequent trading increases costs.

Historical Context: How Selling Puts Has Performed

Institutional data backs up the effectiveness of systematic put-selling strategies:

- The Cboe S&P 500 PutWrite Index (PUT) which simulates selling one-month, at-the-money puts on the S&P 500 has shown smaller drawdowns and lower volatility than holding the S&P 500 outright.

- A Cboe study (2006–2018) found that the PUT index generated average annual gross premiums of around 37% while still maintaining less downside exposure than equities.

- This demonstrates how consistent premium collection can smooth returns, especially when markets move sideways or gradually upward.

While these numbers are historical and not guaranteed, they highlight the long-term viability of selling puts as an income and entry strategy.

Risks and Benefits of Selling Puts

Risks of Selling Puts

Despite its benefits, the strategy carries meaningful risks.

- Downside Exposure: If the stock collapses, you could face large losses since you’re obligated to buy at the strike.

- Limited Upside: Maximum profit equals the premium received. Gains stop there.

- Early Assignment: American-style options can be exercised anytime before expiration, especially near dividend dates.

- Capital or Margin Requirement:

- Cash-Secured Puts require full cash coverage for potential assignment. It is safer but capital-heavy.

- Margin Puts allow leverage but amplify losses and margin call risk.

Always assume assignment is possible and sell puts only on stocks you’d genuinely hold long-term.

When Selling Puts Works Best

Selling puts shines in stable or mildly bullish markets, where prices hover or drift upward.

It can also perform well in moderate volatility environments. Higher volatility inflates option premiums means you get paid more, but it also raises assignment probability.

However, avoid selling puts before earnings announcements or major policy decisions, when sudden moves can quickly wipe out profits.

Before You Pick a Strike

You have seen the benefits of selling puts. The next step is choosing which put is worth selling. Do a quick sense check first. Focus on a quality stock, avoid near term earnings, and confirm there is good liquidity. Once that filter is done, use one simple yardstick to compare your choices.

Compare Choices with Yield to Strike

What it is

YTS = Premium ÷ Strike Price. It shows the income you earn for the obligation you take.

Why it matters

A higher Yield to Strike usually means more income and a higher chance of assignment. A lower Yield to Strike is safer but pays less.

How to use it

Shortlist two or three out of the money strikes after checking events and liquidity. Compare their Yield to Strike and pick the balance that fits your risk appetite.

Quick example

Stock at 50. Sell the 45 put for 2. Yield to Strike equals 2 divided by 45 which is 4.44 percent for the life of the option. Compare this with nearby strikes and choose the one that matches your plan.

Tips and Misconceptions

Tips for Beginners

- Start with Cash-Secured Puts: safer and simpler.

- Sell OTM Strikes: 10–20% below current price for a good risk/reward balance.

- Trade Quality Stocks: large-cap, liquid names are easier to manage.

- Watch Volatility: sell when implied volatility is above average but not extreme.

- Have a Plan: decide when to take profits, roll, or accept assignment.

Common Misconceptions

“Selling puts is risk-free.”

False. The stock can drop sharply, creating substantial losses.

“You’ll always be assigned.”

Not true. Many puts expire worthless. Especially if sold well out of the money.

“It’s the same as buying the stock.”

Not exactly. Selling puts includes time and volatility factors that can shift results significantly.

Key Takeaway

As option volumes grow, more traders and institutions use put-writing to collect steady premiums or to enter positions at better prices. The method is disciplined and systematic when you select quality names, respect events, and size positions sensibly.

Selling puts can be an effective way to earn steady income or accumulate shares at a discount.

Start small, stay cash-secured, and focus on quality names.

Used responsibly, it’s not a gamble. It’s a patient, systematic way to get paid while waiting for opportunity.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.