Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomNetflix Stock Splits: Timeline and Impact

If you are researching Netflix stock splits, here is the short version. Netflix has split its stock three times so far2004 two-for-one, 2015 seven-for-one, and 2025 ten-for-one. A split multiplies your share count and reduces the per-share price by the same factor. It does not change the company’s market value or your ownership percentage at the moment it happens.

2025 Key Dates at a Glance

Before we dive into the details, here are the dates investors care about.

- Record date Monday 10 November 2025

- Distribution after the close on Friday 14 November 2025

- Split-adjusted trading begins at the open on Monday 17 November 2025

Netflix says the purpose is to reset the share price to a range that is more accessible for employees participating in stock option programmes and, by extension, retail investors.

What a Stock Split Actually Does

A stock split is arithmetic. If a share trades at around $1,100 and the company executes a 10-for-1 split, one share becomes ten at roughly one-tenth the price. Your position value is unchanged at the instant of the split and the company’s market capitalisation does not move simply because of the split.

Why Lower Prices Can Improve Market Quality

Before the list, a quick note on why the mechanics matter even in a world with fractional shares.

- Tighter bid-ask spreads and deeper books. Market makers typically quote in 100-share round lots. Pre-split, a lot in a four-figure stock ties up six-figure capital. Post-split, the notional per lot falls roughly tenfold, which often supports more quotes and tighter spreads during regular hours on liquid names. That can improve execution quality for everyone.

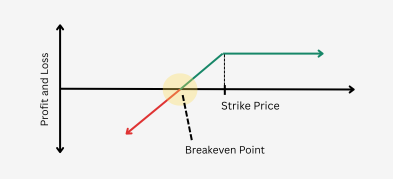

- Options become more accessible in dollar terms. Each standard option controls 100 shares, so split-adjusted contracts usually carry premiums around one-tenth of the pre-split cash outlay while keeping economic exposure equivalent. Brokers and clearing houses handle the automatic adjustments.

- Psychology still plays a role. Whole-share ownership and lower ticket sizes feel more approachable to many employees and retail investors, which can lift participation even though intrinsic value does not change. These effects help explain why stocks sometimes pop around split news. Netflix Stock Split Timeline

Netflix Stock Split Timeline

- 2004 two-for-one: Record Feb 2, 2004; new shares Feb 11; split-adjusted trading Feb 12.

- 2015 seven-for-one: Record Jul 2; payment Jul 14; split-adjusted trading Jul 15; due-bill mechanics ensured buyers between record and payment received the extra shares.

- 2025 ten-for-one: Record Nov 10; distribution Nov 14 (after close); split-adjusted trading Nov 17; intent tied to employee stock options and access.

Fresh Context You Can Use

To keep your analysis current, these points from recent coverage add helpful colour.

- Ten Titans concentration. Commentators group Netflix among mega-caps driving a large share of S&P 500 returns. That context explains why seemingly mechanical news like a split can ripple through sentiment.

- Dow eligibility angle. The Dow is price-weighted, so a four-figure sticker price is a practical barrier. Recent changes show that Amazon joined the Dow in February 2024, while Nvidia and Sherwin-Williams joined in November 2024. A sub-$200 post-split price makes Netflix mechanically more compatible, though inclusion is never guaranteed.

- Q3 2025 noise vs signal. Netflix booked an unexpected ~$619 million Brazilian tax expense, which dented reported margins and the share reaction despite otherwise solid operating trends. This explains why the investment debate shifted temporarily even as the split news landed.

- Long-term ambition. Leadership has discussed a 2030 aspiration to reach a $1 trillion market cap by doubling revenue and expanding operating income. Ambitious, debated, and useful context for longer-horizon readers.

What It Means for Investors

Here is a simple framework to evaluate the split without losing sight of the business.

- Your ownership does not change. You own more shares at a lower price. The split is value-neutral at the moment it happens.

- Options adjust automatically. Contract size and strikes are revised so economic exposure remains the same. Your broker will show “adjusted” contracts around the effective date.

- Liquidity and access can improve. Lower ticket sizes tend to support tighter spreads and deeper order books on liquid names, which is good for scaling in or out.

- Do not confuse optics with fundamentals. Near-term pops happen, but long-run returns still hinge on subscriber momentum, margin expansion, ad-tier monetisation, and content efficiency rather than the sticker price. The Brazil tax charge is a good reminder to separate accounting noise from operating progress.

FAQs on Netflix Stock Splits

How many Netflix stock splits are there?

Three times so far. 2004 two-for-one, 2015 seven-for-one, 2025 ten-for-one.

What are the exact 2025 dates again

Record 10 November, distribution 14 November after the close, split-adjusted trading 17 November.

If I buy between the record and payment dates will I still get the extra shares

Yes, entitlements follow the shares through due-bill mechanics. Netflix spelled this out explicitly in 2015, which is a good reference for how brokers route split entitlements.

Does a split change dividends EPS or valuation

Per-share figures are arithmetically adjusted, but your total dividends and Netflix’s valuation do not improve simply because of a split.

Could the split help Netflix join the Dow

A lower nominal price removes a practical hurdle in a price-weighted index. It improves the odds mechanically, but inclusion is up to the index committee. Recent changes added Amazon in 2024 and Nvidia and Sherwin-Williams later in 2024.

Conclusion

Netflix stock splits are about access, liquidity and participation rather than value creation. The 10-for-1 in 2025 should make shares and options feel more approachable and can improve day-to-day trading conditions. Your investment case still rests on execution, not the share price. Keep your analysis there, and treat the split as a helpful mechanical reset rather than a change in intrinsic worth.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.