Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomPolitical Stalemate and Liquidity Strain Keep Crypto Markets on Edge

U.S. Government Shutdown – A Record in Sight

The political impasse has officially tied the record for the longest U.S. government shutdown in history, now stretching to 35 days since October 1, with no resolution in sight.

According to the Congressional Budget Office (CBO), the shutdown could shave 2–3% off Q4 GDP growth. With all major official data releases — including NFP and GDP — suspended, markets are effectively flying blind, increasing reliance on private-sector indicators such as today’s ISM Manufacturing PMI.

The prolonged data blackout complicates the Federal Reserve’s decision-making. With limited economic visibility, policymakers may hesitate to adjust rates, adding further uncertainty to the outlook for the next Fed move.

Monetary Policy: “Hawkish Cut” Aftermath

Markets continue to digest the Federal Reserve’s recent policy shift, which has tightened global liquidity conditions more than expected.

- Powell’s Signal: Last week’s 25 bps rate cut was overshadowed by Chair Powell’s cautious tone, which downplayed expectations for another cut in December. This “hawkish cut” pushed the U.S. Dollar (DXY) higher and lifted short-term Treasury yields.

- Liquidity Impact: With a slower pace of easing expected, global liquidity is tighter than markets had anticipated. This backdrop pressures risk assets, including equities, emerging-market currencies, and cryptocurrencies.

- Market Reaction: The U.S. Dollar remains firm near recent highs, maintaining broad strength against major peers while keeping gold and other high-beta assets under pressure.

What to Expect Next?

The main focus today remains on how long the U.S. government shutdown will persist and whether any progress can be made toward a resolution.

While there is no imminent deal, a few developments may offer some hope:

- Funding Deadline Pressure: Lawmakers will soon face another funding deadline, as a temporary spending measure (CR) proposed earlier would have only funded the government until November 21. The need to extend this deadline could force negotiations in the coming weeks.

- Bipartisan Talks: Reports suggest quiet discussions among moderate Republicans and Democrats exploring a possible compromise, potentially involving health care policy concessions in exchange for reopening the government.

Still, until a clear breakthrough emerges, uncertainty will remain elevated. A prolonged shutdown could easily trigger broader risk aversion, especially if market sentiment begins to weaken amid the data blackout.

Liquidity Pressure & Political Uncertainty Weighs on Cryptocurrency Market

The cryptocurrency market remains under pressure following the Fed’s “hawkish cut” and the U.S. Dollar’s ongoing strength. Bitcoin (BTC) has slipped back below the $110,000 level, extending its consolidation phase as risk sentiment weakens.

- Macro Headwind: The reduced expectation of aggressive rate cuts has tightened overall liquidity conditions, limiting the flow of capital into high-beta assets such as cryptocurrencies.

- Correlation Shift: The negative correlation between Bitcoin and the U.S. Dollar has re-emerged — each leg higher in the Dollar Index continues to weigh on major digital assets.

- Market Dynamics: Altcoins have seen sharper drawdowns, with Ethereum (ETH) struggling to hold above $3,800, while smaller tokens remain underperformers amid risk aversion.

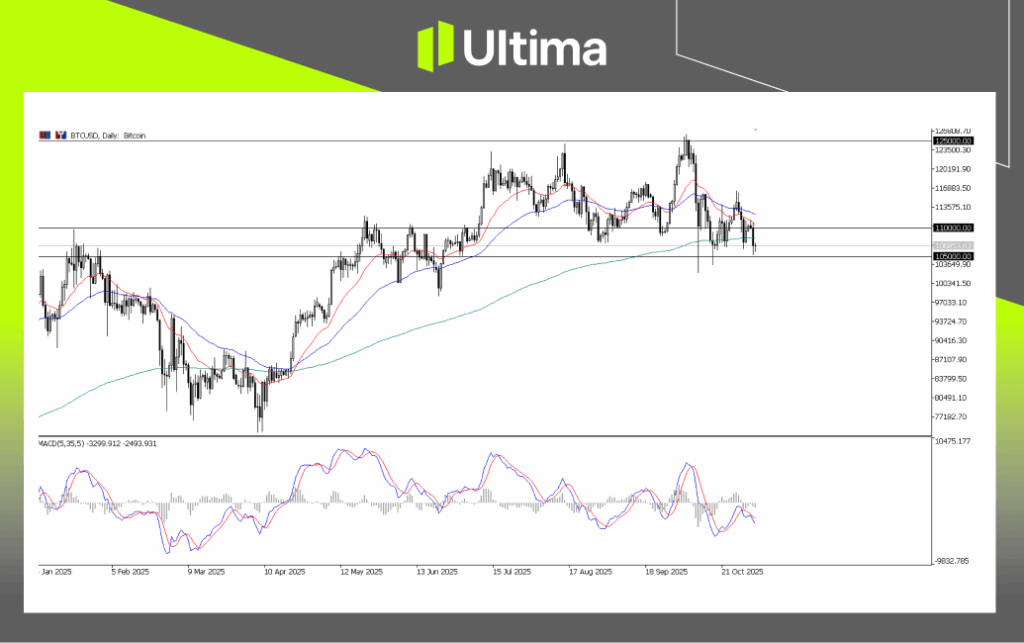

BTCUSD: Range Breakout?

Bitcoin continues to consolidate between $110,000–$105,000, maintaining its broader bullish structure as long as this zone holds.

BTCUSD, Daily Chart | Ultima Market MT5

Still, technically, a decisive break below $105,000 could, however, trigger a mid-term bearish shift, especially if broader macro sentiment turns cautious.

On the upside, a rebound from support would reaffirm the long-term uptrend and potentially retest $115,000–$118,000.

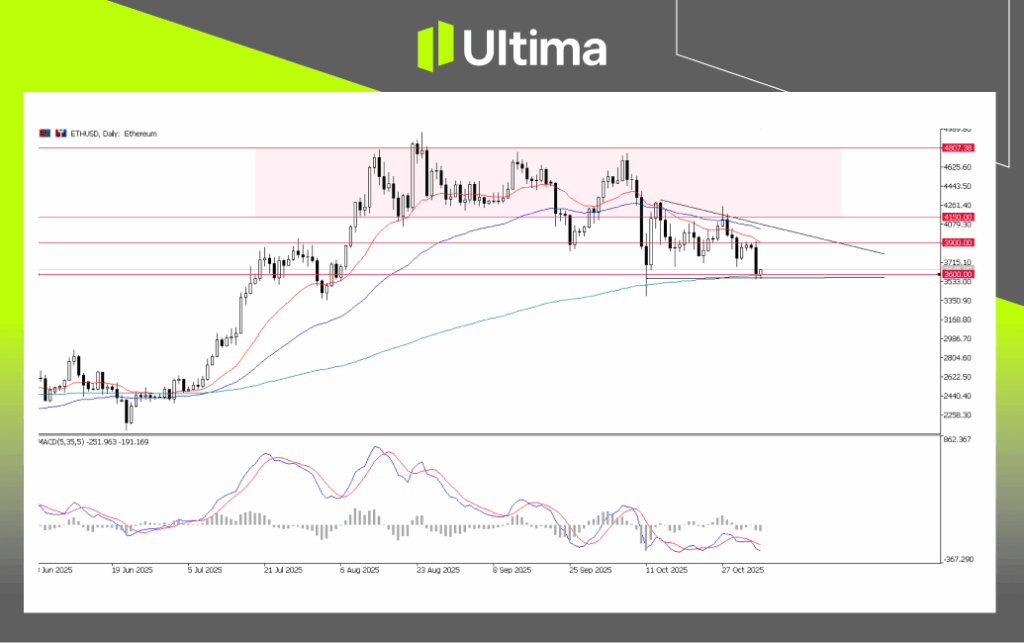

ETHUSD: Descending Triangle Formed

Meanwhile, Ethereum has slipped below $3,900, extending losses toward the $3,600 zone.

ETHUSD, Daily Chart | Ultima Market MT5

The price structure is forming a descending triangle pattern, typically a bearish signal if confirmed by a downside breakout. A sustained break below $3,600 could open the door toward $3,400, while recovery above $4,000 would neutralize the bearish bias.

Daily Market Outlook

For now, markets remain caught between the prolonged U.S. government shutdown and the aftermath of the Fed’s “hawkish cut.” With official data releases halted, monetary policy visibility is limited, leaving investors and policymakers navigating with uncertainty.

The extended shutdown further weakens confidence, stalls fiscal operations, and clouds near-term growth prospects. Combined with tighter global liquidity, these factors continue to support a stronger U.S. Dollar while pressuring risk assets, especially cryptocurrencies and emerging-market currencies.

In the near term, crypto markets are likely to stay under stress as liquidity tightens and the Dollar holds firm near the 100 level. Without a clear political breakthrough, risk appetite may remain fragile, keeping BTCUSD and ETHUSD vulnerable to continued downside consolidation.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server