Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomRisk-On Rally Extends on Trade Truce; But U.S. Shutdown Underscores Data Risk

Daily Market Insights for November 3, 2025, brought to you by Ultima Markets.

The new trading week opens with pronounced “Risk-On” momentum, driven by the U.S.-China trade truce and continued strength in Tech earnings. However, the ongoing U.S. Government Shutdown casts a long shadow over the economic calendar, including the status of Friday’s crucial Non-Farm Payroll (NFP) report.

Macro Theme: Trade Truce vs. U.S. Shutdown

The core driver of the current market rally remains the breakthrough between Presidents Trump and Xi Jinping — a one-year pause on new tariffs and a mutual agreement to ease restrictions on rare-earth exports.

- Geopolitical Relief: The suspension of tariff escalations has removed a major tail risk for global growth, supporting risk appetite and fuelling flows into cyclical and emerging market assets.

- Caution Ahead: Despite the optimism, the rally remains heavily concentrated in a handful of Big Tech stocks, creating a narrow market breadth. This concentration raises vulnerability to sharp corrections should any of the major leaders disappoint.

Meanwhile, the U.S. Government Shutdown is now stretching to its 34th Day, closing to its highest record of 35 days. With critical official data (GDP, Retail Sales, NFP) halted, the market’s attention is focused entirely on private sector surveys to gauge economic health.

The political impasse creates fundamental uncertainty and acts as a softening factor for the broader economy, subtly supporting the Fed’s stance that policy easing may still be required to counter these non-monetary risks.

ISM Manufacturing PMI (Today’s Key Focus): The ISM is the single most important report today. As the government cannot provide official statistics, this private sector report is crucial for assessing the industrial sector’s health. The market is hoping the report will show stabilization following the de-escalation of trade war threats.

Outlook: While the sentiment from the trade truce remains overwhelmingly positive, the U.S. Shutdown and subsequent uncertainty over U.S. growth data pose a clear headwind for the market today and into this week.

US Dollar: Bullish Continuation Confirmed, But in Test

The US Dollar has successfully broken out of its key resistance of 99 earlier, and is now in a clear short-term uptrend, fuled by the “hawkish cut” from the Fed and policy divergence against the BoJ/ECB.

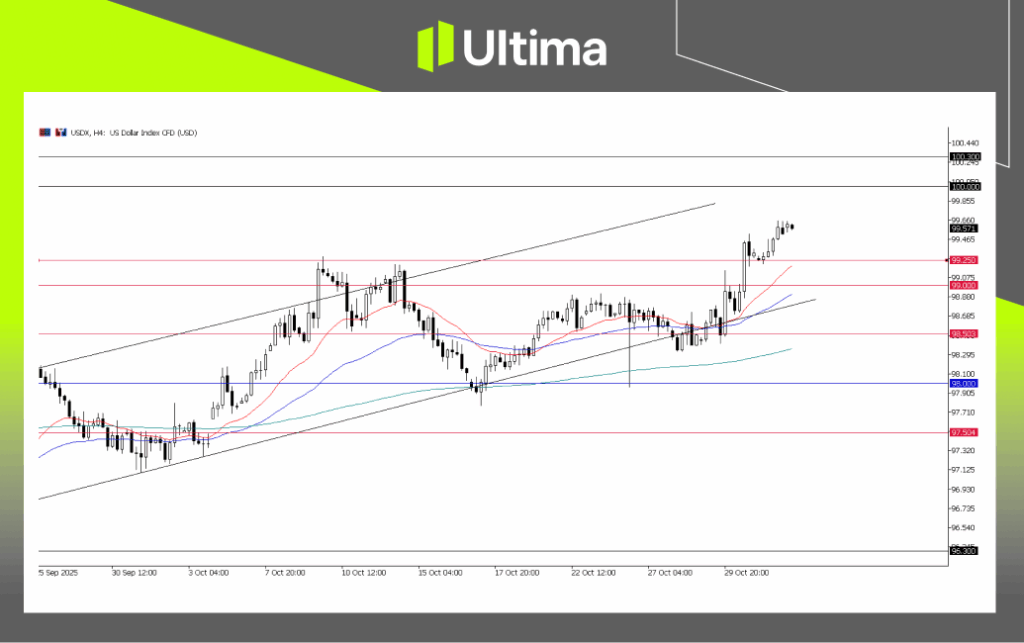

USDX, H4 Chart | Ultima Market MT5

The U.S. Dollar Index (USDX) is trading near the 99.60 level, confirming the continuation of its mid-October rally. Momentum remains positive, but the index is now approaching a key technical hurdle between 100.00 – 100.30.

A decisive daily close above this zone would confirm a broader bullish breakout and potentially signal a long-term trend reversal, opening the door for further upside beyond the 100.00 mark. For now, this zone acts as the immediate ceiling for the dollar’s recent advance.

On the downside, the first layer of support sits near 99.25, followed by the psychological 99.00 handle — a crucial short-term floor. As long as losses remain contained above 99.00, the near-term bullish bias for the USD remains intact.

U.S. Stock Indices: Near-Term Vulnerability at Record Highs

U.S. indices, particularly the Nasdaq and S&P 500, rallied to fresh record highs last week, but the rally is showing concerning technical fatigue.

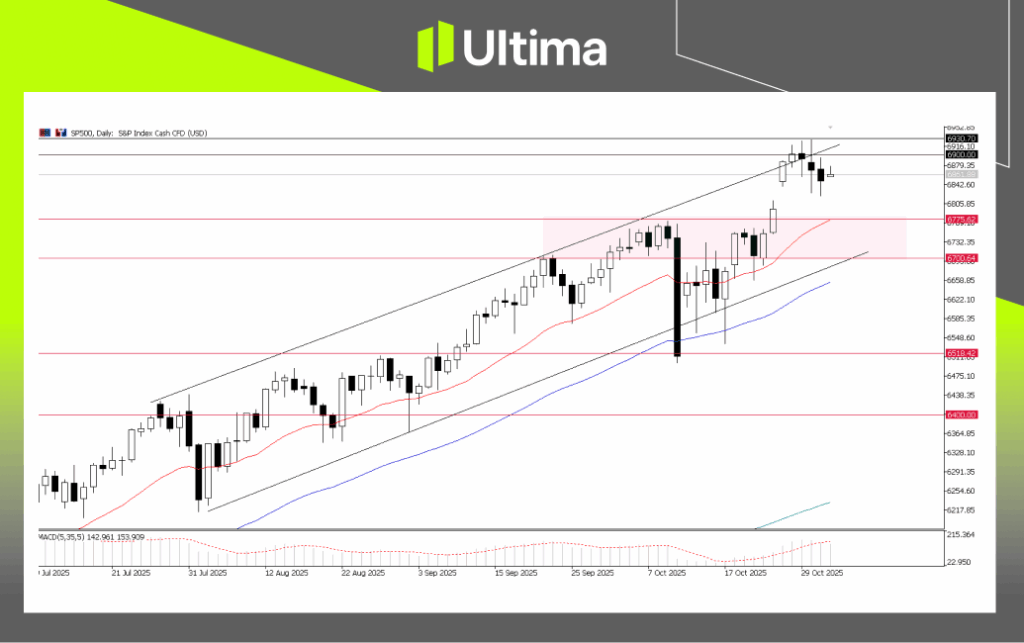

SP500, Daily Chart | Ultima Market MT5

The S&P 500 is currently hovering just below a major technical confluence zone near 6900, which capped the upside last week. This 6900–6930 range serves as a critical pivot area — aligning with both horizontal resistance and the upper boundary of the medium-term trend channel.

A failure to break and hold above 6900 may trigger a corrective pullback, though any retracement is likely to remain limited as long as prices stay above 6775.

Maintaining support above this level would preserve the broader bullish structure and suggest the rally is consolidating rather than reversing.

Daily Key Takeaways

Market sentiment opened the week firmly in “risk-on” mode following the U.S.-China trade truce, but optimism now faces a key test as the prolonged U.S. government shutdown disrupts critical data flow and clouds growth visibility.

The U.S. Dollar remains in a short-term uptrend, supported by policy divergence and a hawkish Fed tone, though momentum could stall near the 100.00 resistance zone if private data fail to confirm economic resilience.

Meanwhile, U.S. equities continue to show strength but are beginning to display signs of fatigue at record highs. The S&P 500’s 6900–6930 resistance zone is pivotal — a breakout would reaffirm bullish continuation, while rejection could trigger a healthy pullback toward 6775.

In short, risk appetite remains intact but fragile, hinging on how today’s key data and the ongoing U.S. government shutdown evolve through the week.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server