Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomFOMC Decision Preview: The Tone, Not the Rate

Ultima Markets Daily Market Insights – October 29, 2025

Markets are on edge ahead of the Federal Reserve’s policy announcement later today. Following yesterday’s strong rally in equities, traders are braced for sharp moves depending on how Chair Jerome Powell frames the path forward.

The Fed is widely expected to deliver its second rate cut of the year, reducing the federal funds rate by 25 basis points to 3.75%–4.00%. With the move already fully priced in, the key driver for market reaction will be Powell’s tone and forward guidance, not the rate cut itself.

Fed Preview: The Tone Will Be Everything

The Fed faces a delicate balancing act between a softening labor market, which supports further easing, and persistent inflation pressures, partly fueled by tariffs, that call for caution. The key questions for investors:

- Will Powell validate market pricing for another cut in December?

- Will he hint at an earlier end to Quantitative Tightening (QT)?

In tonight’s Fed meeting, here are the key scenarios that could move the markets:

- Dovish Surprise (Bullish for Stocks/Gold): Powell is more explicit about future cuts, confirms concern over employment risks, and hints at ending Quantitative Tightening (QT) sooner than expected. This would be the “soft landing plus liquidity” scenario, causing the USD to plunge and risk assets to surge.

- Hawkish Surprise (Bearish for Stocks/Gold): Powell is overly cautious, arguing that inflation remains above target and that the Fed must “wait and see” before committing to December. This signals a policy pause, which would be a severe disappointment. This outcome would cause a sharp sell-off in equities and a strong rally in the U.S. Dollar.

Analyst View: With the rate cut largely a done deal, Powell’s tone will define tonight’s market reaction. A dovish message could reinforce risk appetite and extend the recent global rally, while a cautious or hawkish tone could quickly unwind optimism.

However, if the dovish tone remains within expectations — meaning the Fed refrains from committing to additional aggressive easing — the downside pressure on the U.S. dollar may be limited, as markets have already priced in another potential rate cut in December.

US Dollar Index: Coiled for Policy Break

The US Dollar Index is exhibiting cautious movement, currently trading near the 98.50–98.70 range. This stability is the quiet before the storm, as the market awaits the FOMC.

USDX, H4 Chart | Source: Ultima Market MT5

The 98.50–99.00 zone remains the key overhead resistance for the U.S. Dollar Index (DXY). Failure to reclaim this level would indicate mounting pressure on the dollar, invalidate the current bullish momentum, and suggest a more significant downside move ahead.

- At present, 98.50 serves as the pivotal level. A decisive break below this zone — particularly if triggered by a dovish surprise from Powell — would confirm a resumption of the broader downtrend, potentially driving the index lower toward 97.50.

- Conversely, a sustained recovery above 98.50 could open the door for a test and possible breakout above the 99.00 mark.

The short-term direction of the DXY will depend entirely on which narrative Powell emphasizes — a weak labor market (bearish for the dollar) or sticky inflation (bullish for the dollar). If he signals fewer cuts than markets currently expect for December, the greenback could stage a short-term relief rally before broader fundamentals reassert downside pressure.

U.S. Stock Outlook: Record Highs on a Tightrope

U.S. stock indices continue to defy gravity, hovering near record highs amid renewed trade optimism and strong corporate earnings.

Optimism remains supported by expectations that a rate cut will signal a return to a more accommodative environment, where lower borrowing costs fuel further equity expansion. Adding to the momentum, three of the “Magnificent Seven” — Microsoft, Alphabet, and Meta — are set to report earnings between tonight and tomorrow, with positive guidance from these tech giants likely to extend the rally.

However, the market’s current trajectory is highly dependent on the Fed’s tone. If Powell delivers a hawkish surprise, market sentiment could turn sharply. Such a scenario would likely trigger a spike in volatility.

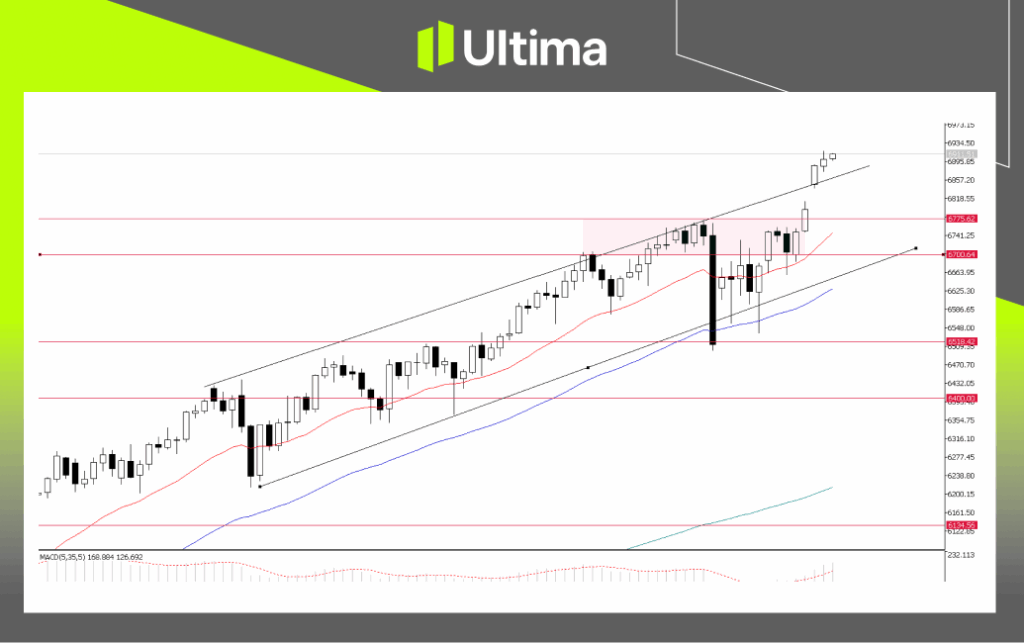

SP500, Daily Chart | Ultima Market MT5

The S&P 500 remains in a broadly bullish trend. A hawkish surprise from Powell could trigger a deeper short-term pullback in the index and across major benchmarks, as investors unwind some risk positions.

However, such a reaction is likely to be temporary, as the underlying momentum continues to be driven by solid fundamentals, easing financial conditions, and resilient corporate earnings.

In short, a hawkish Fed may prompt a corrective sell-off or profit-taking phase, but it is unlikely to derail the broader bullish trajectory of the equity market, at least for now.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server