Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomThe FTSE China A50 Index is one of the most widely recognized benchmarks for China’s A-share market. This index represents the 50 largest and most liquid companies listed on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE). With growing international interest in China’s financial markets, the FTSE China A50 provides an accessible way for global investors to gain exposure to the Chinese economy.

In this article, we’ll cover everything you need to know about the FTSE China A50 Index, including how it works, why it matters, and how you can invest in it.

What is the FTSE China A50 Index?

The FTSE China A50 Index tracks the performance of the largest A-share companies in mainland China. It was launched in 2003 by FTSE Russell, a subsidiary of the London Stock Exchange Group (LSEG). A-shares are shares of Chinese companies that are listed on mainland exchanges and are denominated in Chinese Yuan (CNY). Historically, these stocks were mostly available to domestic investors but are now accessible to foreign investors through initiatives like the Stock Connect program.

The index is a vital tool for both local and international investors, offering a clear snapshot of the largest publicly traded companies in mainland China. It is often used as a benchmark for the Chinese A-share market and as the underlying index for various Exchange-Traded Funds (ETFs) and derivatives.

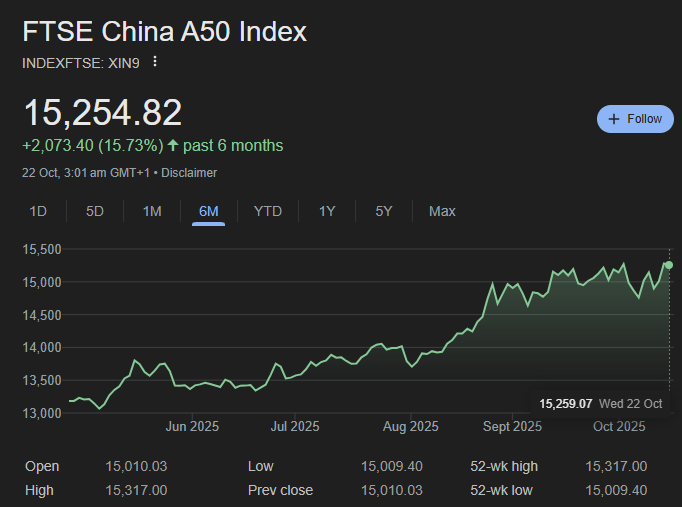

As of October 22, 2025, the FTSE China A50 Index has demonstrated a strong performance over the past year. The index has increased by approximately 10.95% over the last 12 months, reflecting investor optimism in China’s large-cap A-share market.

In recent trading sessions, the index has shown notable volatility. For instance, on October 9, 2025, it closed at 15,271.37, marking a 0.85% gain for the day. However, on September 26, 2025, it experienced a 1.23% decline, closing at 15,028.07.

These fluctuations underscore the dynamic nature of the FTSE China A50 Index, influenced by various factors including domestic economic policies, global market trends, and investor sentiment. For investors and traders, staying informed about these movements is crucial for making timely and informed decisions.

How Does the FTSE China A50 Index Work?

The FTSE China A50 Index is made up of 50 of the largest and most liquid A-share companies, which are selected based on market capitalization and liquidity. The companies are drawn from two main stock exchanges in China: the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

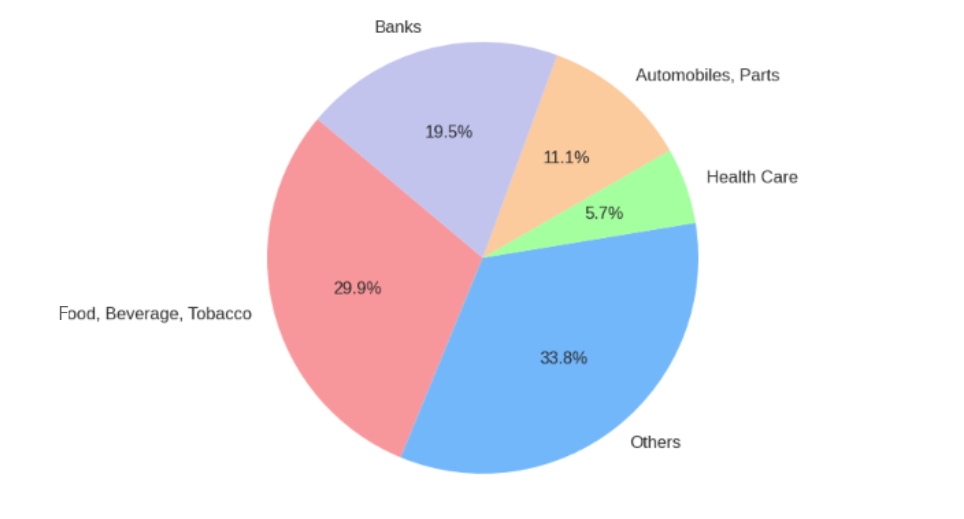

The index is designed to represent a broad spectrum of industries within mainland China’s stock market, including sectors like financials, technology, consumer goods, and energy. It is reviewed quarterly to ensure that the companies included remain the largest and most representative of the market.

Key Characteristics of the FTSE China A50 Index

Focus on A-Shares

The FTSE China A50 Index exclusively tracks A-shares, which are stocks listed on Chinese mainland exchanges. A-shares were previously inaccessible to foreign investors, but today, they can be accessed through channels like Stock Connect or indirectly through ETFs and futures contracts.

Number of Constituents

The index includes the top 50 largest companies in terms of market capitalization and liquidity. Despite representing just a small fraction of the total number of A-share stocks, the FTSE China A50 covers around one-third of the total A-share market capitalization.

Sector Exposure

Historically, the index has had a heavy focus on financials, such as Chinese banks and insurance companies. However, in recent years, sectors like technology, consumer goods, and renewable energy have seen increased representation, reflecting the country’s evolving economic landscape.

Why Does the FTSE China A50 Index Matter?

A Critical Benchmark for China’s A-Share Market

The FTSE China A50 Index serves as one of the primary benchmarks for the mainland Chinese stock market. Because the index represents a concentrated group of large-cap stocks, it’s a crucial tool for institutional investors, fund managers, and analysts to gauge the performance of the Chinese equity market.

Investment and Trading Opportunities

For investors, the FTSE China A50 Index offers the ability to gain exposure to China’s economic growth without the need to individually pick stocks. ETFs, futures contracts, and other derivative products that track the FTSE China A50 Index make it easier for foreign investors to gain exposure to mainland China without navigating the complexities of China’s regulatory environment.

A Strong Proxy for Economic Sentiment

The index is also a reflection of market sentiment toward China’s economic policies and macroeconomic outlook. A strong performance in the FTSE China A50 can signal investor optimism, while a downturn could reflect broader concerns about China’s economic health.

How to Invest or Trade the FTSE China A50 Index

Investors can gain exposure to the FTSE China A50 Index through several vehicles:

- ETFs: The iShares FTSE China A50 ETF is one of the most popular products tracking the index, allowing investors to gain broad exposure to the A-share market without having to invest directly in individual stocks.

- Futures Contracts: Investors can trade futures contracts on the Singapore Exchange (SGX), which offers one of the most liquid markets for trading the FTSE China A50 Index.

- Index-linked Funds: Some mutual funds also track the FTSE China A50 Index. These funds are ideal for investors seeking passive exposure to the index’s performance.

- Direct Stock Investment: While more complicated, investors can directly purchase shares of the constituent companies that make up the index. However, this involves greater risk, as the performance will be tied to individual stocks rather than the diversified exposure of the full index.

Key Risks and Limitations

- Concentration Risk: Despite tracking 50 companies, the FTSE China A50 Index is less diversified compared to broader indices like the CSI 300. The index is heavily weighted toward financials, which can expose investors to sector-specific risks.

- Market Risk: China’s market is subject to government regulation, geopolitical risks, and economic shifts. Changes in China’s domestic policies, regulatory environment, or economic outlook can have a significant impact on the performance of the FTSE China A50 Index.

- Liquidity Risks: Although the companies in the FTSE China A50 are generally highly liquid, certain market events or global downturns could lead to reduced liquidity in the index or its derivative products.

FTSE China A50 vs Other China Indices

While the FTSE China A50 Index focuses on the 50 largest and most liquid A-share companies from mainland China, other indices tracking Chinese stocks offer different types of exposure. For example, the CSI 300 includes 300 large-cap A-shares, providing broader coverage of China’s A-share market. Meanwhile, the Hang Seng Index focuses on companies listed in Hong Kong, offering exposure to Chinese companies listed offshore.

These indices differ not only in the number of constituents but also in their sector composition and market reach, which can significantly impact performance. Understanding these differences can help investors choose the right index or product based on their investment goals and risk tolerance.

| Index | Focus | Constituents | Key Difference |

| FTSE China A50 | Large-cap A-shares | 50 | Focuses purely on large-cap companies from the SSE and SZSE. |

| CSI 300 | Large-cap A-shares | 300 | Broader exposure with more constituents. |

| Hang Seng Index | Hong Kong-listed shares | 50 | Focuses on companies listed in Hong Kong, not mainland A-shares. |

Conclusion

The FTSE China A50 Index offers a focused way to gain exposure to the largest companies in mainland China’s A-share market, making it an attractive choice for investors seeking concentrated exposure to China’s key sectors, such as financials and technology. However, its relatively small number of constituents means it carries a higher level of concentration risk compared to broader indices like the CSI 300, which includes a wider array of A-share companies. For those looking to diversify across a broader segment of the Chinese market, the CSI 300 or other indices might be a better fit.

When it comes to trading, each index offers unique advantages. The FTSE China A50 is highly tradable through various ETFs and futures contracts, making it suitable for both short-term traders and long-term investors. On the other hand, indices like the Hang Seng Index provide a different angle by focusing on companies listed in Hong Kong, allowing investors to access offshore Chinese stocks.

Ultimately, whether you choose to trade the FTSE China A50 or explore other indices depends on your investment strategy, market outlook, and risk profile. For active traders, futures contracts and ETFs linked to these indices offer an efficient way to gain exposure to China’s dynamic economy while managing risk. Understanding the nuances of these indices will help you make informed decisions and align your trades with your financial goals.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.