Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomFed Outlook & US China Trade Talk Ahead

Daily Market Insights – October 22, 2025, brought to you by Ultima Markets

Fed Policy Outlook & Market Repricing

U.S. and global equities continue to perform strongly after last week’s brief pullback. In the U.S., momentum is being supported by robust earnings from the technology sector and the continued dovish tone from the Federal Reserve, which has pushed the U.S. dollar and Treasury yields lower — a positive backdrop for stocks.

Markets are still pricing in two additional rate cuts before year-end, but upcoming Fed speeches and the delayed U.S. CPI release (rescheduled for Friday due to the government shutdown) will be key drivers for rate expectations. Any inflation surprise could shift the tone on Fed policy and market positioning.

U.S.–China Trade Tensions — Retaliation Watch

Trade tensions remain front and center in the global macro landscape. Reciprocal port fees between the U.S. and China remain in place, and the planned 100% tariffs on Chinese imports starting November 1 continue to loom as a key event risk.

The latest updates indicate:

- U.S. and Chinese officials are set to meet in Malaysia next week in an attempt to de-escalate trade frictions.

- Donald Trump has publicly expressed his intention to meet Xi Jinping soon — possibly at the upcoming Asia-Pacific Economic Cooperation (APEC) summit in South Korea.

- While Trump struck an optimistic tone, saying he hopes for a “fair deal,” he also threatened tariffs as high as 100–155%, highlighting the fragile nature of the negotiations.

Markets remain cautious — pricing in both potential progress in talks and significant downside risk if escalation continues.

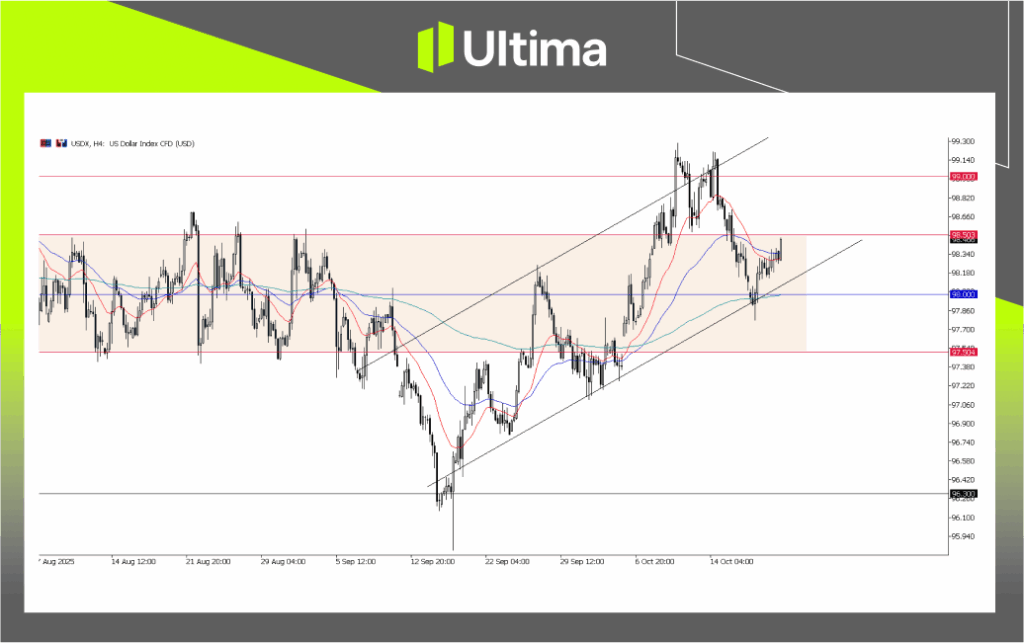

U.S. Dollar: Eyes on 98.5–98.0 Key Zone

Despite ongoing uncertainty surrounding Fed rate-cut expectations and U.S.–China trade tensions, the U.S. dollar has shown signs of short-term resilience. The U.S. Dollar Index (DXY) found support near the 98.00 level earlier and has since rebounded over the past two sessions, extending modest gains into Tuesday.

US Dollar Index, Daily Chart | Source: Ultima Market MT5

From a technical perspective, the 98.00 support continues to validate the near-term bullish structure. The key test now lies at 98.50, which remains the immediate resistance level.

A decisive move above 98.50 could reinforce the bullish bias and open the door for further upside.

However, the broader outlook remains clouded by macro headwinds. Renewed trade tensions and increasing Fed rate-cut expectations may limit upside momentum — and a failure to reclaim 98.50 could quickly shift the bias back to the downside.

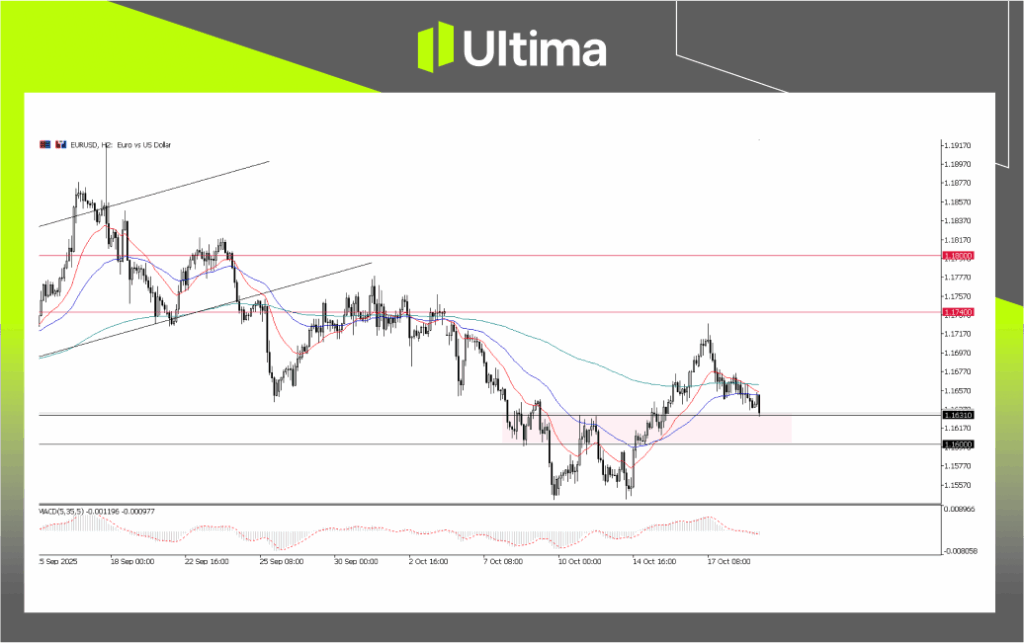

EUR/USD: Testing Key Support Zone

In contrary to the Dollar Index, the Euro remains under pressure in recent session, weighed by weak Eurozone growth signals and ongoing political instability in France, while its recent short-term direction continues to be largely dictated by the US Dollar movement.

EUR/USD, H2 Chart | Source: Ultima Market MT5

From a technical standpoint, EURUSD recent pullback now may test again on the 1.1630 – 1.1600 support again. Recent price action has formed a short-term double-bottom structure, signaling a potential shift in momentum.

If the pair can sustain above 1.1600–1.1630, upside potential may build in the coming sessions, especially if dollar strength stalls. Resistance lies near 1.1720–1.1750, which could act as the next upside target if momentum follows through. Conversely, a break below 1.1600 would negate the reversal setup and re-expose the euro to further downside pressure.

Daily Market Insights

- Fed policy expectations remain the key short-term driver. A surprise in CPI could recalibrate rate cut bets.

- Trade tensions continue to cast a shadow, with November 1 tariffs a critical risk marker.

- The U.S. dollar is stable but vulnerable to macro headlines.

- EUR/USD is holding support but remains reactive to dollar flows.

- Risk assets are steady but headline-sensitive — volatility could pick up quickly as event risks approach.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server