Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

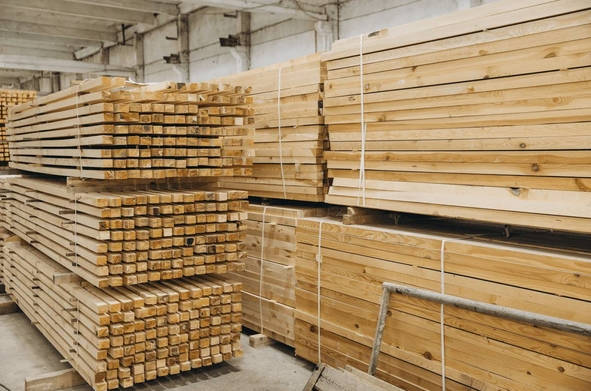

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomGetting To Know What Are Lumber Futures

Lumber futures help you read the housing cycle, manage material costs, and find trading opportunities beyond stocks and FX. This guide explains why people trade lumber, how the current CME contract works, and what to watch if you want to trade them.

Why Trade Lumber Futures

Lumber futures are frequently traded by homebuilders, mills, wholesalers, and macro traders. This is because lumber is tightly linked to North American housing. When mortgage rates shift or builder sentiment turns, lumber often moves first. That makes it useful for hedging real costs, reading the economy, and diversifying a trading book.

But you must know that lumber is a thinner market than many commodities. Liquidity varies by month, price limits can pause moves, and the contract is physically delivered. Plan rolls ahead of time and size risk in dollars, not guesses.

Where the potential is

- Directional views on housing momentum or supply shocks

- Seasonality and carry using calendar spreads across nearby and deferred months

- Hedging for builders and distributors who want budget certainty

- Diversification because lumber does not always move with equities or major FX

What to watch before you trade

- Use limit orders to control slippage

- Roll before the business day prior to the 16th to avoid delivery

- Size by dollars per 1,000 board feet for clear risk

- Track basis so your futures to delivered to 2×4 math stays accurate

What Are Lumber Futures

Lumber futures are exchange traded contracts that lock in a future price for kiln dried softwood lumber. The active benchmark on CME is a physically delivered contract with product code LBR.

- Contract size 27,500 board feet

- Quote US dollars per 1,000 board feet

- Minimum tick $0.50 per 1,000 board feet which equals $13.75 per contract

- Months January March May July September November

- Delivery Rail delivery to the Chicago Switching District

Older guides still mention a 110,000 board foot contract. That product was retired in 2023. Use today’s 27,500 board foot LBR specs for charts, P&L, and risk planning.

Quick sizing rule

Every $10 per 1,000 board feet move is about $275 per contract.

How Lumber Futures Work In Practice

This section shows how a screen quote becomes a delivered number and then the price of a 2×4. Replace placeholders with your local figures.

- Start with the futures quote

Front month LBR settles at X dollars per 1,000 board feet. - Add local costs and basis

- Regional basis versus Chicago rail basis + A

- Rail or truck freight to your area + B

- Handling and reload at a public yard + C

- Last mile local delivery + D

Delivered reference = X + A + B + C + D dollars per 1,000 board feet

- Convert to a 2×4 price

A nominal 2×4 contains 0.667 board feet per linear foot.

Price per foot = Delivered ÷ 1,000 × 0.667 - Price common lengths

- 8 ft = price per foot × 8

- 10 ft = price per foot × 10

- 12 ft = price per foot × 12

- 16 ft = price per foot × 16

Why store prices are higher

Retail adds overhead, grading and length selection, shrink, credit terms, and margin. Treat the delivered reference as a wholesale baseline, not a shelf price.

Market Drivers You Should Watch

This list helps you frame direction and volatility before you trade.

- Mortgage rates and affordability

Cheaper financing can lift housing. Higher rates can cool demand. - Housing starts and permits

Single family and multi family trends can diverge and affect nearby months differently from deferred months. - Supply and logistics

Mill outages, wildfires, tariffs, trucking and rail constraints can tighten nearby supply and widen basis. - Seasonality

Building slows into winter and usually picks up in spring.

Term Structure And Basis Explained

Before planning setups, read the curve correctly and make sure your history matches today’s contract.

Contango and backwardation

- If futures are above local cash, the curve is contango. Near term supply feels comfortable and deferred months often price more risk.

- If futures are below cash, the curve is backwardation. Nearby conditions are tighter and cash can run hotter than the screen.

Why this matters for your trade

- Delivered math In backwardation the regional basis in your delivered ladder often rises, pushing the delivered number above the futures quote. In contango spot may feel easier while deferreds are richer.

- Setups and rolls Contango can favor calendar spreads and rolling long positions may cost carry. Backwardation can earn carry on rolls and warns against chasing thin nearby breakouts.

Keep charts clean

Pre 2023 history used a different contract size. Label the 2023 switch on long range charts so levels, backtests, and volatility reads compare fairly to today’s LBR.

How To Trade Lumber Futures

These tips keep execution sensible and risk visible.

- Use limit orders to manage slippage in a thinner book

- Plan the roll because trading ends the business day before the 16th

- Size by dollars per 1,000 board feet for clear stops and targets

- Know price limits because daily and special limits can affect exits

- Match strategy to goal

- Directional view on housing or supply

- Seasonality or carry with calendar spreads

- Local exposure hedged with the delivered ladder and basis tracking

Alternative Southern Yellow Pine

If you prefer to avoid delivery mechanics or you hedge southern basis, consider Southern Yellow Pine futures. They are cash settled, sized at 22,000 board feet, and use the same primary $0.50 per 1,000 board feet tick which equals $11 per contract. This is useful when your exposure leans southern species or you want a basis comparison alongside LBR.

Prefer Stocks Over Futures

You can also express a lumber view through listed names such as International Paper, Boise Cascade, West Fraser, UFP Industries, and Weyerhaeuser which is a timberland REIT. Equity moves reflect more than lumber prices, including capital structure, business mix, acquisitions, and dividends.

Conclusion

Trade lumber if you want a focused view on housing and supply, a diversifier in your macro book, or a hedge against material costs. Start with the current LBR specs, use the futures to delivered to 2×4 ladder for real world pricing, read the curve and basis before setting up trades or rolls, and manage entries with limit orders and clear dollar based sizing. If futures are not a fit, Southern Yellow Pine or lumber linked equities offer alternative exposure.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.