Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomIn today’s interconnected world, money no longer stays within national borders. From corporations managing offshore accounts to traders hedging positions across continents, currencies are constantly moving through international markets. This global flow of capital gives rise to xenocurrencies, national currencies that circulate or are held outside their country of origin.

Understanding xenocurrency is crucial for anyone involved in forex trading, international investment, or cross-border finance, as it reveals how global liquidity, interest-rate differentials, and regulatory gaps shape opportunities and risks. As globalisation deepens, xenocurrencies play an increasingly vital role in driving trade efficiency and capital mobility worldwide.

What Is a Xenocurrency?

A xenocurrency is any currency that is held, traded, or deposited outside the country where it was issued. The term comes from the Greek word “xeno,” meaning “foreign.”

In simple terms, when a country’s currency is used overseas, it becomes a xenocurrency in that market. For example, U.S. dollars held in banks in London or Singapore are considered xenocurrencies.

Understanding xenocurrency is essential for traders and investors who want to navigate global forex markets, as it influences liquidity, interest rates, and international capital flows.

How Xenocurrencies Work

Xenocurrencies operate in offshore financial markets, which allow investors and institutions to hold and trade currencies outside their issuing countries. Here’s how they work:

- Issuance and Home Country: Each currency starts as a domestic unit like the U.S. dollar, euro, or yen, issued by a central bank.

- Foreign Use and Deposits: When that same currency is deposited or traded in another country, it becomes a xenocurrency. For instance, a U.S. dollar deposit in a Swiss bank is classified as a xenocurrency.

- Interest Rates and Regulation: Because xenocurrencies are held outside their home jurisdictions, they are not bound by domestic banking rules or reserve requirements. This allows for different interest rates and greater liquidity, which can attract corporations and investors seeking flexibility.

- Global Impact: Xenocurrencies facilitate international trade, foreign investment, and cross-border lending, making them vital to the global economy.

Example of a Xenocurrency

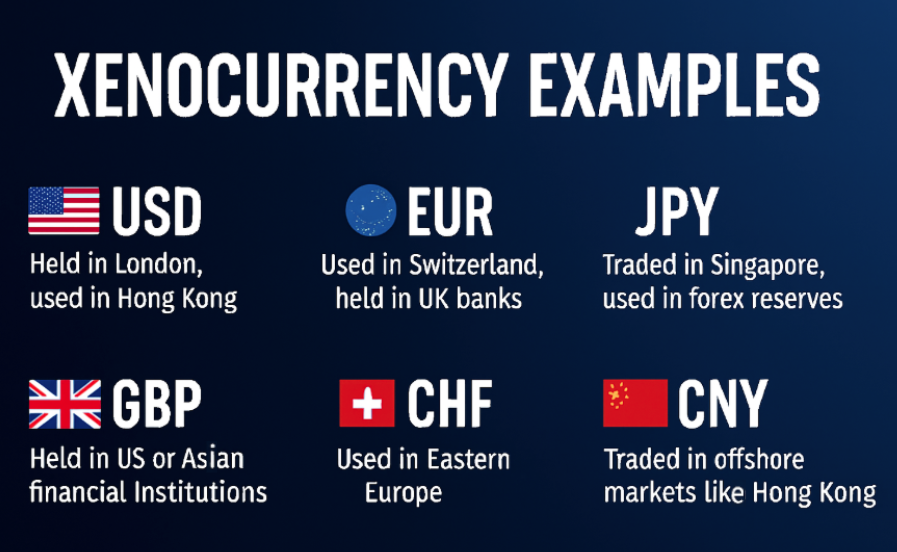

To better understand how xenocurrencies appear in real markets, consider these examples:

US Dollar outside the USA

The US Dollar (USD) is widely held outside the United States and used in trade, investment, banking. Deposits of USD in European banks, or USD used for real estate in Latin America, are examples of xenocurrency usage. Eurodollar most famously in London.

Euro in non-Euro-zone countries

The Euro (EUR) is used outside the Euro-area in non-EU countries, thus functioning as a xenocurrency in those contexts.

Japanese Yen deposits in Swiss bank

If Japanese Yen are held in a Swiss bank outside Japan, those deposits count as a “Euroyen” or xenocurrency deposit.

Emerging-market currency used abroad

Less common, but if e.g. Indian Rupee deposits are held in a foreign bank outside India, or used in trade settlement in another country, that could qualify. Some definitions emphasise that major internationally-used currencies more commonly serve as xenocurrencies.

These deposits often operate in large international money markets known as Eurocurrency markets, where banks lend and borrow foreign currencies free from local regulatory constraints.

Challenges of Using Xenocurrency

While xenocurrencies improve liquidity and access to capital, they also come with unique challenges:

Exchange-Rate Risk

Currency values fluctuate constantly. Holding or trading xenocurrencies exposes investors to foreign exchange (FX) risk, which can lead to gains or losses when converting back to the home currency.

Regulatory Differences

Xenocurrencies operate outside the control of the issuing country’s central bank. This can create regulatory gaps and reduced consumer protection.

Political and Economic Risk

Changes in international relations, sanctions, or financial restrictions can impact how freely xenocurrencies are used abroad.

Limited Transparency

Since these markets are often over-the-counter (OTC) and offshore, transparency can be limited compared to domestic banking systems.

Xenocurrency vs Cryptocurrency

Although the terms sound similar, xenocurrency and cryptocurrency are entirely different concepts.

| Aspect | Xenocurrency | Cryptocurrency |

| Definition | A government-issued currency used outside its home country. | A digital, decentralised currency operating on blockchain technology. |

| Issuer | Central banks or governments. | No central issuer maintained by blockchain networks. |

| Regulation | Subject to foreign exchange laws. | Varies by jurisdiction, often less regulated. |

| Volatility | Influenced by interest rates and global trade. | Driven by supply, demand, and market sentiment. |

| Example | Eurodollars, Euroyen. | Bitcoin, Ethereum. |

While cryptocurrencies are digital and decentralised, xenocurrencies are traditional fiat currencies traded abroad. However, both share a borderless nature that allows global transactions.

Xenocurrency vs Eurocurrency

A eurocurrency is a specific type of xenocurrency. It refers to a currency deposited in a foreign bank outside its home country.

For instance:

- U.S. dollars deposited in a London bank are called Eurodollars.

- Japanese yen held in a Swiss bank are Euroyen.

All eurocurrencies are xenocurrencies, but not all xenocurrencies are eurocurrencies. Xenocurrency covers any foreign-held or traded currency, while eurocurrency refers specifically to bank deposits.

Key distinguishing points

- All eurocurrency instruments are a subset of xenocurrency usage (foreign currency deposits outside home country) but not all xenocurrency usage is eurocurrency. For example, a currency could be used in trade circuits abroad without being held as an offshore deposit.

- Eurocurrency markets emerged historically for offshore deposits and borrowing in major currencies outside domestic regulations (lower reserve requirements, less regulation) and play a distinct role in global financing.

- Xenocurrency has a broader scope, it’s any currency used outside its home country (for trade, finance, deposits), not just bank deposits or loans.

Tips for Xenocurrency Trading

Trading or holding xenocurrencies can offer opportunities, but it also requires sound risk management. Here are practical tips:

Stick to Major Currencies

Focus on liquid currencies such as USD, EUR, JPY, and GBP. These are the most commonly traded xenocurrencies with tight spreads and high liquidity.

Monitor Central Bank Policies

Interest-rate changes and monetary policy decisions in the issuing country can directly affect the value of its xenocurrency abroad.

Hedge Currency Risk

Use hedging tools like forward contracts or options to protect against foreign exchange fluctuations.

Stay Aware of Fees and Conversion Costs

Cross-border transfers often include hidden fees and spreads. Always check conversion rates before executing transactions.

Keep Accurate Records

For businesses and traders, track your xenocurrency exposures carefully to manage accounting and tax reporting.

Conclusion

Xenocurrencies are more than just financial terminology. They are the foundation of today’s foreign exchange (forex) market. Every time a trader buys or sells a currency pair, they are effectively dealing with xenocurrencies, since one of the currencies is being traded outside its home country.

For example, when you trade EUR/USD, the U.S. dollar component often circulates as a xenocurrency in offshore markets like London or Singapore. This global liquidity allows traders to access tighter spreads, deeper markets, and faster execution.

However, it also introduces FX volatility, interest-rate differentials, and regulatory risks that must be managed carefully.

Understanding how xenocurrencies work helps traders anticipate market movements, hedge exposure more effectively, and seize opportunities that arise from global money flows.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.