Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomDonald Trump’s new tariff push in 2025 has reignited global trade tensions. The administration introduced a baseline 10% tariff on most imports and signaled possible 100% duties on Chinese goods, reshaping global markets.

While the stated goal is to protect U.S. industries and reduce trade deficits, the implications stretch far beyond politics, affecting forex markets, commodities prices, and global supply chains.

This article explains why Trump is imposing tariffs and provides a data-driven breakdown of how these measures ripple across currencies and commodities.

Why Is Trump Imposing Tariffs in 2025

After returning to the White House, Donald Trump reignited his signature trade agenda with a sweeping tariff overhaul. The new measures, including a 10 percent blanket tariff on nearly all imports, mark the most aggressive U.S. trade shift since 2018. Officials say the goal is to rebalance trade, protect U.S. factories, and strengthen supply chains, but the ripple effects reach far beyond domestic policy influencing currencies, commodities, and global market sentiment.

Protecting U.S. Manufacturing and Cutting the Trade Deficit

According to Reuters (July 2025), the U.S. imposed a 10% blanket tariff on imports and higher levies on specific goods to reduce a record US$1 trillion trade deficit. A Yale Budget Lab analysis found these tariffs generated US$88 billion in new revenue by August, raising the effective average tariff rate from 2.4% to about 11–12%. By making imported goods more expensive, the policy aims to encourage domestic production and reshape supply chains toward U.S.-based manufacturing.

National Security and Strategic Leverage

The tariffs also serve a strategic purpose to reduce dependency on foreign critical materials and gain leverage in trade negotiations. The administration invoked national-security clauses under U.S. trade law to justify tariffs on metals, electronics, and advanced materials. J.P. Morgan’s 2025 research note highlights that these moves align with “economic security priorities” rather than short-term fiscal goals.

Political Messaging and Global Positioning

Trump’s “America First” slogan remains central. Analysts see tariffs as a mix of economic policy and political signaling, especially ahead of key electoral cycles. Repeated tariff threats including the October 2025 warning of 100% duties on Chinese imports have unsettled investors and created short-term volatility across forex and commodities markets.

How Trump’s Tariffs Affect Forex Markets

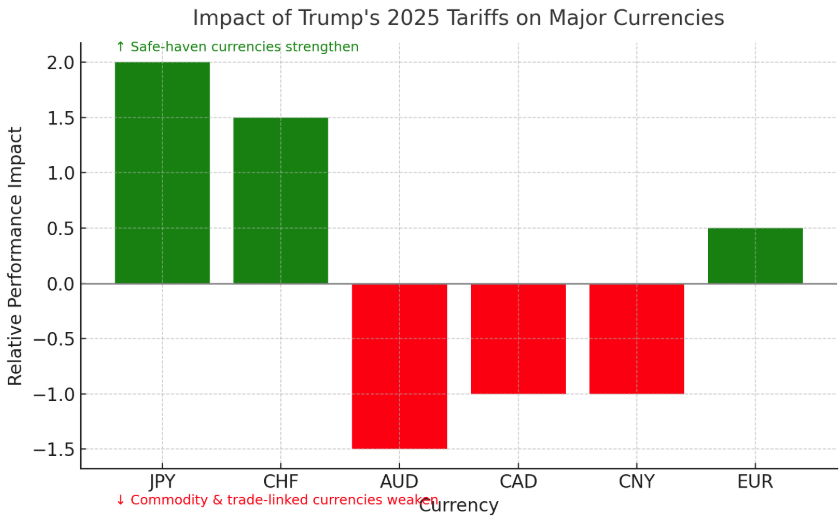

Trump’s 2025 tariffs influence forex markets by shifting investor sentiment, trade flows, and monetary expectations. When tariffs rise, growth fears weaken the U.S. dollar, while safe-haven currencies like the yen and Swiss franc strengthen. Commodity-linked currencies such as the AUD and CAD often fall as global demand slows.

U.S. Dollar Reactions

Contrary to expectations, recent tariff escalations have weakened the U.S. dollar rather than strengthened it. Reuters (Oct 10 2025) reported that the dollar fell after Trump threatened new 100% tariffs on China, as traders priced in slower growth and lower yield expectations. This reflects a key shift: tariffs now increase growth risk more than they boost inflation, reducing safe-haven demand for the USD.

Impact on Major Currencies

- JPY and CHF (Safe Havens): Gain when trade tensions rise, as investors seek lower-risk assets.

- AUD and CAD (Commodity Currencies): Fall when global demand expectations weaken.

- CNY (Chinese Yuan): Faces depreciation pressure if new tariffs materialize, though China’s PBoC has defended key levels to prevent sharp declines.

- EUR (Euro): Often moves inversely to USD may benefit short-term from U.S. policy uncertainty.

Market Volatility and Trading Implications

- Volatility spikes on every tariff headline remain common; algo-trading models now price in “tariff-risk” events similar to NFP or CPI releases.

- Carry trades become riskier as yield spreads tighten and sentiment shifts.

- Traders are advised to monitor USD/JPY, EUR/USD, AUD/USD around major tariff news.

How Trump’s Tariffs Affect Commodities Markets

Trump’s 2025 tariffs are reshaping global commodities by disrupting trade flows and altering demand patterns. Higher import costs and weaker growth expectations have pushed oil and base-metal prices lower, while gold and silver gained as investors turned to safe-haven assets. Industrial commodities tied to global manufacturing like copper and steel, face volatility as supply chains shift and China’s demand softens

Energy Markets: Oil and Gas

Oil prices have been under pressure from both oversupply fears and trade-war-related demand risks. Reuters (Oct 21 2025) noted Brent and WTI declined for five straight sessions, the steepest drop since 2022 as investors reassessed demand under new U.S.–China tariff uncertainty. U.S. domestic producers, however, may benefit from higher internal demand and less foreign competition.

Metals: Copper and Steel

The Financial Times (Sept 2025) reported that Trump’s selective tariffs on semi-finished copper and aluminium products unexpectedly benefited the London Metal Exchange as global supply chains rerouted.

Prices of industrial metals remain volatile, with Chinese demand softening and U.S. suppliers expanding output.

Precious Metals: Gold and Silver

Gold reached a record US$4,300 per ounce in October 2025, before dipping after Trump said the China tariffs were “not sustainable.” Times of India (Oct 2025) attributes the surge to safe-haven buying amid trade uncertainty and central-bank diversification away from the USD. Silver tracked gold’s path, retreating slightly after initial highs.

Global Economic Outlook

Despite tariff escalation, the IMF and World Bank note that the global economy remains resilient, growing around 2.7% in 2025. However, the IMF warns that prolonged trade restrictions could shave 0.3–0.5 percentage points off global GDP next year if tensions continue. Washington Post (Oct 14 2025) reported that while growth “is faring better than anticipated,” underlying trade fragmentation poses long-term risks.

Conclusion

Trump’s 2025 tariff agenda has become a defining force in today’s markets, influencing everything from currency volatility to commodity pricing. For forex traders, tariff headlines now act as macro catalysts, weakening the U.S. dollar when growth fears dominate and boosting safe-haven currencies like the yen and franc. For commodity traders, the story is twofold: industrial metals and oil face demand pressure, while gold and silver benefit from risk aversion.

In this environment, successful trading depends on staying data-driven and flexible. Track tariff developments, watch inflation and trade data, and adapt positions across forex and commodities as policy shifts unfold. The key edge isn’t prediction, it’s preparation for volatility in an economy where trade and politics are once again deeply intertwined.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.