Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomTrading the Hammer Candlestick Pattern

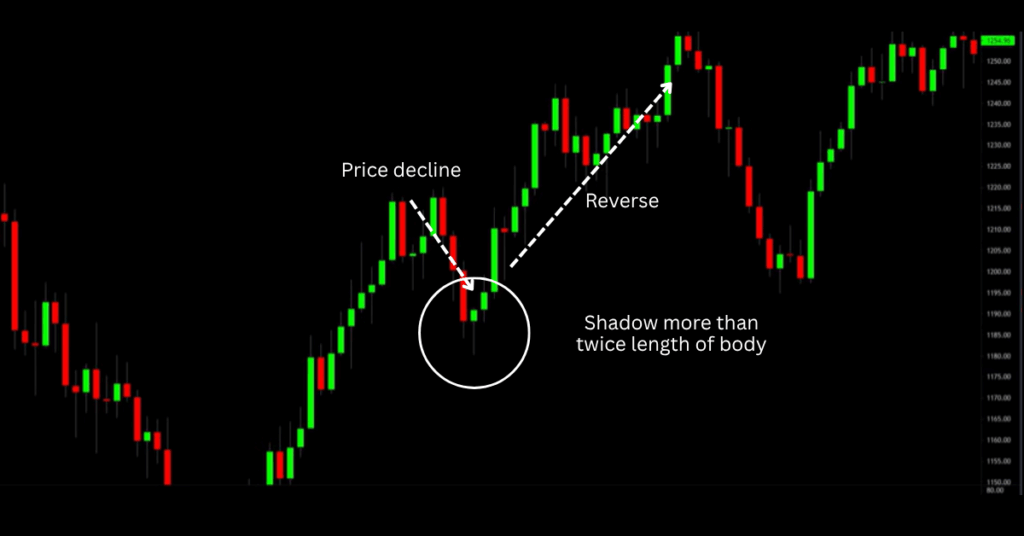

Markets rise and fall on shifts in sentiment. Sometimes you can see that shift forming inside a single candle. The hammer candlestick pattern is one of the clearest signs that selling pressure may be fading and buyers are stepping back in.

In the sections that follow, we will outline what a hammer looks like, where it tends to matter on the chart, and a simple way traders approach it. Quick, clear, and practical so you can spot it with confidence.

What Is A Hammer Candlestick

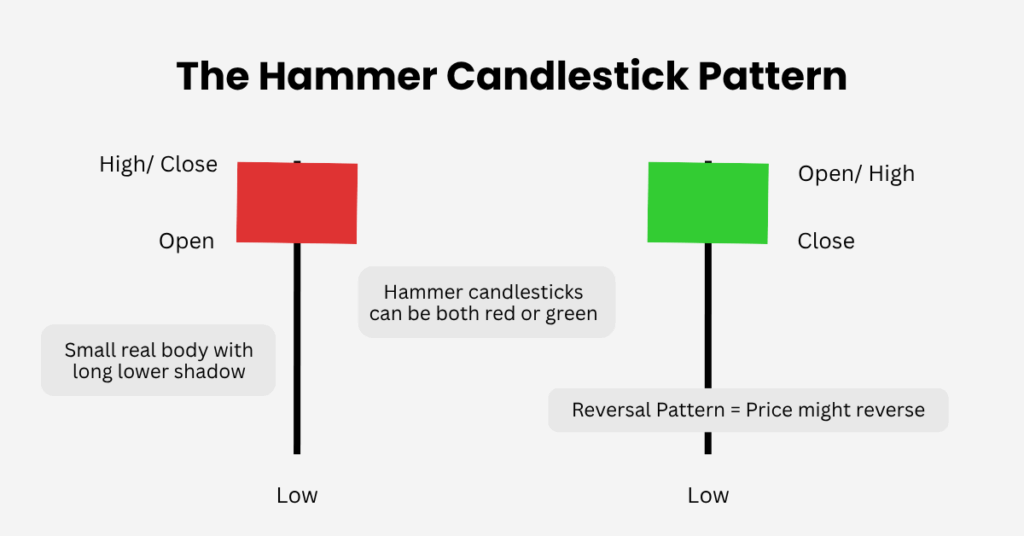

A hammer candlestick is a single candle with a small real body near the top of its range, a long lower shadow, and little or no upper shadow. It usually forms after a decline or during a counter-trend pullback. Sellers push price down, buyers absorb that pressure, and the close finishes back near the highs. Treat it as bullish context, not an automatic buy.

Quick Identification Rules

- Lower shadow is at least two times the candle body

- Body sits near the top of the range

- Minimal or no upper shadow

- Appears after a down move or a pullback

Remember that a hammer can be green or red. A green close is a small positive because buyers held the close, but both are valid as long as the shadow and context fit.

Why The Hammer Candlestick Matters

Markets turn when the balance of orders shifts. A hammer often signals that shift.

- Exhaustion of selling Price probes lower and meets demand

- Failed breakdown Bears cannot keep price below support

- Momentum pause The close near the highs hints at stabilising forces

These clues become more useful when the hammer forms at clear technical levels such as prior swing lows, a demand zone, a trendline, or a well-watched moving average.

Hammer Candlestick Context And Confluence

Before you trade any candlestick, anchor it in the bigger picture.

- Trend In an uptrend, a hammer during a pullback can be a continuation clue

- Levels Reliability rises at established support or Fibonacci retracement zones

- Timeframe Signals are cleaner from H1 and higher. Lower timeframes need stronger filters

- Events and liquidity Major data or policy events can create gaps and slippage. Around those times, demand stronger confirmation and reduce size

It’s important to remember that a hammer must follow a decline. If price has moved sideways with no prior drop, the shape may fit but the context is weak.

Valid Versus Weak Hammers

Stronger Hammers

- Long lower shadow into or through known support

- Close in the upper quarter of the candle range

- Next candle closes higher or breaks the hammer high

- Volume expansion and a momentum turn such as RSI ticking up

Weaker Hammers

- Forms in the middle of nowhere with no nearby level

- Large upper shadow or tiny lower shadow

- Prints inside a sideways range without a prior selloff

- Next candle closes below the hammer low

A longer lower shadow sometimes three to five times the body can show stronger intraperiod buying. It is still only a clue until there is confirmation.

Confirmation That Improves Reliability

Use firm rules so you are not guessing.

- Price confirmation Prefer a bullish follow-up candle that closes above the hammer high or a clean break above that high

- Volume confirmation Higher-than-average volume on the hammer or the confirmation bar shows participation

- Indicator confirmation RSI turning up from oversold, a contracting negative MACD histogram, or a reclaim of the 20-period moving average or VWAP

A green hammer is a small positive, but confirmation is still required.

How To Trade A Hammer Candlestick Step By Step

- Map Context

Mark trend, support and resistance, and any upcoming events. Decide your maximum risk per trade. - Verify The Candle

Small body at the top, long lower shadow at least two times the body, minimal upper wick. - Wait For Confirmation

Prefer a close above the hammer high. If you trade intrabar breaks, keep position sizes smaller. - Choose Your Entry

- Conservative: Enter on a break above the hammer high or after the confirming close

- Aggressive: Enter on a shallow retracement into the upper third of the hammer range, only when the confluence is strong

- Place The Stop

Just below the hammer low with a small buffer. Many traders add an ATR buffer for noise control, for example 0.2 to 0.3 times ATR. - Plan Targets

- First target Nearest resistance or prior swing high

- Second target A measured move using the hammer height or an ATR multiple

Scale out at T1, then trail the remainder under higher lows

- Manage The Trade

If price hesitates near resistance, take more off. If momentum builds, trail more loosely to let the winner run. Follow your plan.

Indicator Combos That Help

- RSI or Stochastics A turn up from oversold adds weight

- MACD histogram Fading negative momentum hints at seller fatigue

- Volume Expansion on the hammer or its confirmation strengthens the signal

- Moving averages or VWAP An immediate reclaim after the hammer often improves follow-through

These tools are secondary filters. Price structure and confirmation come first.

Backtests And Research

Large backtests show the hammer can reverse the prior move around six times out of ten on average. Results are better when the candle forms in the lower third of the yearly range and when it closes green.

Even so, average follow through sits mid pack versus other patterns. Studies also note that pattern edges depend on clear rules and market conditions. This is why confirmation, defined stops, and sensible sizing are essential.

Tips And Pitfalls

Tips

- Look for follow-through above the hammer high on rising volume

- Prioritise confluence support, trendline, or Fibonacci plus one confirming tool

Pitfalls and Fixes

- Trading without confirmation: Wait for a higher close or a clean break above the high

- Ignoring context: Filter by trend and level. Skip range-bound hammers with no prior drop

- Improper stops: Place the stop below the hammer low with a buffer often ATR-based

- Relying on the candle alone: Use RSI, MACD, moving averages, or pivot levels to support the case

- Over-concentrating exposure: Avoid stacking similar longs across correlated markets

FAQs

Is a hammer candlestick pattern bullish by itself

It is a bullish clue, not a stand-alone trigger. It still requires confirmation.

What timeframe works best

Many traders prefer H1 and higher for clearer signals. Lower timeframes can work with stronger filters and faster management.

Where should I place the stop

Common practice is just below the hammer low with a small buffer. An ATR addition helps reduce noise.

Do longer shadows matter

Yes. Longer lower shadows often reflect stronger intraperiod buying, but you still need confirmation and confluence.

What targets should I use

Nearby resistance, prior swings, moving averages, Fibonacci retracements, or pivot points, and always check that the trade meets your minimum risk-reward before entry.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.